The Social Security System (SSS) in the Philippines provides a series of Employee’s Compensation (EC) benefits for participating employees, self-employed persons, and voluntary contributors. The coverage includes sickness, maternity, unemployment, and contingencies. In this passage, we are going to talk about what is sss sickness benefit, how to calculate it, how to claim it, and some frequently asked questions.

What Are SSS Sickness Benefits in the Philippines?

The SSS sickness benefit is financial assistance for those who have to stop working because of sickness or injury. Daily cash allowance is provided to cover their daily expenses and subsidize medical expenses. It applies to a variety of common chronic, acute, and infectious diseases, such as diabetes, COVID-19 infections, etc.

Who Are Qualified for SSS Sickness Benefits?

To be eligible for the program, the following requirements must be satisfied.

- The applicant has to stay in hospital or at home for at least 4 days due to sickness or injury and cannot work;

- The applicant has paid SSS contributions for no less than 3 months in the last 12 months;

- The applicant has run out of current paid sick leaves.

- The applicant has informed his/her employer of the sickness or injury.

- Separating employees, self-employed persons, OFWs, or voluntary members should notify the SSS directly.

How to Compute SSS Sickness Benefit

According to the SSS, you can claim an amount equivalent to 90% of the average daily salary credit (ADSC) for up to 120 days in general cases or 240 days for chronic illnesses. The SSS sickness benefit can be calculated through the following steps.

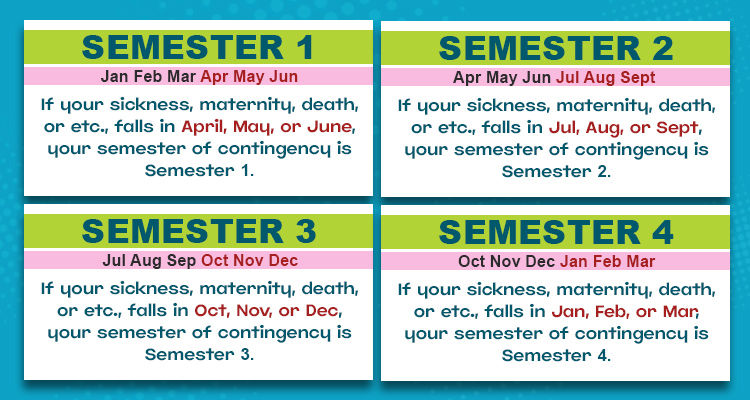

- Identify the semester of contingency.

A semester means 6 consecutive months of two quarters listed below. The semester of contingency refers to the semester ending in the months when you are sick or injured.

| Semesters | Quarters | Specifications |

| Semester 1 | Quarters 1 & 2 | January, February, March, April, May, June |

| Semester 2 | Quarters 2 & 3 | April, May, June, July, August, September |

| Semester 3 | Quarters 3 & 4 | July, August, September, October, November, December |

| Semester 4 | Quarters 4 & 1 | October, November, December, January, February, March |

- Identify the claim period.

It should be 12 months before the semester of contingency (not included).

- Identify the highest MSCs.

MSC, referring to monthly salary credit, is the amount of monthly earnings used to compute SSS contributions and benefits. It should be acknowledged in the SSS Contribution Schedule that is released every year. Pick the 6 highest MSCs during the 12-month period.

- Get a total MSC by adding up the 6 highest MSCs.

- Get an average daily salary credit (ADSC) by dividing the total MSC by 180 days.

- Get the daily sickness allowance by multiplying the ADSC by 90%.

- Compute the total amount of sickness benefit by multiplying the daily sickness allowance by the number of days claimed.

To help you better understand the SSS sickness benefit calculator, here is an example. Supposing that an employee is absent from work from Jun 1st, 2024 to June 20th, 2024 and the highest MSC is P15,000 per month. How much is SSS sickness benefit? It can be calculated through the following steps.

- Semester of contingency: April 2024 – September 2024

- 12-month period: April 2023 – March 2024

- Total MSCs: P15,000 + P15,000 + P15,000 + P15,000 + P15,000 + P15,000 = P90,000

- Average daily salary credit (ADSC): P90,000 / 180 = P500

- Daily sickness allowance: P500 x 90% = P450

- Amount of benefit: P450 x 20 days = P9,000

SSS Sickness Benefit Requirements

To claim the benefit, applicants should satisfy a set of requirements according to their employment status:

SSS Sickness Benefit Requirements for Employed

Employees should inform the employer of the contingency within 5 days after being sick or injured and the employer should inform SSS within 5 days after receiving the employee’s notification.

When you file the notification personally, you should provide:

- A duly accomplished Sickness Notification Form.

- A valid government-issued identification, such as an SSS ID card, driver’s license, passport, UMID, postal ID, etc.

- Medical document (if any).

When the notification is filed by a company representative, the following is needed:

- A duly accomplished Sickness Notification Form.

- Transmittal List (TL) or Acknowledgment Letter generated by the system or from the employer.

- The employee’s identification.

- Medical document (if any).

If the claim is related to work, extra documents below are needed.

- Accident/Sickness Report from the employer.

- Police report (in the case of vehicle accidents and third-party involvement).

- Photocopy of the employer’s logbook.

If your time of sickness is prolonged, you have to submit extra documents, including:

- An original or true copy of diagnostic results, such as X-ray, ECG, etc.

- An original or true copy of hospital or clinical records to confirm the diagnosis.

If you are ill or hurt on strike/shutdown, please also include:

- An original or true copy of the notice of strike certificate issued by the Department of Labor and Employment (DOLE).

- An original or true copy of the certification of Foreclosure (if applicable).

- An original or true copy of certification from the DOLE stating that there is a pending labor case with the employee or employer involved.

- An original or true copy of the certification of non-advancement of the benefit.

SSS Sickness Benefit Requirements for Self-Employed

To claim SSS sickness benefits for voluntary members (VM) and the self-employed (SE). The beneficiaries themselves should inform SSS directly through a sickness benefit application within 5 days of being sick or injured. Overseas Filipino Workers (OFW) confined at home will be given another 30 days while those confined in a hospital can file within 1 year after being discharged. The required documents are listed below.

- A duly accomplished Sickness Benefit Application (SBA) Form.

- Copy of EC claim approval.

- One primary ID (SS card, UMID card, passport, PRC card, or Seaman’s Book) or 2 secondary IDs (at least one photo ID and both with signature). When it is filed through someone else, the IDs of both the representative and the beneficiary are needed.

- Proof of prolonged confinement or sickness.

If you are confined during employment and currently separated, you should also submit:

- An original or true copy of the certification of separation and non-advancement of SSS sickness benefit with an effective date of separation and signature of the employer’s authorized signatory.

For previously employed SE/VM or separated employees, additional documents are required in special cases.

If the company is on strike, please include:

- An original or true copy of the notice of strike issued by the Department of Labor and Employment (DOLE).

- Duly notarized Affidavit of Undertaking indicating no advance payment and effected date of separation.

If the company has been dissolved or has winded up business, please include:

- Duly notarized Affidavit of Undertaking indicating no advance payment and effected date of separation.

If the employer/employee has a pending case, please include:

- Certification from DOLE.

- Duly notarized Affidavit of Undertaking indicating no advance payment and effected date of separation.

If you are separated from employment due to Absence without Leave (AWOL) or strained relations with the employer, please include:

- Duly notarized Affidavit of Undertaking indicating no advance payment and effected date of separation.

How to File SSS Sickness Benefit

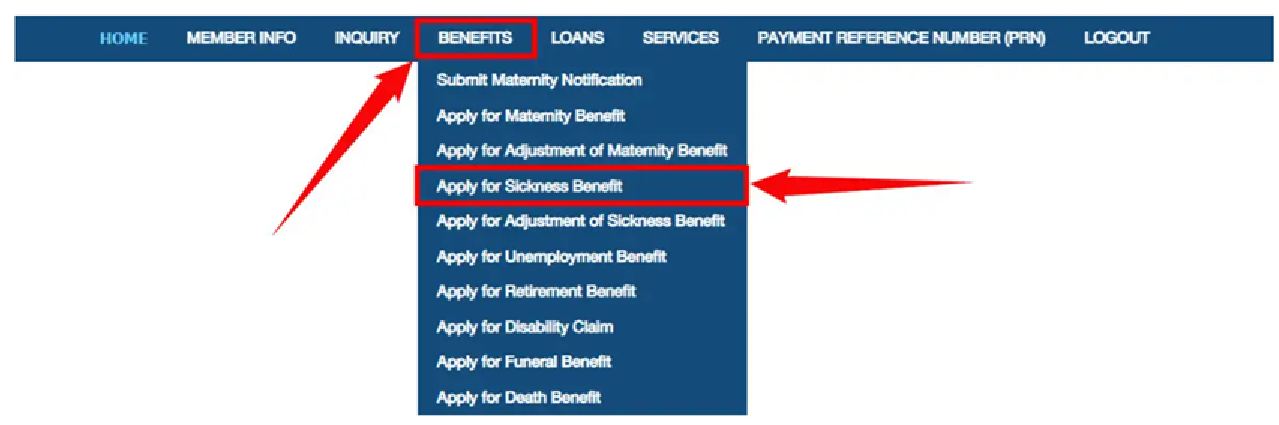

SEs, OFWs, and VMs can claim the SSS sickness benefit on the SSS official website on their own while employees should claim through the employer. Here are detailed instructions on how to file SSS sickness benefits online.

- Visit SSS portal and log in or create an account.

- Hover the cursor on “BENEFITS” at the top menu bar and click on “Apply for Sickness Benefit.”

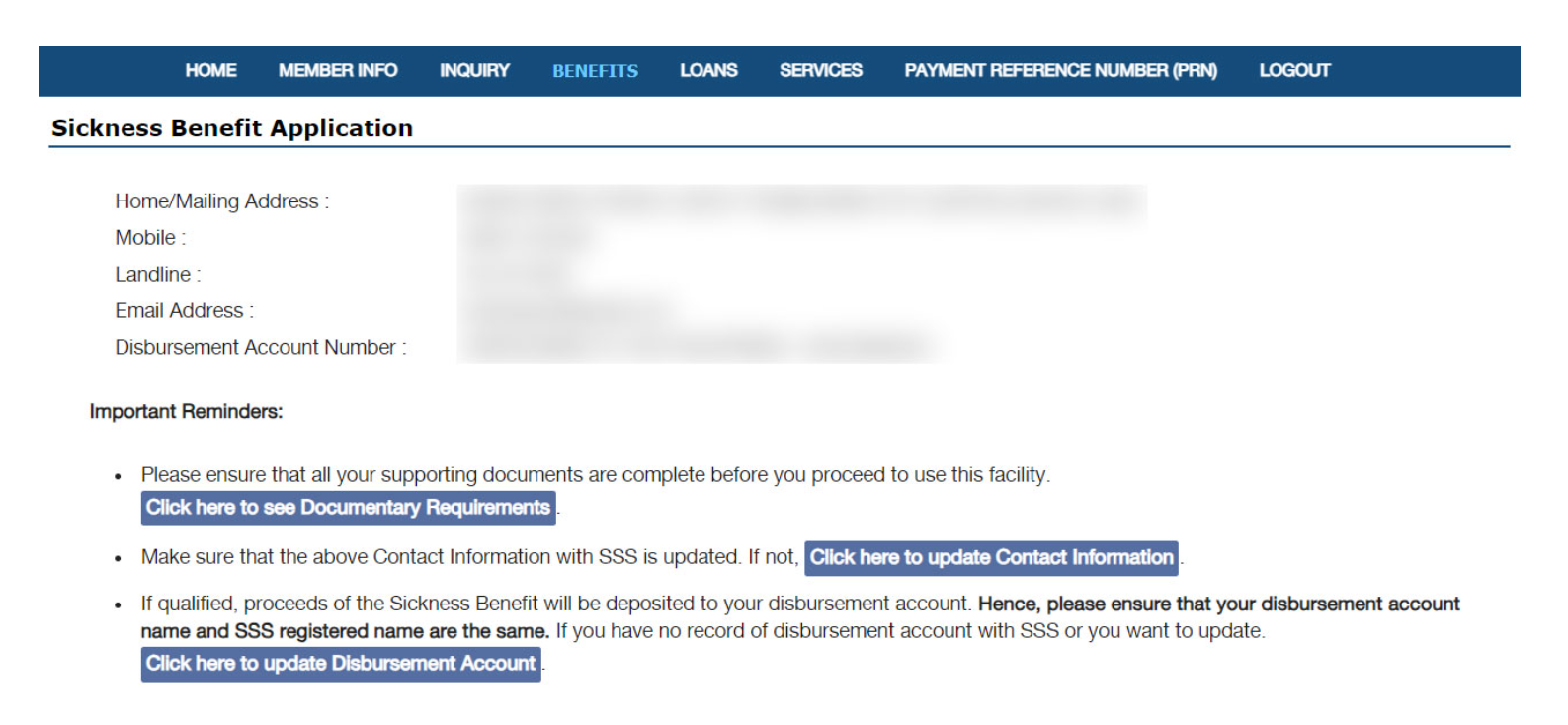

- Check information about the address and disbursement account on the screen. If there is anything wrong, click on “Click here to update contact information” or “Click here to update disbursement account”. If not, click on “Proceed” to continue.

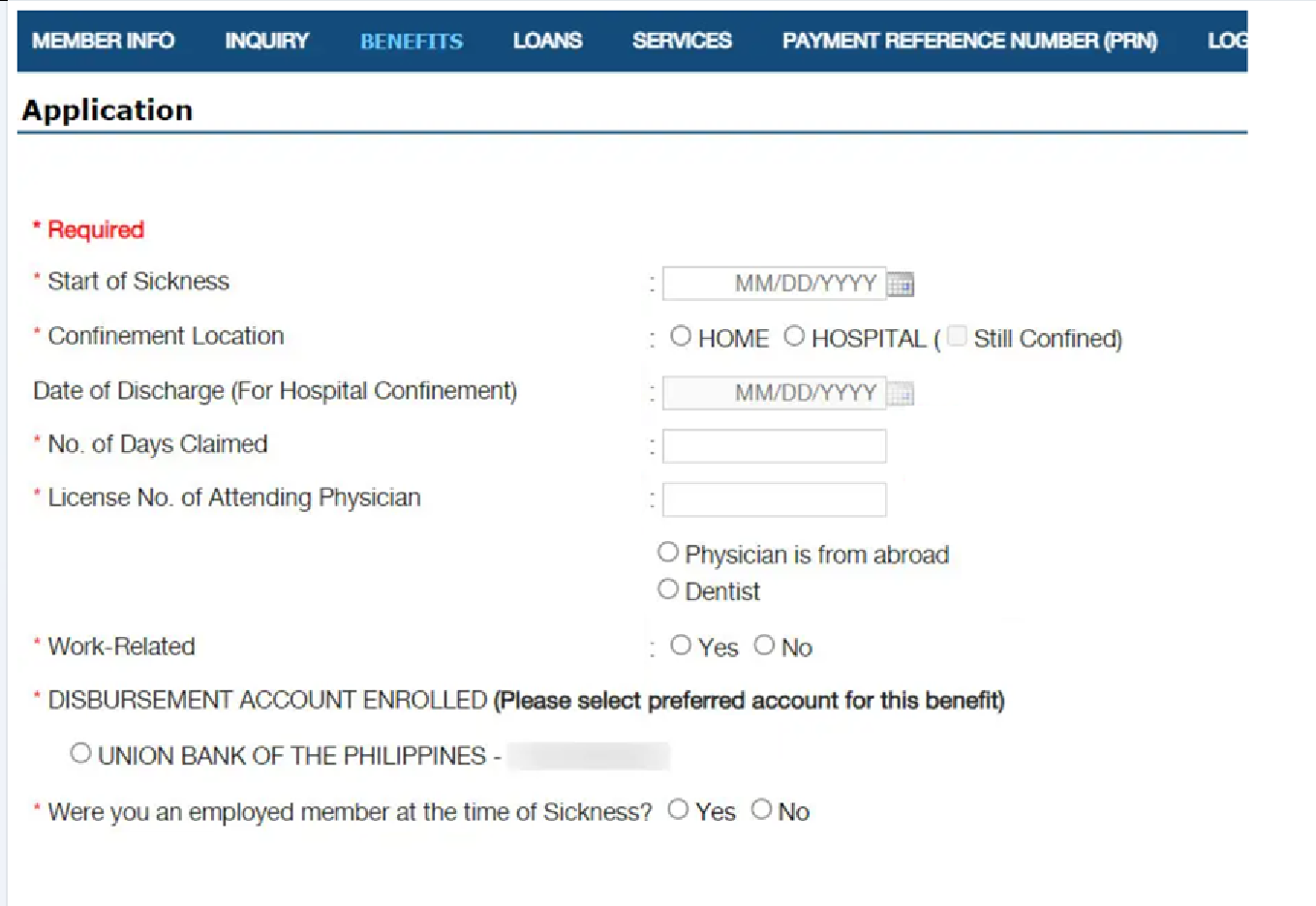

- Fill out the Sickness Benefit Application (SBA) Form. Make sure to complete all fields with asterisks accurately and honestly. Click on the “Proceed” button at the end to continue.

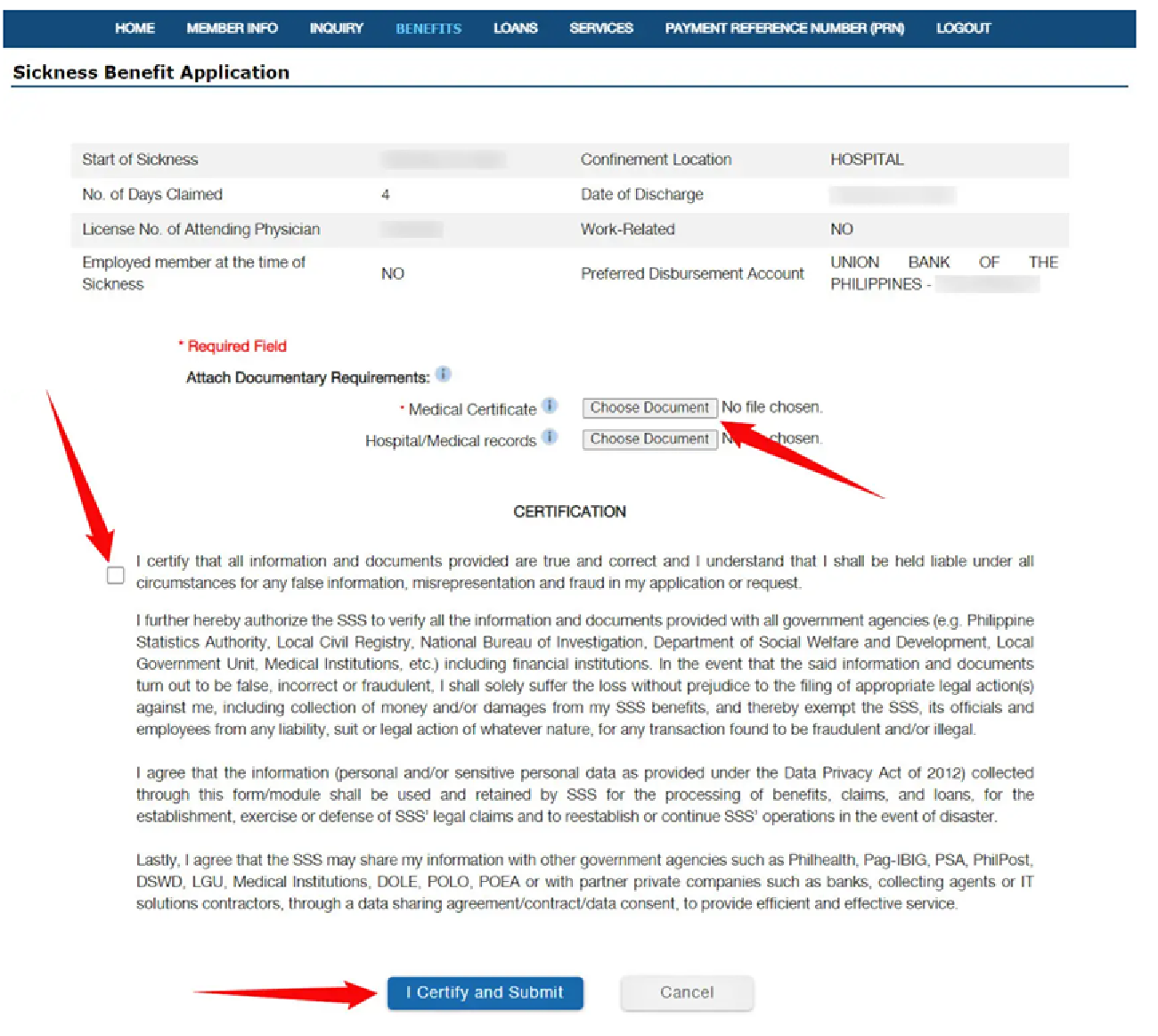

- Review and confirm the information provided before. If there is nothing wrong, click on “Choose Document” and upload clear copies of the medical certificate and hospital/medical records separately. Either pictures or PDF files within 3MB are acceptable. Read the statement at the end and check the box to agree to it. Click on “I Certify and Submit”.

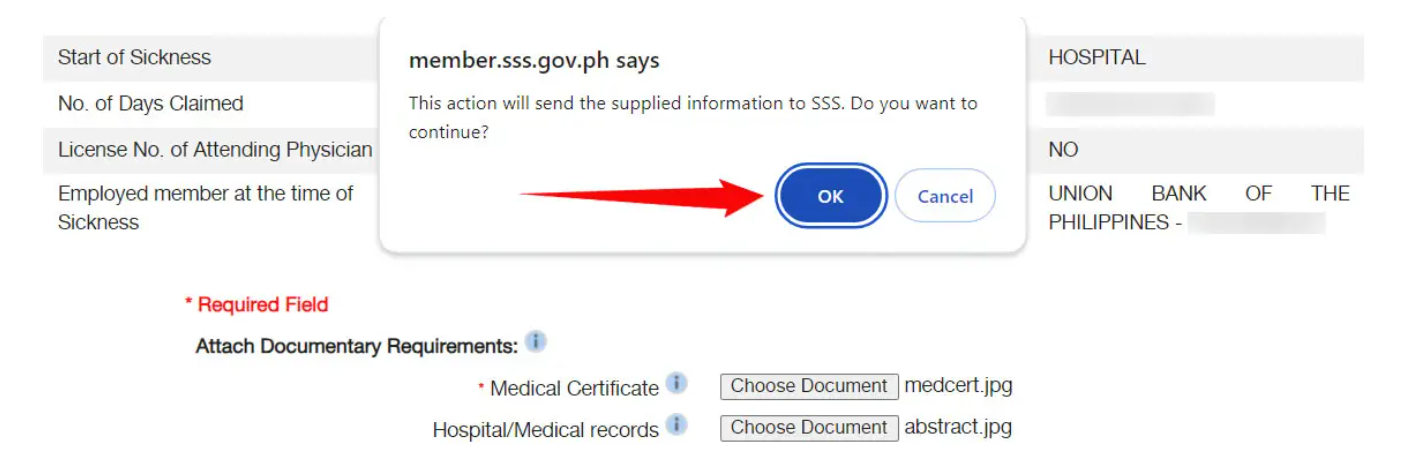

- Click on the “OK” button in the pop-up window to submit the application.

- Note down the transaction number on the confirmation notice on the screen which could be used to track application status. The number can also be found in the confirmation email sent to your registered email ID.

How Many Days to Claim SSS Sickness Benefit

Individuals can claim an allowance for up to 120 days in one calendar year. Even if you claim less than 120 days, the remaining days will be cleared at the end of the year and cannot be transferred or added to the next year e.

You are not allowed to claim for the same sickness or injury for more than 240 days, otherwise, you are supposed to claim as a disability benefit.

How Will I Know if My SSS Sickness Benefit is Approved?

An email will be sent once your application is approved. You can also check the application status while waiting for the result. Here is how to check SSS sickness benefit status online.

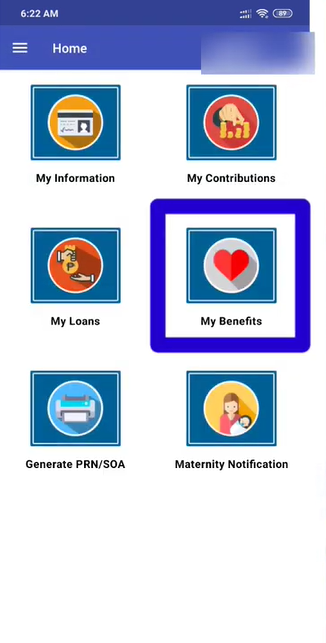

- Visit SSS website and log into My.SSS account. Or access to SSS Mobile App.

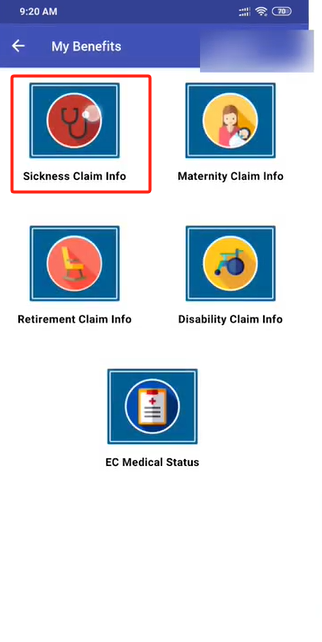

- Navigate to the Sickness Benefit page.

- Click on the “Monitoring of Claims”.

- Enter the transaction number.

- Check the application status. If you are approved, you will see the amount of benefit and date of disbursement.

How Will the SSS Sickness Benefit Be Paid?

The sickness benefit allowance will be disbursed to the nominated Philippine National Bank (PNB) deposit account of the beneficiary electronically. Applicants should create a new account or nominate an existing one and submit to the bank the enrollment form along with a photocopy of proof of the account, such as a passbook, bank statement, ATM card, or checks with the name of the account owner and account number. The branch of the chosen bank will send the form to the SSS office and inform you of the enrollment status. Once approved, you will receive the benefit through the enrolled account.

FAQ

📌How do I claim the SSS Sickness Benefit of OFW?

You can file an application on the SSS website yourself.

📌How long is SSS sickness benefit?

It covers a maximum of 120 days in one calendar year.

📌What to do if my SSS sickness benefit claim is rejected?

Check the reason for rejection and correct your application again.

Summary

The SSS sickness benefit is a great support to those who have to extend their sick leave. Anyone who qualified for the SSS sickness benefit requirements could apply for it online. It should be filed by the employer on behalf of the employee or SEs/VMs/OFWs themselves. The SSS sickness benefit processing time takes 10-30 working days, so it is necessary to check the status and wait patiently for the result. Once approved, the allowance will be disbursed electronically.