The Philippine government has built up a perfect Philippine Social Security System (SSS). For example, there is cash aid for deceased members’ beneficiaries, known as SSS death benefits. This article will discuss who can claim the benefits, the requirements for death claim SSS, how to claim for it, and other related issues.

What Are SSS Death Benefits?

The SSS death benefit is a cash allowance issued to the surviving beneficiaries of a deceased SSS member. It aims to help the surviving family members deal with financial difficulty due to the loss of a family member. There are two types of benefits.

- Lump sum: It is a one-time payment. It is released to beneficiaries of a deceased SSS member who paid contributions to SSS for no more than 36 months (3 years) or to designated beneficiaries and legal heirs when there are no primary beneficiaries.

- Monthly payment: The subsidies will be given by month if the SSS member pays contributions for 36 months or longer.

How Much Is the Death Claim in SSS

The total amount might vary according to the contributions and Credited Years of Service (CYS). Here is how much the beneficiary can receive.

| 13th-month Pension | Less than 10 CYS | At least 10 CYS | At least 20 CYS |

| Mini. Monthly death pension | PHP 1,000 | PHP 1,200 | PHP 2,400 |

| Extra Benefits | PHP 1,000 (as of January 2017) | ||

| Dependent’s Pension | 10% of the monthly pension or PHP 250 (choose the higher one) for one minor child, no more than 5 children in total. | ||

| 13th month Pension | Equa to the SSS member’s monthly pension | ||

Who Is Eligible to Claim SSS Death Requirements

The SSS death benefits are given to direct family members of a deceased SSS member. Qualified beneficiaries are divided into two categories.

Primary Beneficiary

It refers to legitimate spouses, legitimate/legitimated/adopted/illegitimate dependent children under 21, and incapacitated dependent children despite their age. The spouse will not be eligible after remarriage.

Secondary Beneficiary

It includes dependent parents, persons who have been named as a beneficiary before the death, or legal heirs according to the Family Code of the Philippines.

SSS Death Claim Requirements 2024

Before claiming the SSS death benefits, it is suggested to prepare the following supporting documents in advance.

- Death Claim Application Form. It is used to notify SSS of the death of a member. It is available at the SSS branch or can be filled out on the SSS website.

- Birth certificate of the deceased issued by the Philippine Statistics Authority (PSA) or baptismal certificate.

- Death certificate of the deceased from PSA (original or certified true copy).

- Marriage certificate from PSA (if applicable).

- A valid government-issued photo ID of the beneficiary, such as a passport, driver’s license, UMID, etc.

- PSA birth certificate of dependent children (if applicable).

- A passport-style photograph of the claimant.

- Bank account passbook or ATM card along with a validated bank statement, such as a deposit slip or card enrollment form.

- Other supporting documents.

How to Claim SSS Death Benefits in 2024

SSS death benefit claim is quite straightforward after confirming your eligibility and preparing the required documents. It can be done in person or online.

Claim SSS Death Benefits In Person

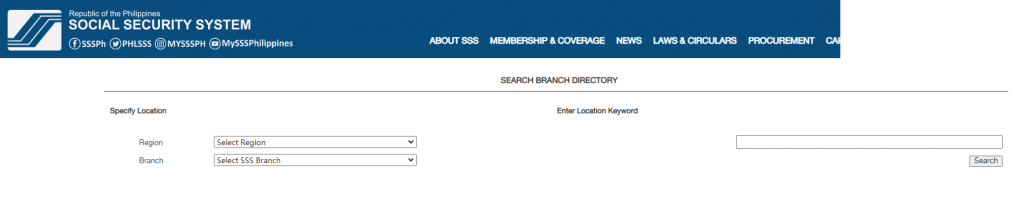

It is the most traditional way for those who have no access to online services or My.SSS account. All applicants should visit an SSS branch with the supporting documents, obtain an application form, fill it out, and submit the application at the counter. You can search for a nearby branch online or on Google Maps. The opening hours vary from office to office and some might require a prior appointment. It is suggested to contact the officer and check the detailed information. Last but not least, if you do not submit a single bank account for benefit reimbursement, you will need to go to the branch where you file the claim and collect a check.

Claim SSS Death Benefits Online

To simplify the procedure and accelerate the processing time, the Philippine government launched an online platform, My.SSS Portal for beneficiaries to claim to file to file their Social Security (SS) and Employees’ Compensation (EC). Next is a detailed instruction on how to claim SSS death benefits.

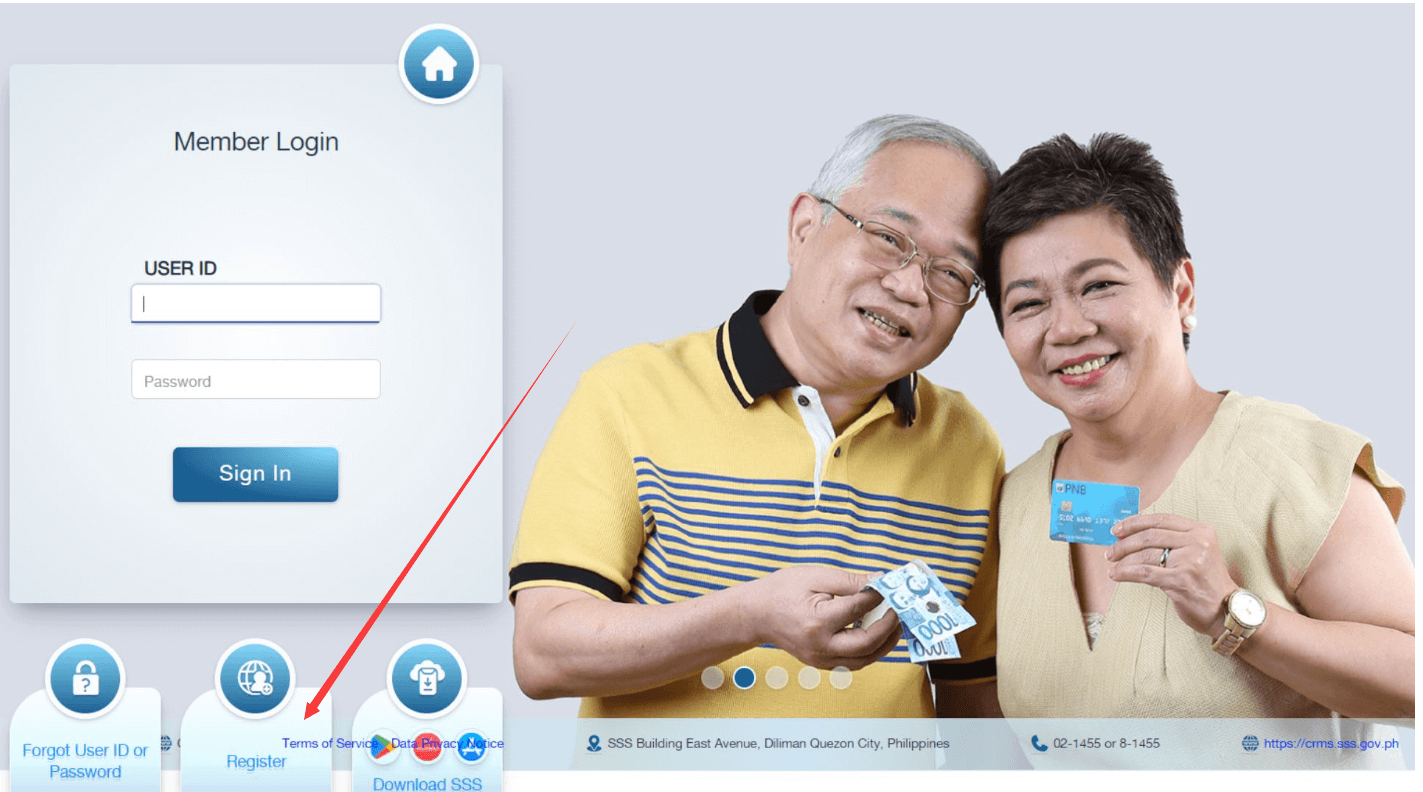

- Go to the official website of SSS and Click on the “Member” button.

- Click on “Register” to create an account. It is free of charge to register. If you already have an account, just skip this step and sign in with the user ID and password.

- Enter the required information, including CRN/SS number, name, date of birth, and email address.

- Read the terms and conditions and agree to them.

- Receive a confirmation email and click on the link attached to activate your account.

- Set a password and security questions.

- Log in to your SSS account.

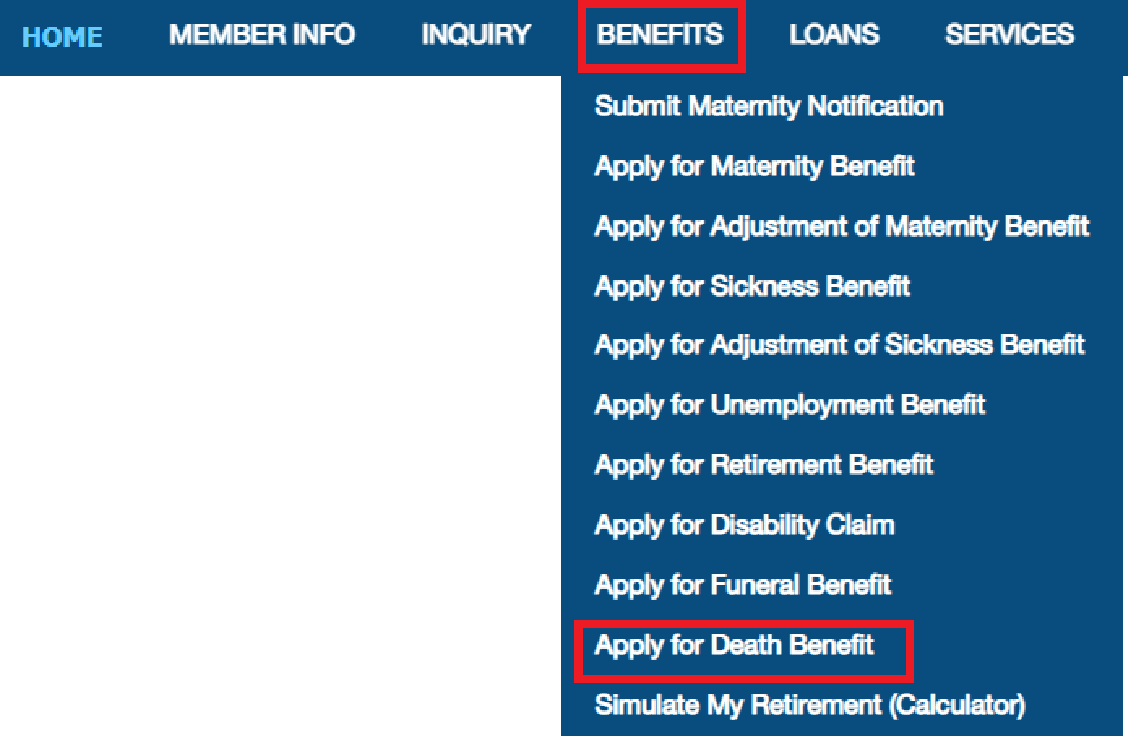

- Navigate to the “Apply for Death Benefit” under the “BENEFIT” menu.

- Complete the online application form accurately and honestly. It requires the personal information of the beneficiary and the deceased, information on marriage, etc.

- Provide details of a valid disbursement account to receive the pension.

- Upload the supporting documents. Make sure all copies are clear and satisfy the file size requirements.

- Review your application and submit it after confirming there is nothing wrong.

- Wait for the result. A confirmation email will be sent after your application is submitted. The authority might require you to provide extra documents if they have any questions about your application. Pay attention to your case status and respond promptly.

SSS Death Claim Processing Time

The processing time depends on the number of applications at the SSS office, the completeness of your application, and so on. Generally, it takes about 10-45 days. SSS will inform you of the result and the date of disbursement by SMS or email. It is recommended to keep track of your case status on the SSS portal to monitor whether your application is approved and when the benefits will be released.

Difference Between SSS Death and Funeral Benefits

Both death and funeral benefits are financial assistance to the living family of a deceased SSS member, but they are not the same thing. SSS death benefits are used to subsidize all kinds of household expenses while the SSS funeral benefits are issued to cover only the burial expenses. Here is an ultimate comparison between them.

| Types of Benefits | SSS Death Benefits | SSS Funera Benefits |

| Disbursement methods | Lump sum or by month | Lump sum |

| Amount | At least PHP 1,000 – 2,400 per month (depending on contributions and Credited Years of Service (CYS)) | P20,000.00 – P40,000 (depending on contributions and Average Monthly Salary Credit (AMSC)) |

| Eligible claimant | Primary or secondary beneficiaries | Whoever paying the funeral and burial expenses despite his relation to the deceased |

| Requirements | PSA Birth certificate of the deceased.PSA Death certificate of the deceased.PSA Marriage certificate. | PSA Death certificate of the deceased.Payment receipt for the funeral from a legal funeral parlor.Proof of SSS contributions of the deceased. |

Can I Claim SSS Death and Funeral Benefits Simultaneously?

Yes. You can claim both benefits at the same time on the SSS portal or at the SSS branch as long as you satisfy all the requirements, but you have to use different application forms to apply for them. Moreover, you might not receive them simultaneously because their payment methods and amounts of benefits differ.

FAQ

How the death claim is calculated?

It is calculated according to the previous monthly contributions, credited Years of Service, and the number of dependent children.

How much is the lump sum death benefit from SSS?

It is equivalent to all monthly pensions for a monthly contribution to the SSS before the semester of death or 2 times the monthly pension (whichever is higher).

Is there a deadline for filing an SSS death benefit claim?

Yes. It must be claimed within 2 years after the date of death.

Can illegitimate children claim the SSS death benefit?

Yes. Illegitimate children under 21 years old are primary beneficiaries. The subsidies will cover up to 5 children, either legitimate or illegitimate.

Can an SSS death benefit be claimed if the member died outside the Philippines?

Yes. It could be claimed as long as the member has made a contribution to SSS and the claimant can provide the required documents.

How can I track the status of my SSS death benefit claim?

You can log in to your SSS account and check the status of the application submitted.

Does PhilHealth have death benefits?

No. PhilHealth provides inpatient and outpatient health benefits, but there are no PhilHealth death benefits.

Conclusion

SSS death benefits are useful in releasing a family’s or individual’s financial burden while they are suffering the loss of loved ones. Eligible beneficiaries must claim the benefits within 2 years on the SSS official website. Moreover, you can also claim SSS funeral benefits to cover the funeral and burial expenses. We hope this passage will help you learn thoroughly about the SSS death claim requirements and receive it successfully.