In the Philippines, you can apply for a calamity loan through the Social Security System (SSS), which can provide financial support during times of crisis. You can check the status of your loan after you have submitted the loan application. In this article, we will show you a comprehensive guide on how to check sss calamity loan status online.

How Can I Check My SSS Calamity Loan Status

After you have applied for the SSS calamity loan, you can use the following methods to check your loan status, such as online, the SSS mobile app or the call.

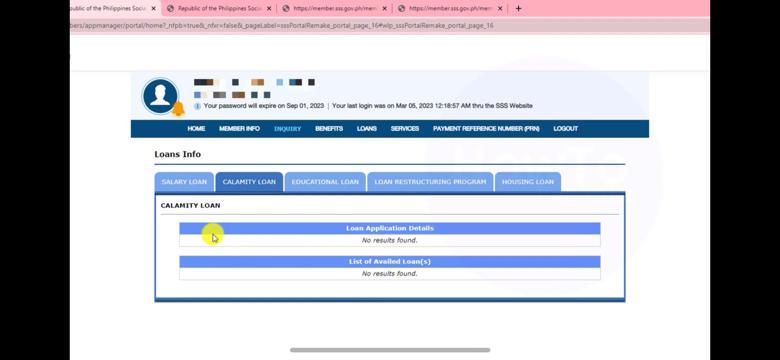

Check SSS Calamity Loan Status Online

- You can visit the official SSS website on the browser and choose the member option.

- You need to log in to your my.sss account by entering the user ID and password.

- Navigate to the ‘E-services’ tab on the menu and click ‘INQUIRY’ > ‘Loans Info’, then ‘CALAMITY LOAN’.

- Then you can see the SSS calamity loan status, which will be displayed as “Processed,” “Approved,” or “Disapproved.”

All the application information will be shown on the page.

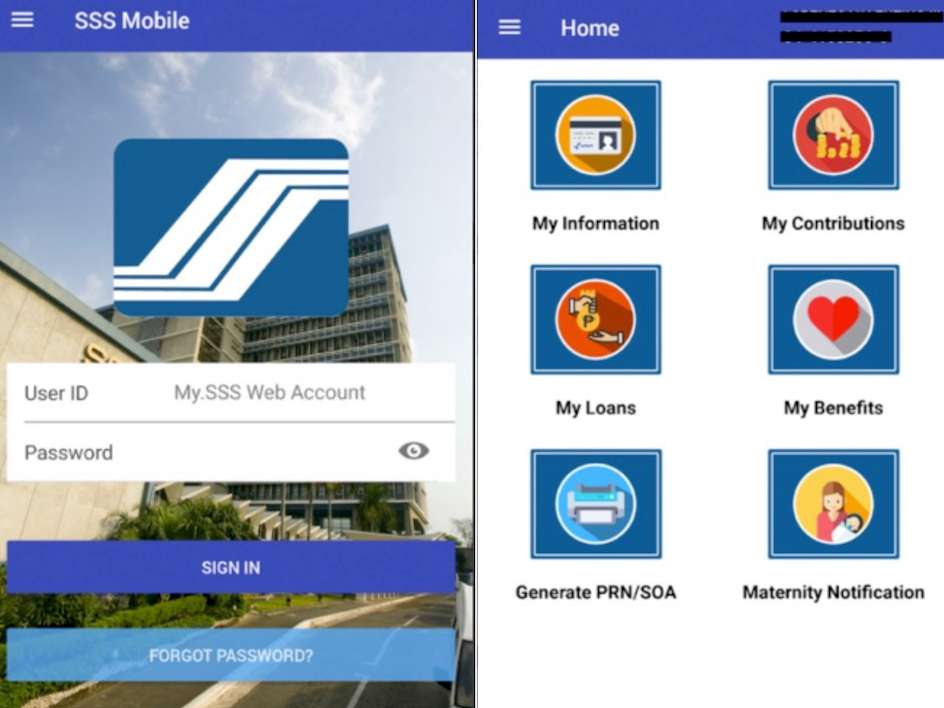

Check SSS Calamity Loan Status via the SSS Mobile App

The SSS branch offers a user-friendly mobile app that lets you check your loan status on the app.

You need to download and open the SSS Mobile App on your Android or iOS device.

Then you should Log in to your SSS account and navigate to the ‘Loans’ or ‘Loan Status’ section.

You can check all your loan details and current loan status.

Check SSS Calamity Loan Status by Call

This is an easy way to check the SSS calamity loan status. You can call 920-6446 at 55 or 917-7777 to check the status of your loan. The recipient will tell you the details of the load application status and other information.

Why Do You Need to Check Your SSS Calamity Loan Status?

You must check the SSS Calamity loan status after submitting the application. Here are the reasons:

- You need to know if the application is approved. If not, you should consider other ways to help you out of the crisis.

- You can check if you have the right card to receive the SSS loan.

- If approved, you need to know the monthly amortization and due date. If you do not pay the loan on time, you will receive an additional 1% penalty per month on unpaid principal and interest until it is fully paid.

What to Do If I Can’t Find SSS Calamity Loan Record?

If you have logged into the SSS website but can’t find the SSS calamity loan record, you are not the only one who has this problem. You can call the SSS hotline to ask if the loan application has been synced. Or you can write an email to SSS asking what happened. If you don’t want to wait for the email, you can visit the SSS branch directly with your valid ID. They will help you understand why and fix the problem.

How Many Days SSS Calamity Loan Release?

After you have completed a form and the required documents, the SSS will process your loan application within two to three weeks. If approved, the loan will be released approximately 10 working days from the approval date.

How Can I Receive SSS credit?

When you apply, you can choose the most convenient channel to receive the SSS calamity loan. Here are three ways to get the loan.

- Active UMID-ATM: This is the most common way to get a loan if you have an activated UMID-ATM.

- PESONET-accredited banks: You can register your bank account in the Payment Account Enrollment Module on My.SSS.

- UnionBank Quick Cards: It allows you to use UnionBank Quick Cards at selected SSS branches with a UnionBank of the Philippines (UPB) kiosk.

Common Reasons Your SSS Calamity Loan Got Rejected

It is normal for your SSS Calamity loan to be rejected by the SSS branch. There are some common reasons why your SSS loan may fail online.

- You don’t meet the eligibility for the loan application, for example, you are not a permanent SS member, you have several unpaid loans or you don’t have a job or place of residence.

- You are not one of the members who can apply for a loan.

- You do not prepare the necessary requirements for the SSS calamity loan, such as an incomplete application form, invalid ID, or insufficient proof of income.

- You are not considered an honest person and you can’t afford the loan.

If your application is rejected, you can inquire about the reason at your nearest SSS branch. Therefore, you can correct it in the next application.

FAQ

📌How much will I get from the SSS calamity loan?

When you apply for the SSS calamity loan, you will receive the calamity loan SSS amount equivalent to one monthly salary credit (MSC) or up to PHP 20,000, whichever is lower. The monthly salary credit (MSC) is calculated based on the average of the last 12 MSCs (rounded to the nearest thousand). You can repay the loan in 24 equal monthly installments within 24 months.

📌How will I know if my SSS loan is released?

If your SSS loan application is approved, you will receive the money after 10 working days from the approval date. You can check the loan release date by using the methods mentioned above. Or you will receive an SMS or email when it is released.

📌Is the SSS Calamity loan available in 2024?

Yes. If you meet all eligibility requirements and prepare the necessary documentation, you can apply for an SSS calamity loan online in 2024.

Conclusion

In conclusion, it is necessary for you to check the SSS calamity loan status in a timely manner to ensure that you know the deadline each month to pay the minimum amount of money. If you do not have updated information from the load application, it is recommended to visit the SSS branch to check the status.