Paying tax is a civil obligation of individuals and entities in the Philippines. Anyone violating the rules might face punishment and be ineligible for certain benefits. Therefore, a certificate of taxation credibility is necessary. In this passage, we will introduce what is tax clearance, where and how to get tax clearance certificate.

What Is Tax Clearance in the Philippines?

A Tax Clearance is an official certificate issued by the Bureau of Internal Revenue (BIR) in the Philippines. It serves as proof of tax compliance and good standing of a taxpayer or entity. The certificate will expire after one year. It will also be revoked if the document owner violates any tax code during the validity period.

When Do I Need a Tax Clearance?

Before learning about how to obtain this document, it is necessary to learn about the importance of tax clearance certificate. As it demonstrates that an individual/business has fulfilled all the tax obligations and there is no unpaid tax. This proof of credibility is usually required in the following conditions.

- Apply for a business license;

- Close or sell a business;

- Purchase a business;

- Apply for a loan;

- Transfer the land;

- Apply for certain types of visas;

Requirement for Tax Clearance Certificate

To obtain a certificate of good taxation, all applicants should satisfy the following tax clearance requirements.

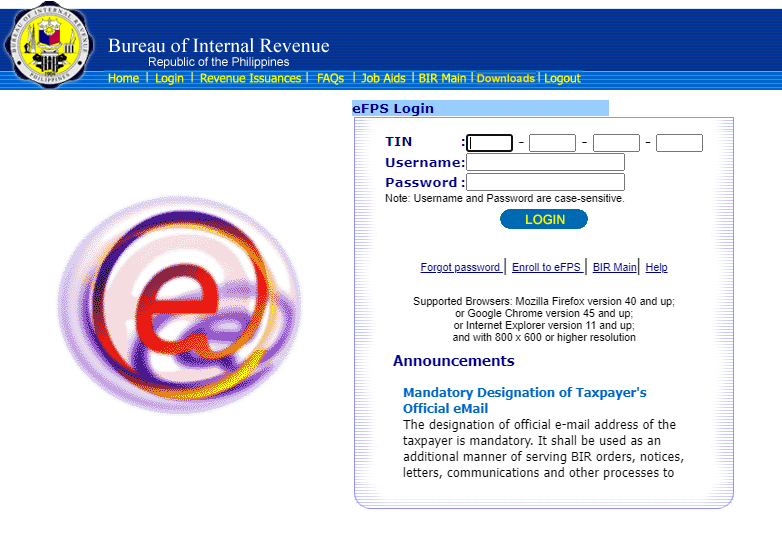

- You have been registered with BIR Electronic Filing and Payment System (eFPS). Otherwise, you have to go to the Revenue District Office (RDO) and get enrolled. A written request for enrollment is required. The request should include names, emails, positions, and phone numbers of 2 authorized users.

- You don’t have any outstanding taxes or are not marked as a Cannot Be Located (CBL) taxpayer.

- You should not have any pending cases related to taxation.

- A written request for Tax Clearance should be submitted.

Where to Get Tax Clearance?

The tax clearance certificate can be applied at BIR Regional Offices and here is the directory of the revenue regions in the Philippines.

| Revenue Region | Address |

| Revenue Region No.1 Calasiao | 2nd & 3rd Floor, BIR Building, Mc Arthur Hi-way, Calasiao, Pangasinan |

| Revenue Region No.2 Cordillera Administrative Region (CAR) | No.69 Leonard Wood Road, Baguio City 2600 |

| Revenue Region No.3 Tuguegarao City | No.11 Pagayaya Street, Regional Government Center Carig Sur, Tuguegarao City |

| Revenue Region No.4 City Of San Fernando, Pampanga | RR 4 Building, BIR Complex, McArthur Highway Sindalan City of San Fernando, Pampanga |

| Revenue Region No. 5 Caloocan City | BIR Regional Office, New DPD Building #140 Calaanan, EDSA, Caloocan City |

| Revenue Region No. 6 City Of Manila | BIR Regional Office Bldg., Tuazon Bldg., Solana cor Beaterio St., Intramuros, Manila |

| Revenue Region No.7A Quezon City | 5th Floor (roof deck) FISHER MALL, Quezon Avenue cor. Roosevelt Junction, Quezon City |

| Revenue Region No.7B East NCR | 24th & 25th Floors, The Podium west Tower, ADB Road, Ortigas Center Mandaluyong City |

| Revenue Region No.8A Makati City | 36/F Exportbank Plaza cor. Chino Roces and Sen. Gil Puyat Avenue, Makati City |

| Revenue Region No.8B South NCR | BlR Regional Office Building, 313 Sen. Gil Puyat Ave, Makati City |

| Revenue Region No.9A – CaBaMiRo (Cavite-Batangas-Mindoro-Romblon) | 2nd and 3rd Floor, Liana’s Junction Plaza, Poblacion lV, Sto. Tomas Batangas 4234 |

| Revenue Region No.9B-LaQueMar (Laguna-Quezon-Marinduque) | Brgy. San Nicholas Maharlika Highway, San Pablo City |

| Revenue Region No.10-Legazpi City | BIR Bldg. Camia St. Imperial Court Subd. Legazpi City |

| Revenue Region No. 11 lloilo City | BIR Building, M.H.Del Pilar St. Molo, Iloilo City |

| Revenue Region No.12 Bacolod | BIR Regional Office Building, Jocson-P. Henares St. Extension Brgy. Taculing, Bacolod City |

| Revenue Region No.13 Cebu City | BlR Regional Office Bldg., Archbishop Reyes Avenue, Cebu City |

| Revenue Region No.14 Eastern Visayas Region | BIR Regional Office Building, Government Center, Candahug Palo, Leyte |

| Revenue Region No.15 Zamboanga City | BIR Regional Office Building, Petit Barracks, Zamboanga City |

| Revenue Region No.16 Cagayan De Oro City | BIR Regional Office Bldg., West Bound Terminal, Bulua, Cagayan de Oro City |

| Revenue Region No.17 Butuan City | BIR Regional Office Building, J. Rosales Avenue, Butuan City |

| Revenue Region No. 18 Koronadal City | BlR Bldg., Brgy. Concepcion. National Hi-Way, Koronadal City |

| Revenue Region No.19 Davao City | BIR Regional Office Building Bolten Extension, Davao City |

How Do I Get a Tax Clearance Certificate

After confirming where to get a BIR tax clearance, you are supposed to apply for the document through the steps below.

- Bring a written request for Tax clearance to the Revenue District Office (RDO).

- Wait for the RDO to check whether there is any delinquency or missed tax payment. If yes, settle it before proceeding. If not, a Certificate of No Tax Liability will be issued.

- Pay the application fee through eFPS portal and secure a payment confirmation receipt.

- Bring all supporting documents to the BIR regional office, including Certificate of No Tax Liability, Sworn Application Form for Tax Clearance, Payment Form (Form 0605), eFPS payment confirmation receipt, photocopy of Certificate of Registration (COR), previous tax clearance (if any), Letter of Request for Tax Clearance, 2 loose documentary stamps, and the latest Tax Returns paid through eFPS.

- Claim the Tax Clearance after your application is approved.

How Much Does a Tax Clearance Cost?

It takes P100 to get a tax clearance certificate. eFPS-registered individuals should file Form 0605 visa eFPS no matter when they are applying for the first time or renewing the document. New applicants or foreign entities can pay the fees through AABs, RCOs, Gcash, Bizlink, or other authorized channels.

Does the Tax Clearance Certificate Expire?

Yes. It is valid for one year upon the date of issuance. If you are a business owner, you are suggested to renew it annually. The renewal requirements and process are generally similar to first-time applications. Moreover, if you move to another province, you might be required to obtain a new BIR tax clearance. Please contact the local BIR regional office and inquire about the replacement/renewal.

Summary

A tax clearance certificate is necessary to engage in business activities whether as an individual or business entity. It seems complicated to get the document. If you meet the tax clearance requirements and file an application according to the official instructions, you will receive the document quickly. We hope this passage will help you learn more about tax clearance and get everything ready in advance.