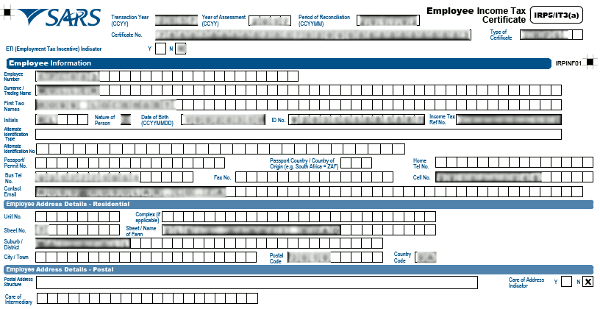

The 2024 tax filing for individual taxpayers is in progress until 21 October. As an employee, you need an IRP5 certificate to complete your income tax filing for this tax year. If you haven’t received one, read this guide to the IRP5 certificate and learn the IRP5 meaning, where can I get my IRP5, and how to submit IRP5 on eFiling.

What Is IRP5 Certificate

An IRP5 is a tax certificate issued to employees at the end of a tax year (1 March 2023 to 28 February 2024), detailing the total incomes, deductions, and related taxes for the tax year. As an employee in South Africa, to complete your income tax return for a tax year, you need an IRP5 certificate issued by your employer.

How Does IRP5 Work

As a crucial document summarizing your earnings, deductions, and taxes in a tax year, the IRP5 certificate pulls through to your income tax return by SARS (South African Revenue Service). Once your IRP5 is submitted to SARS, it is used to verify and assess your tax liability, including data verification, tax calculation, refund or payment determination, fraud detection, and statistical analysis.

🔎Read Also: Tax Compliance Status Verification in South Africa

How Do I Get My IRP5 Certificate

Generally, you can get your IRP5 certificate from your employer, which can be a physical or digital copy. Your employer is legally obligated to provide this document to you at the end of each tax year. If you are unable to contact your employer for your IRP5 copy, you can get it from SARS’s online eFiling system instead. Here is how:

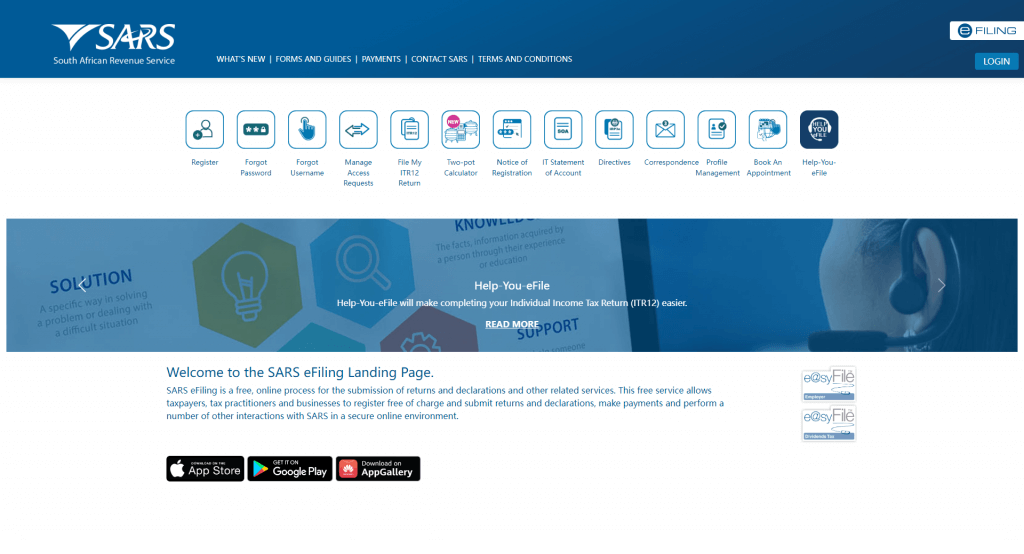

Step 1. Access the online portal at www.sarsefilling.co.za with a smartphone or PC and log in.

Step 2. Select the “Returns Issued” option.

Step 3. Select the “Personal Income Tax (ITR12)” option on the drop-down.

Step 4. Select the already requested tax year on the list and open it. Or select the “tax year” on the top right and request the return, then open it. You should find your IRP5 form submitted by your employer to SARS and populated on your tax return.

If you cannot find your IRP5 online, that could be a technical issue (e.g. unsuccessful submission by the employer), contact SARS for assistance.

How to Check My SARS IRP5 Status

Similarly, you can ask whether your employer has submitted your IRP5 to SARS, which should be completed by May. If failing to do so, you can use the SARS’s online eFiling system to check the status of your IRP5. Here are the steps to check your IRP5 status using this online portal:

Step 1. Access the online portal at www.sarsefilling.co.za with a smartphone or PC and log in.

Step 2. On the left menu option, select “Third Party Data Certificate Search”.

Step 3. On the “Request Third Party Certificates” section, click the “certificate type” and select the IRP5 Form in the drop-down list, then select a tax year for which your IRP5 form is applicable.

Step 4. Once the selection is completed, click the “Submit Query” button at the bottom of the page. Your IRP5 form will be displayed with the “Download Certificate” option allowing you to download an electronic copy of your IRP5 certificate. Please note that this certificate copy cannot be used to submit to SARS.

How Long Does It Take to Get IRP5 Certificate

It is your employer’s obligation to complete the IRP5 certificate for a single tax year and submit it to SARS by the end of May each year as part of the tax collection process. Generally, you should expect to receive your IRP5 certificate from your employer in June of the year, so you may complete your 2024 tax return with it when the filing season opens on 1 July 2024.

You may also wonder: when should I receive my IRP5 if I already left the company? In fact, even if you left your company around this time and did not work for the entire tax year, you should still receive an IRP5 certificate from your former employer, because it is your employer’s responsibility under the laws of the Republic of South Africa.

What If I Don’t Get IRP5 Certificate from Employer?

If you still haven’t received an IRP5 Certificate from your employer by now, it’s crucial to take immediate action. This document is essential for filing your annual income tax return, and not having it can lead to significant penalties and potential legal issues. Here are the steps you should take:

1. Contact your employer immediately:

Reach out to your employer and inquire about the status of your IRP5. They may have encountered delays or technical issues, and they should be able to provide you with an update.

2. Report it to SARS:

If your employer fails to provide you with an IRP5 beacuse he/she did not pay the PAYE (Pay-as-you-earn) tax to SARS, you should report your employer to SARS. It offers a simple-to-use report system for suspicious activity as such. Here are the steps:

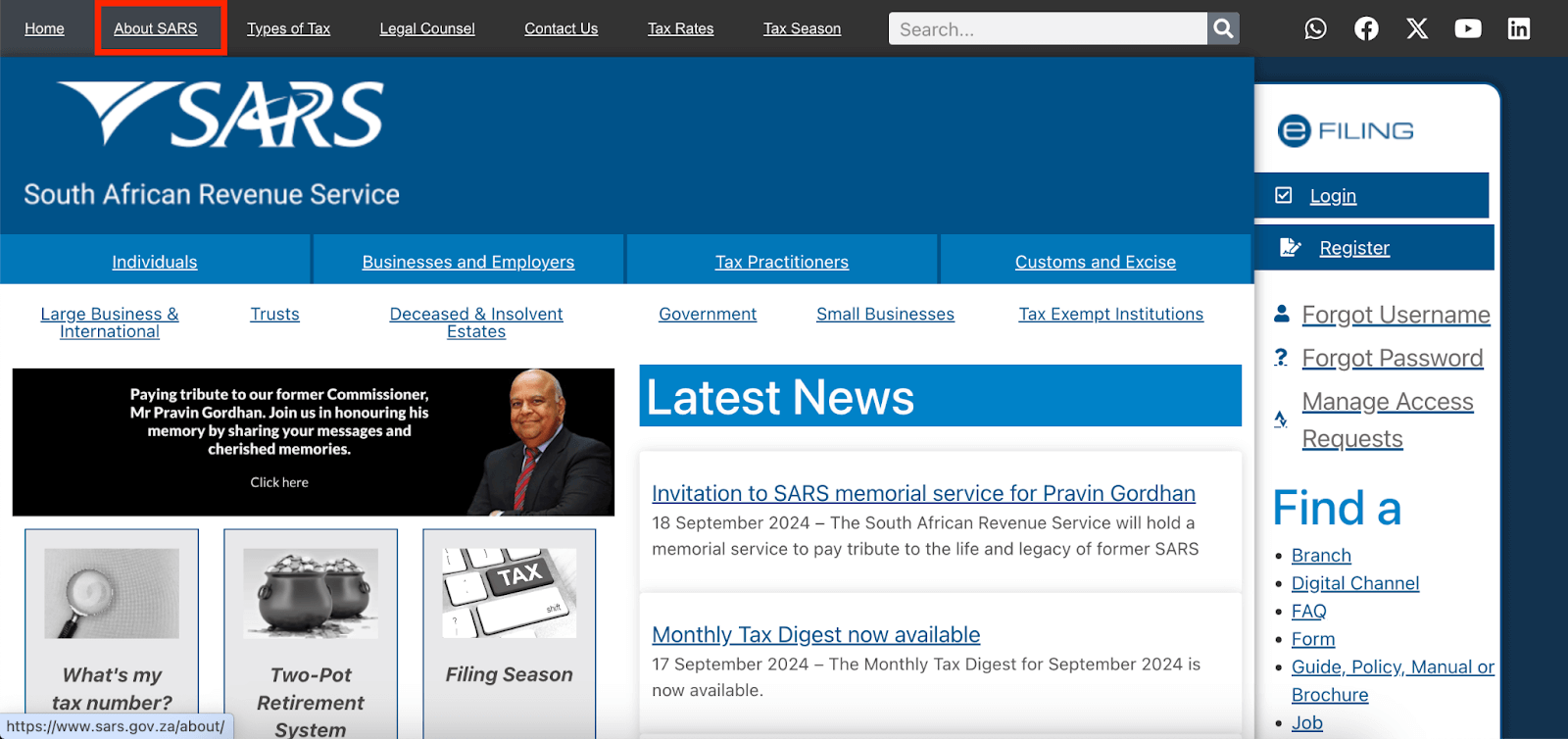

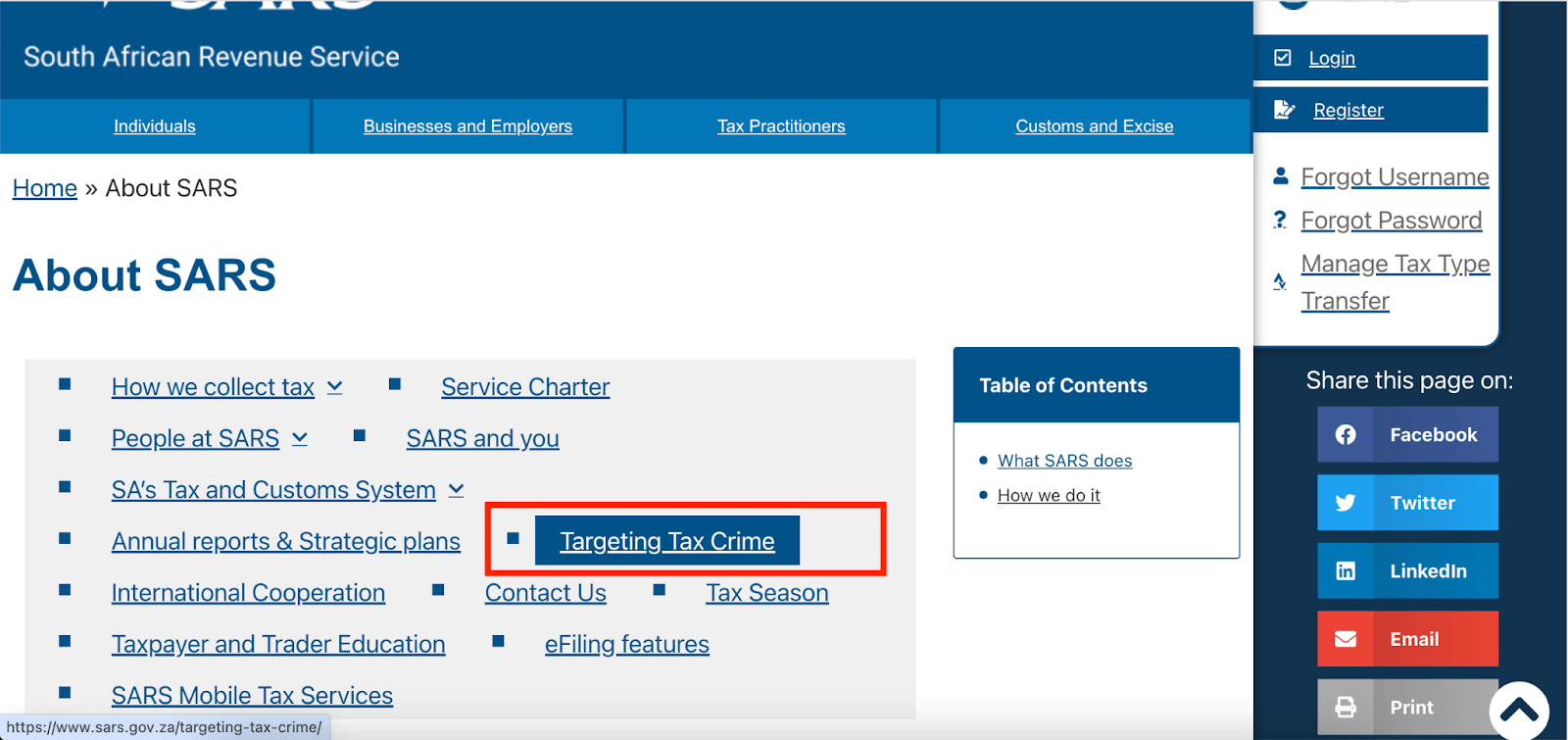

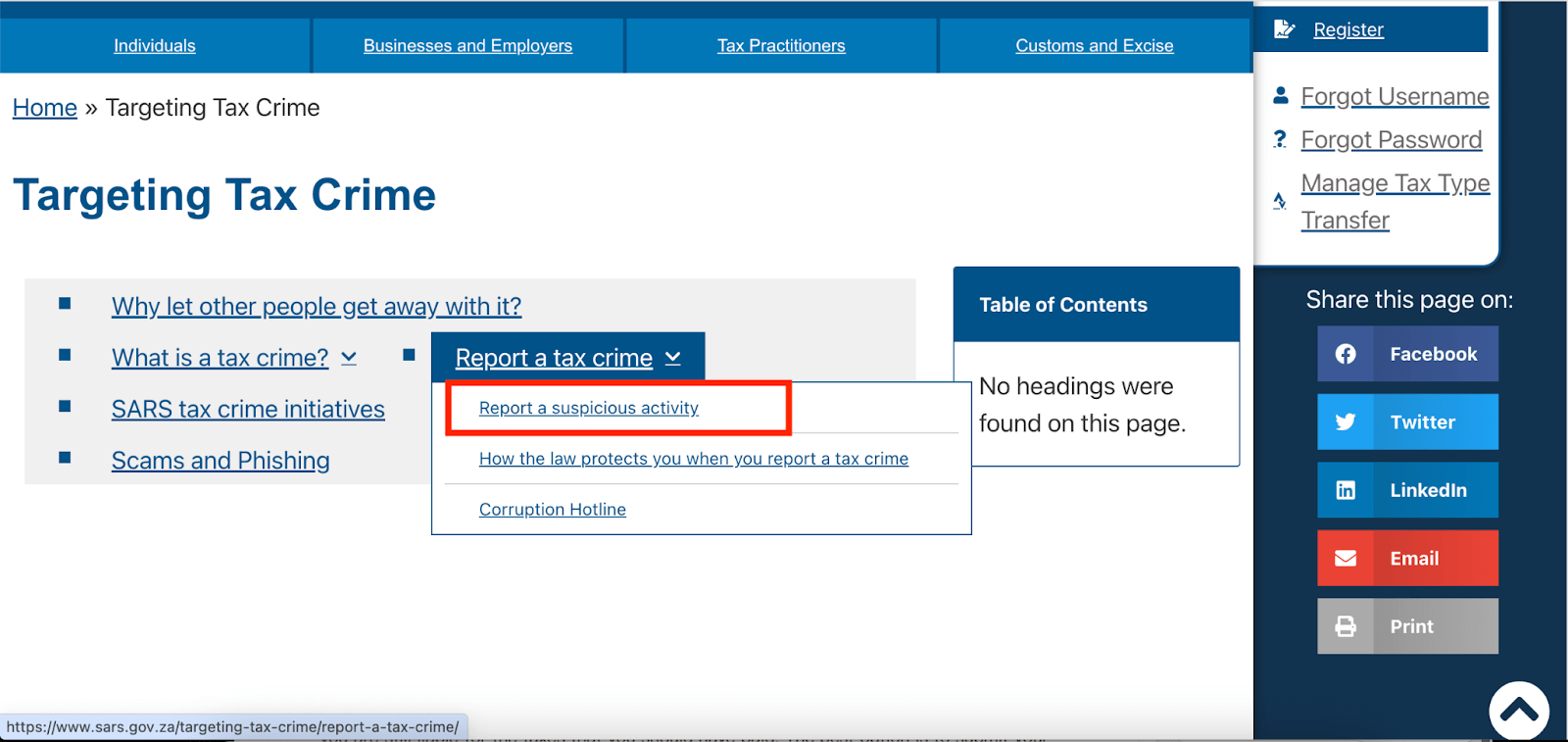

Step 1. Visit the official SARS website.

Step 2. Click the “About SARS” tab and then the “Targeting Tax Crime”.

Step 3. Select “Report a tax crime” and then click “Report a suspicious activity”.

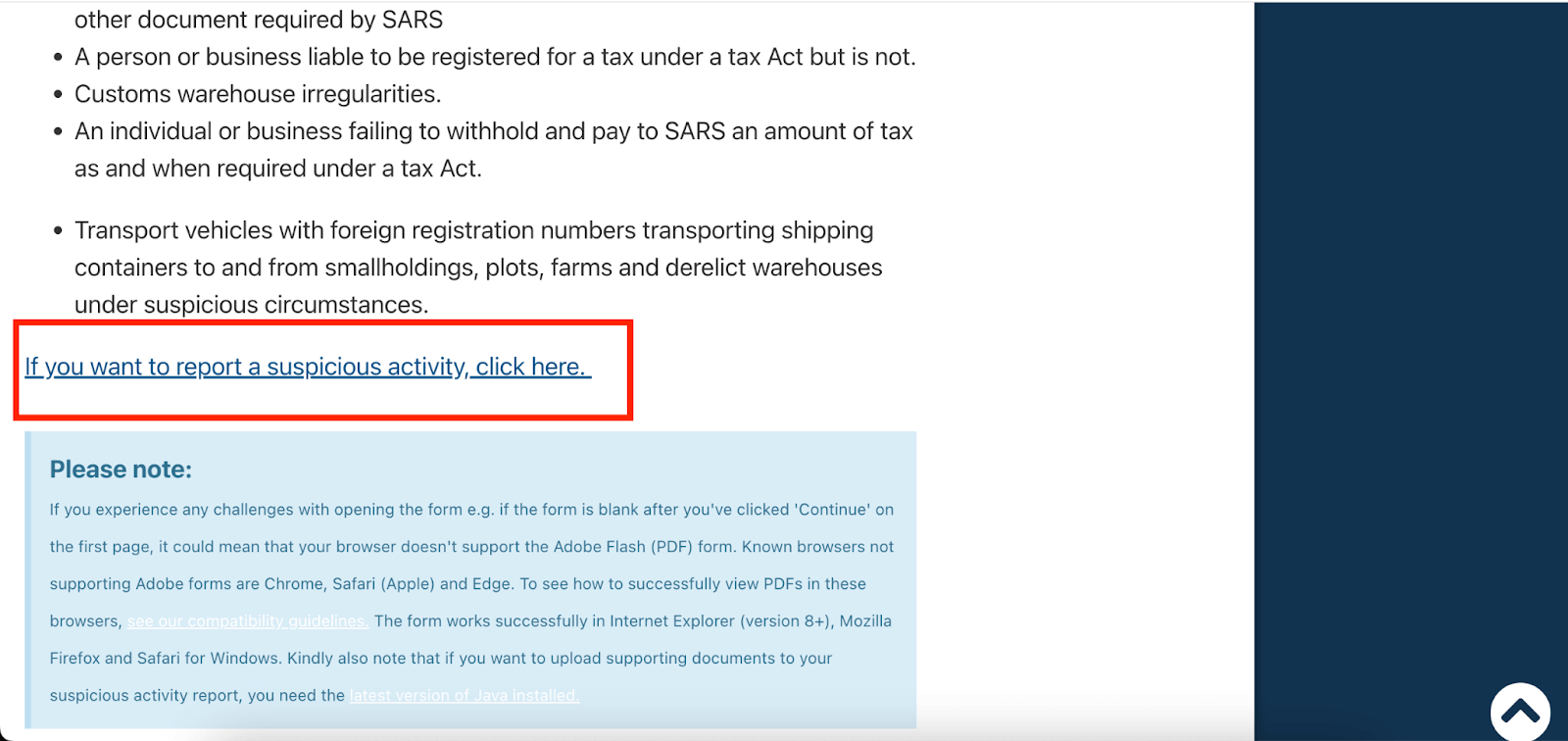

Step 4. Scroll down to find “If you want to report a suspicious activity, click here”, and click it.

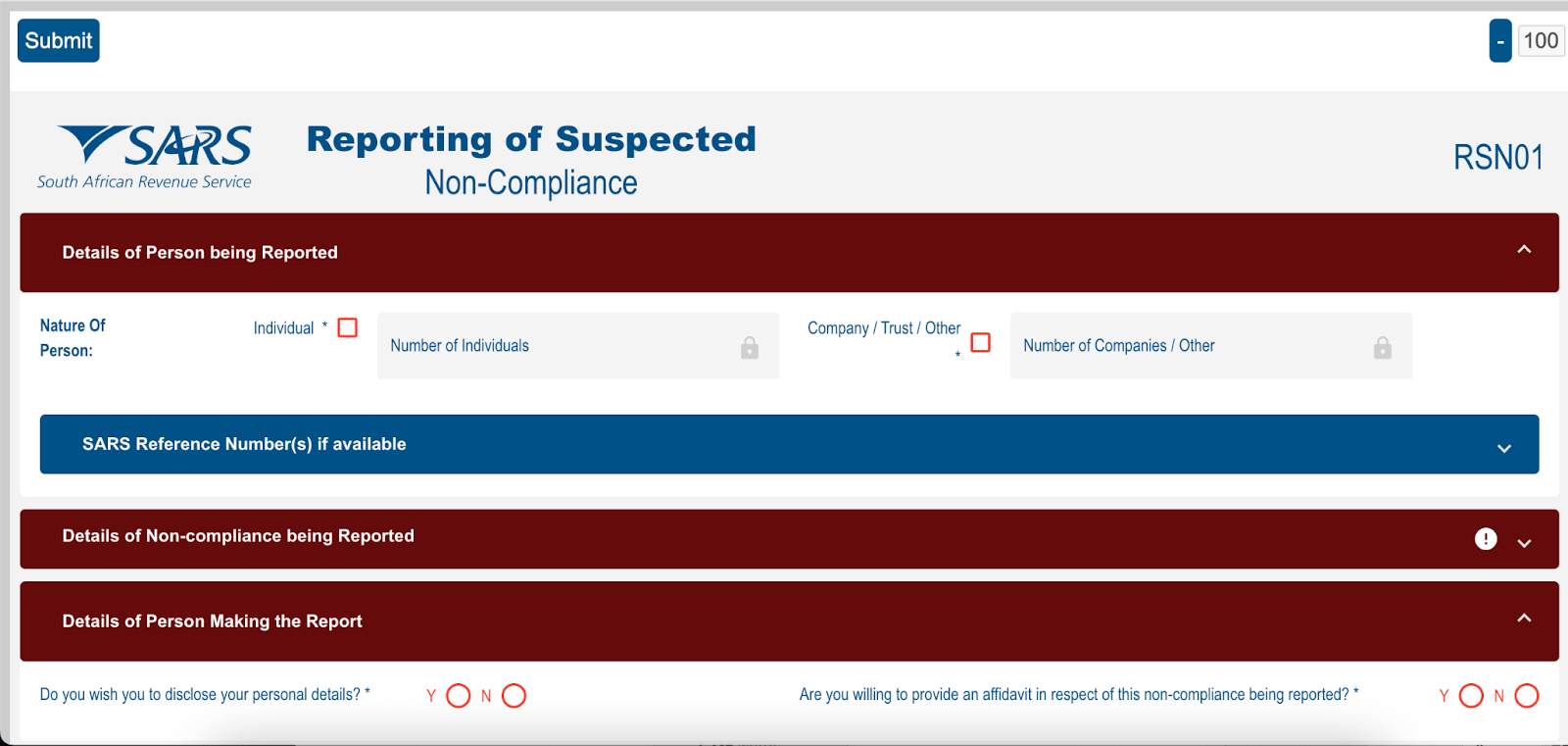

Step 5. Complete the non-compliance form, and upload any documentation that can be helpful in the investigation.

3. Submit your Payslips to SARS

At this point, you will be still liable for the income taxes that you should have paid. In this case, you should submit your Payslips and bank statements to SARS as an estimated income. You can file your income tax return using this estimated income figure. However, it’s important to keep detailed records of your income and expenses to support your return.

How to Submit IRP5 on eFiling and File Income Tax Return?

If you managed to obtain your IRP5 certificate from your employer, you may now proceed to your income tax return filing, which can be done easily online. Here’s a step-by-step guide on how to submit your IRP5 certificate on the SARS eFiling platform and file a return:

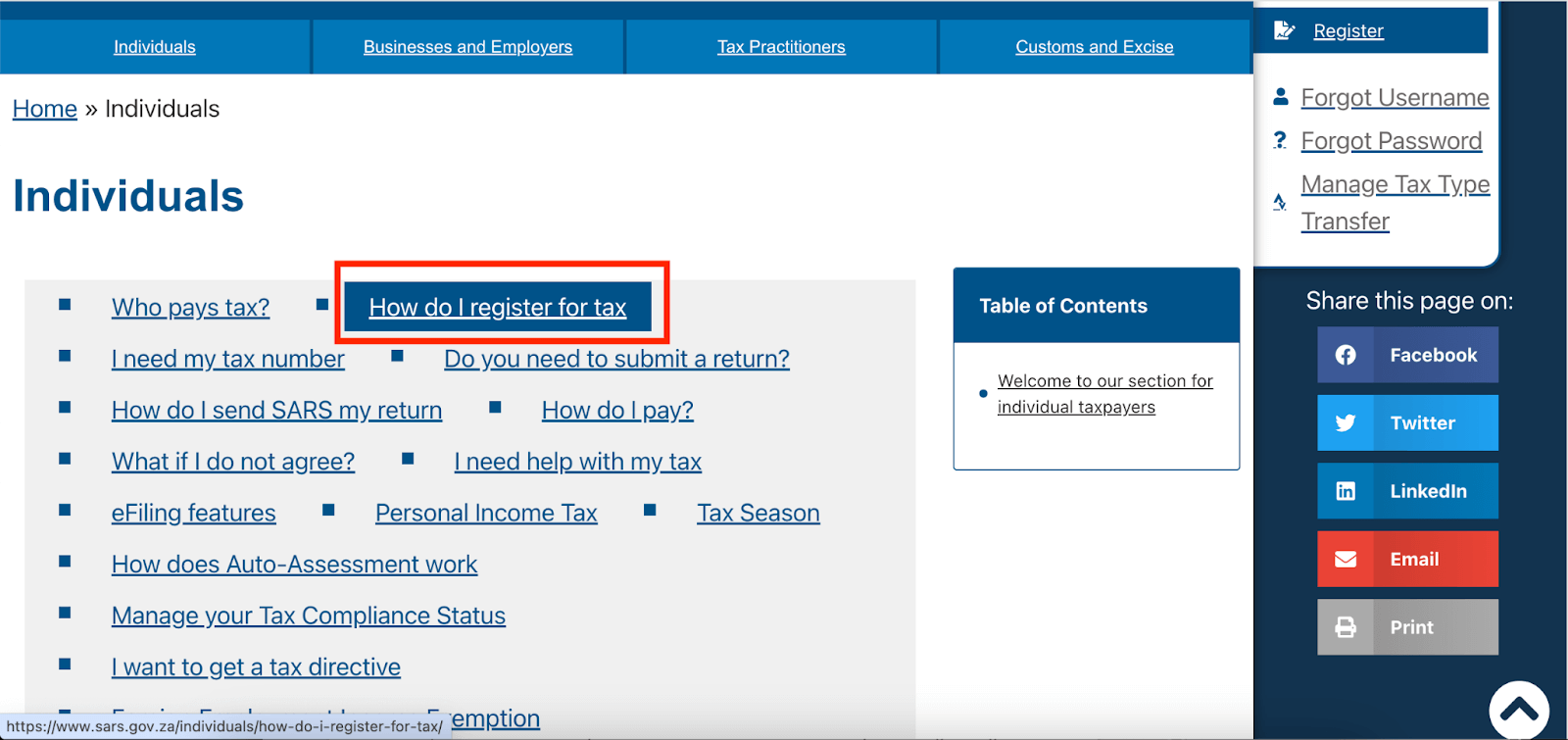

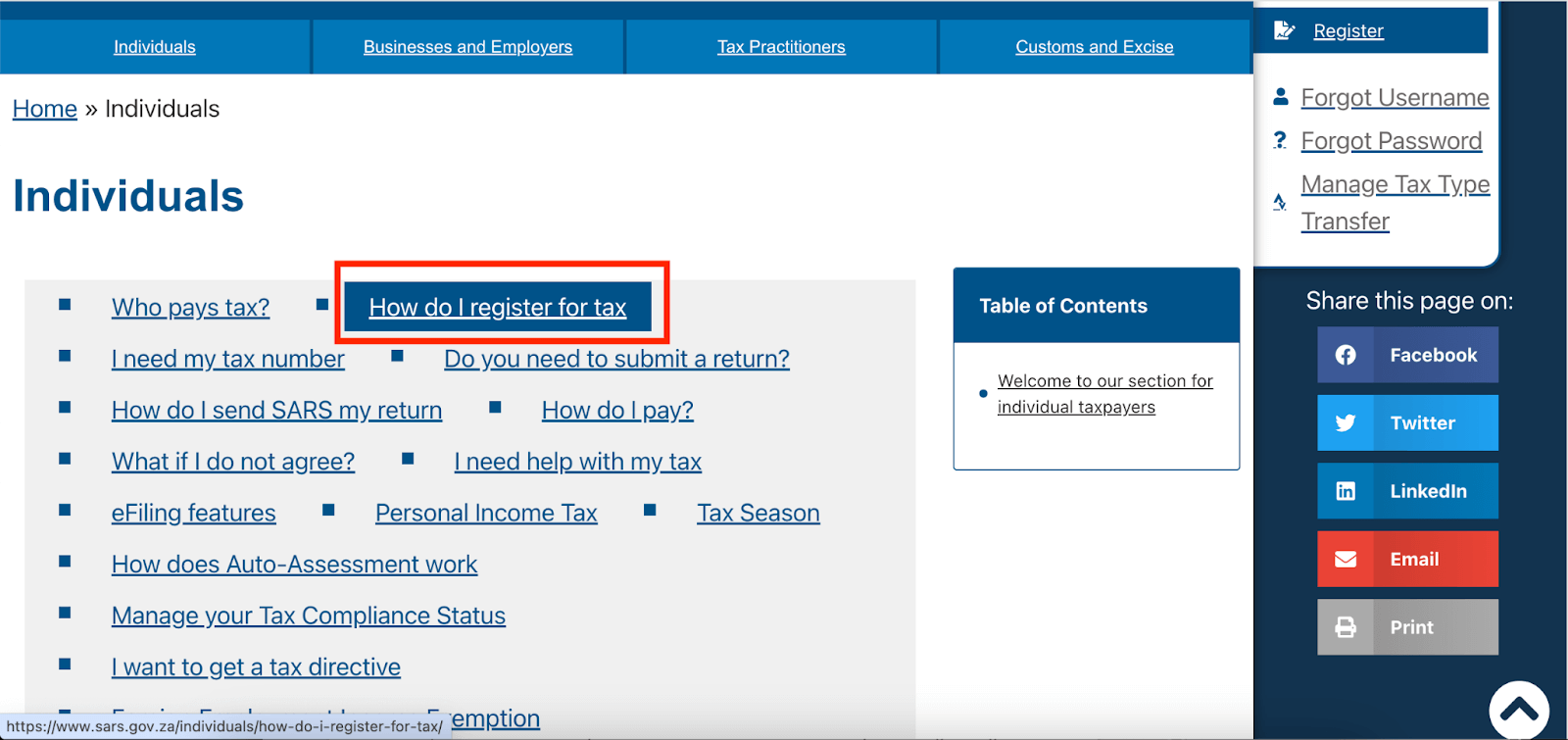

Step 1. Visit the official SARS website and Log in to your account.

Step 2. Select the Individual section and click “How do I register for tax”.

Step 3. Scroll down and Click “Register”. You will be directed to the eFiling portal.

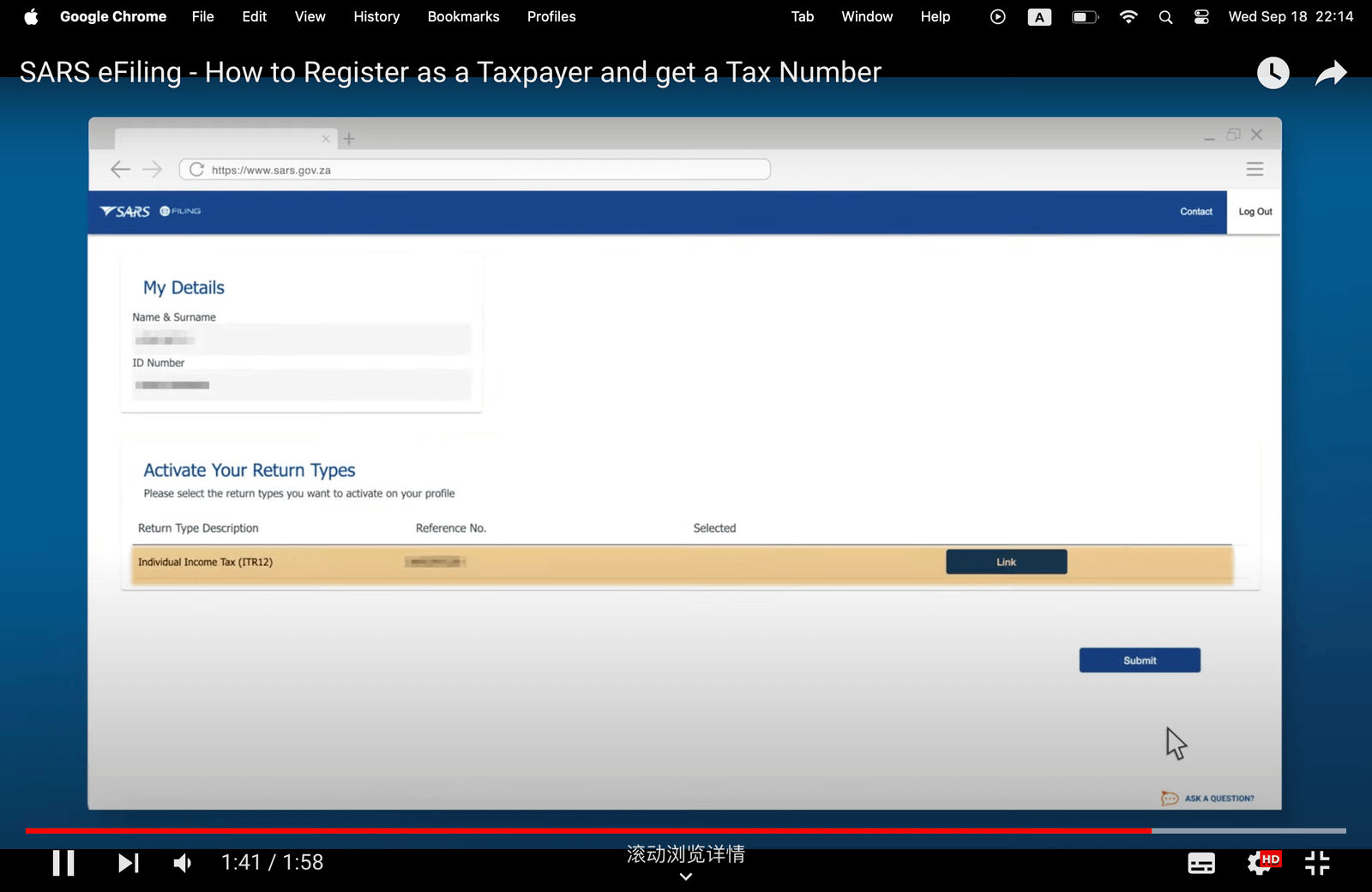

Step 4. Choose the tax period for which you’re filing the return (e.g., 2023/2024).

Step 5. Under the “Income Tax Return” category, you should find a specific option related to the IRP5 certificate. Look for something like “Income Tax Return (IRP5/ITR.12)” or a similar label.

Step 6. Upload your IRP5 certificate and any supporting documents reflecting your income and expenses related to work.

Step 7. Review your income tax return carefully to ensure all information is accurate. Then submit the return by following the prompts on the eFiling platform.

You can also submit your IRP5 via SARS MobiApp and follow the same steps. Either way, it is recommended to start the process soon, in case additional documents are required.

FAQs

What is an IRP5 used for in SARS?

In SARS, IRP5 is used for calculating and assessing your tax liability for the year. It provides a comprehensive overview of your income and the taxes withheld from your earnings during the tax year.

Is IRP5 the same as Payslip?

No, IRP5 and Payslip are not the same. While both documents are related to your employment income, they serve different purposes. A Payslip is a document that shows your earnings, deductions, and net pay for a specific pay period. It typically includes details such as your basic salary, allowances, overtime pay, and deductions like taxes, pension contributions, and insurance premiums. An IRP5 is a tax certificate that summarizes your income and the taxes withheld from your earnings for the entire tax year. It is used by SARS to calculate and assess your tax liability for the year.

Who submits IRP5 to SARS?

Your employer is responsible for submitting your IRP5 to SARS when a tax year ends. The IRP5 is a tax certificate summarizing your income and the taxes withheld from your earnings during the tax year. Your employer uses this information to calculate and submit the appropriate taxes to SARS on your behalf.

When should my employer give me my IRP5?

Your employer is required to provide you with your IRP5 by the end of June at the latest, so you may file an income tax return in July. If you haven’t received your IRP5 yet, contact your employer immediately to request it or seek help from SARS.

Recap

This article covers everything about the IRP5 certificate for employees, aiming to help you understand and get one for your income tax return filing in 2024 ending on 21 October soon. In need of help with SARS, Call 0800 00 (7277) or visit your nearest SARS branch. If you have not got an IRP5 yet, take action soon!