Mobile payment through a mobile device is becoming more and more popular around the world. People in the Philippines can pay cashlessly with GCash, and the account ID is of great importance. In this passage, we are going to talk about what the GCash account ID number is, where to find it, how to apply for it, and how to verify it.

What Is GCash?

GCash is a popular mobile wallet installed on smartphones in the Philippines. It could be used for mobile payment, money transfer, online shopping, investment, etc. The application was launched in 2004 by Mynt, a subsidiary of Globe Telecom. The company also issues a GCash MasterCard that supports overseas transactions in more than 200 countries. GCash aims to facilitate daily transactions and ensure capital safety because users don’t need to worry about insufficient cash or counterfeit money.

What Is GCash Account ID?

GCash account ID, also known as GCash account number, is a unique 11-digit identifier code in the GCash ecosystem. It is the same as the mobile phone number that is used to create a GCash account. Similar to the account number of a bank card, the number is required for every transaction through Gcash for transfer between the bank and Gcash or international remittances.

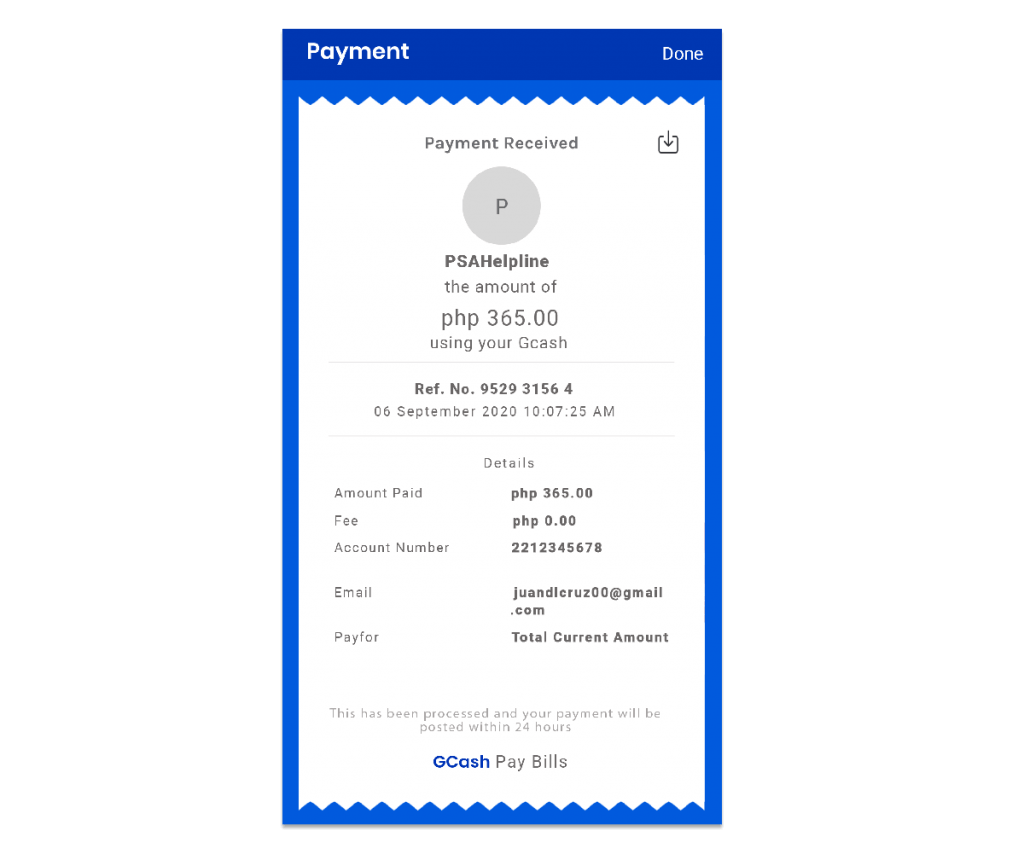

Where to Find GCash Account ID

Supposing that you forgot or lost the GCash account ID number, you can check or retrieve it through one of the following methods.

Check Your GCash Account ID via the Mobile App

It is the most straightforward way to find the account ID as long as you can log in to the app.

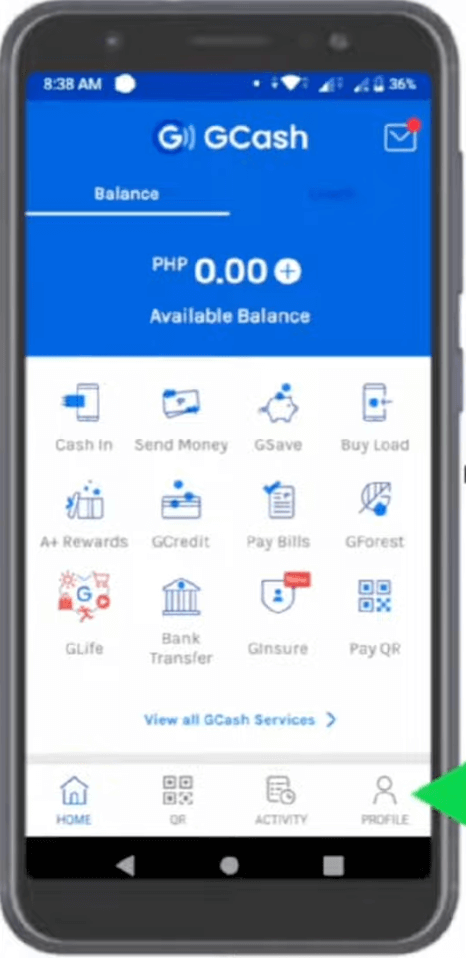

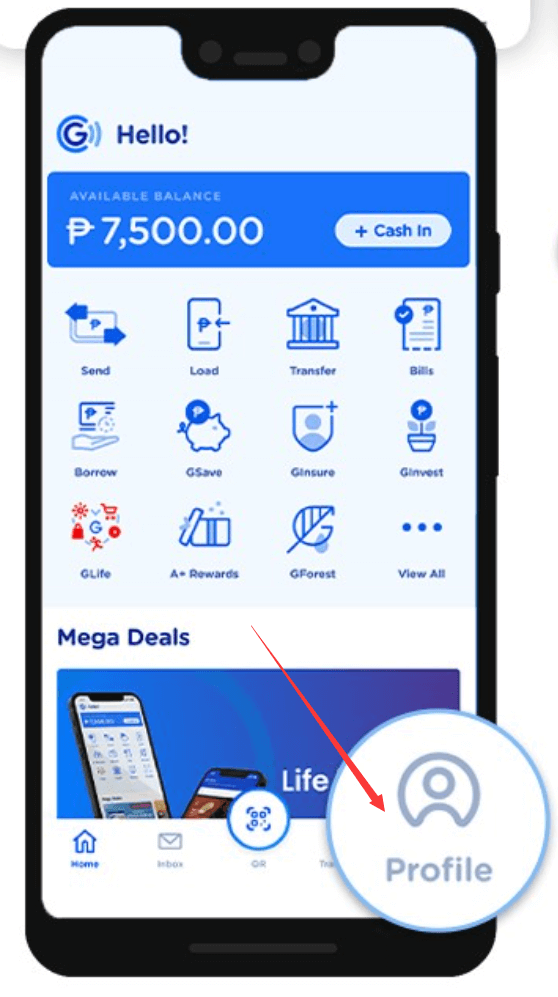

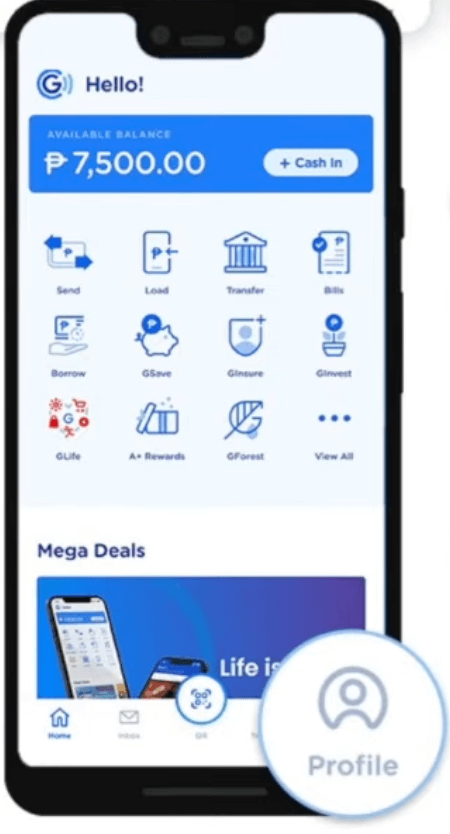

- Open the GCash app on your mobile phone.

- Log in with MPIN (Mobile Personal Identification Number) or biometrics.

- Tab the “PROFILE” icon in the bottom menu bar.

- Check the 11-digit code beneath the user name beside the profile picture at the top.

Send an Email to the GCash Support Team

If you fail to sign in to the GCash app, you can retrieve the account ID by emailing support@gcash.com. Explain why you are writing and provide your name, address, date of birth, and email address. Attaching a copy of a valid ID is also suggested to help the staff verify your identity. The authority will reply in 1-2 working days. Extra proof might be required, so please pay attention to your email and respond promptly. You should specify your request concisely and politely. Here is an example.

Subject: Check GCash Account ID

Dear GCash,

I am writing to retrieve my GCash account ID number because I cannot log in to my account. Here are my personal details.

Name:

Address:

Date of Birth:

Email:

Attached is a copy of my identity document for identity verification. Look forward to your reply. Thank you.

Yours,

xxx(your name)

Call the GCash Support Hotline

If you don’t want to wait for the reply by email and want to get your account number as soon as possible, calling GCash is also a popular alternative. Globe subscribers should call 2882 while Non-Globe subscribers should call (02) 7730-2882 between 8:00 am to 5:00 pm from Monday to Sunday. The GCash customer service representative will ask you for some personal information to confirm who you are and tell your account ID. Please note that there might be extra charges when using a non-Globe SIM card.

How to Apply for Your First GCash Account

It is free of charge to create a GCash account. Individuals can register with GCash through a Philippine network, such as Globe, TM, Talk N Text, Smart, SUN, or DITO. The application method varies according to the applicant’s age.

How to Apply for a Gcash Account for Above 18 Years Old

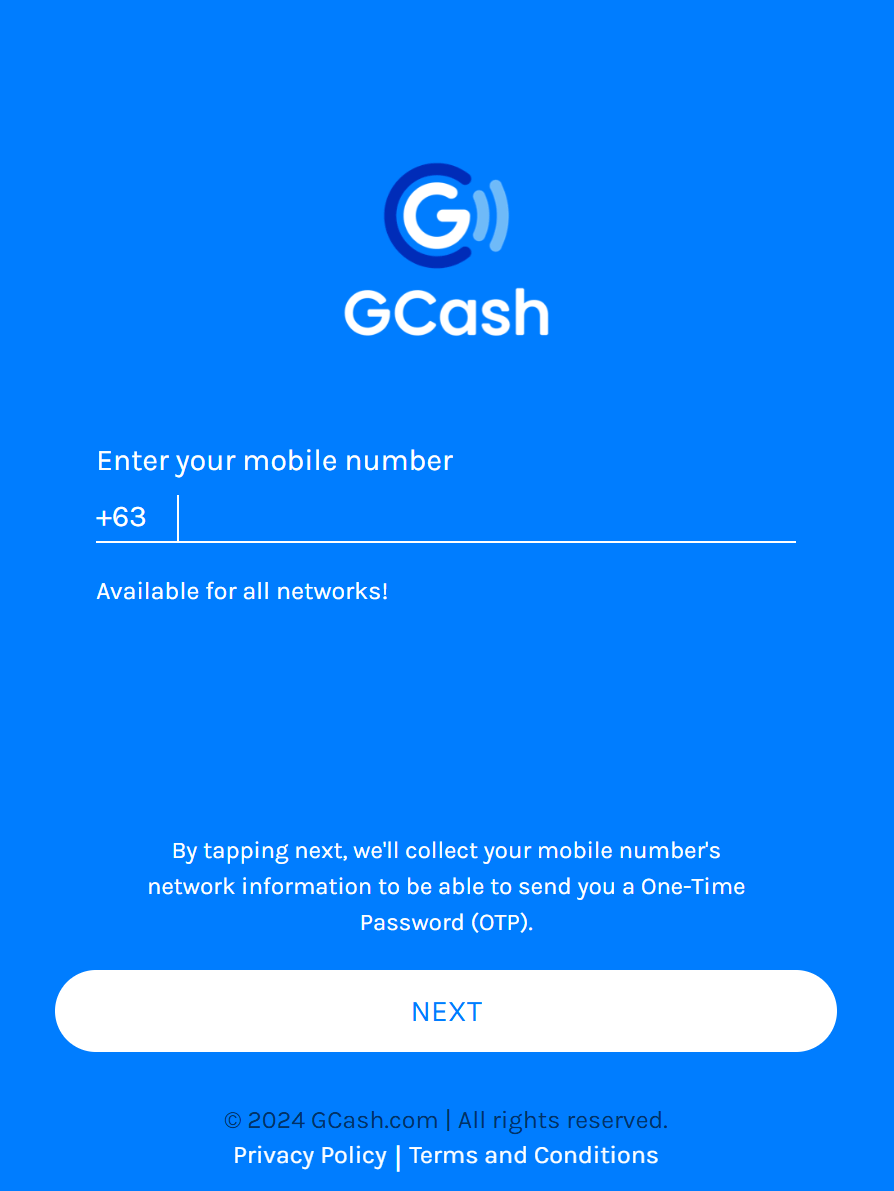

- Download the GCash app from the Google Play Store (for Android systems) or App Store (for IOS systems) and install it on your mobile phone.

- Enter your mobile phone number and tap the “Next” button. The country code “+63” represents the Philippines, so make sure you are using a Philippine phone number.

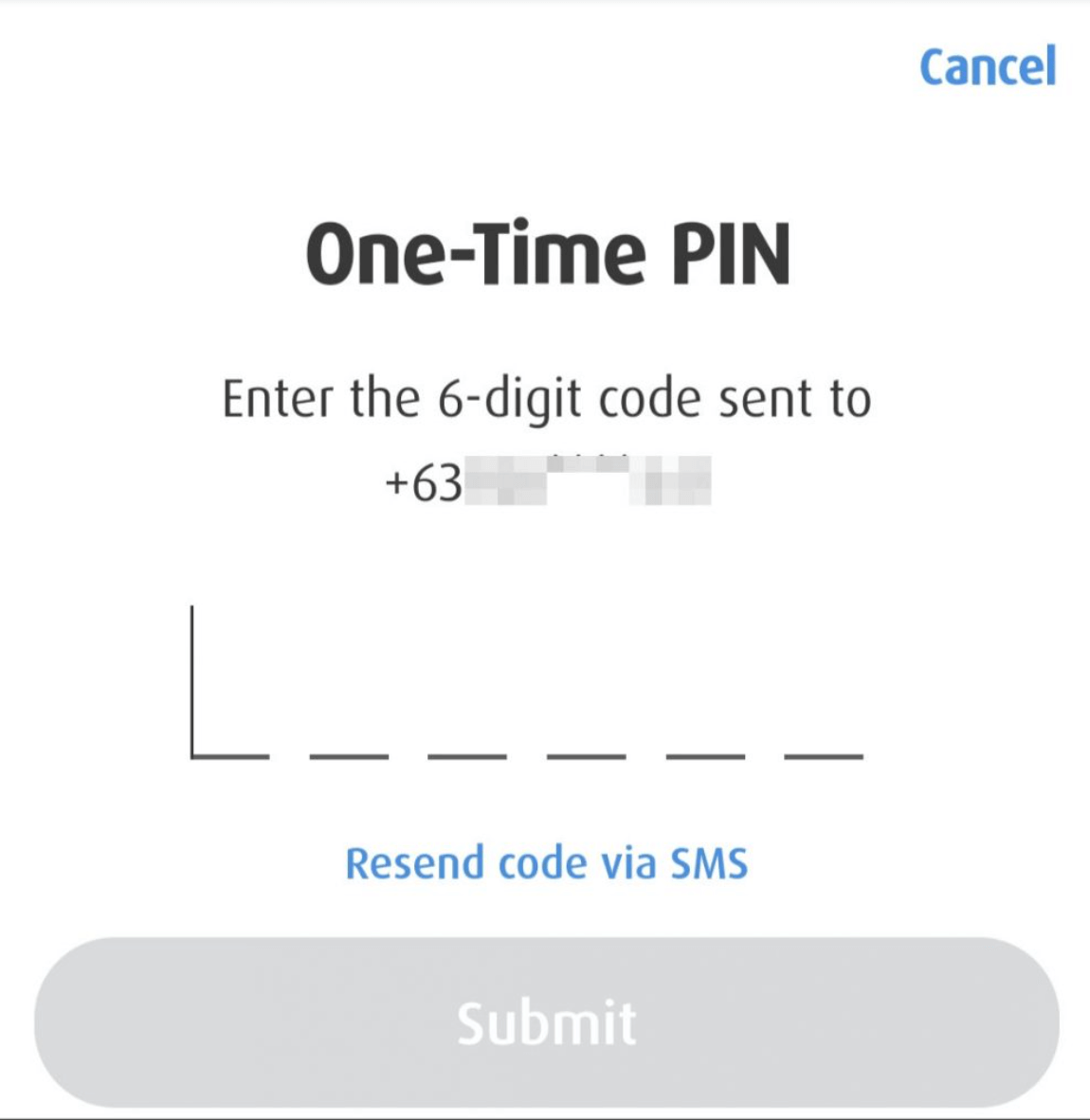

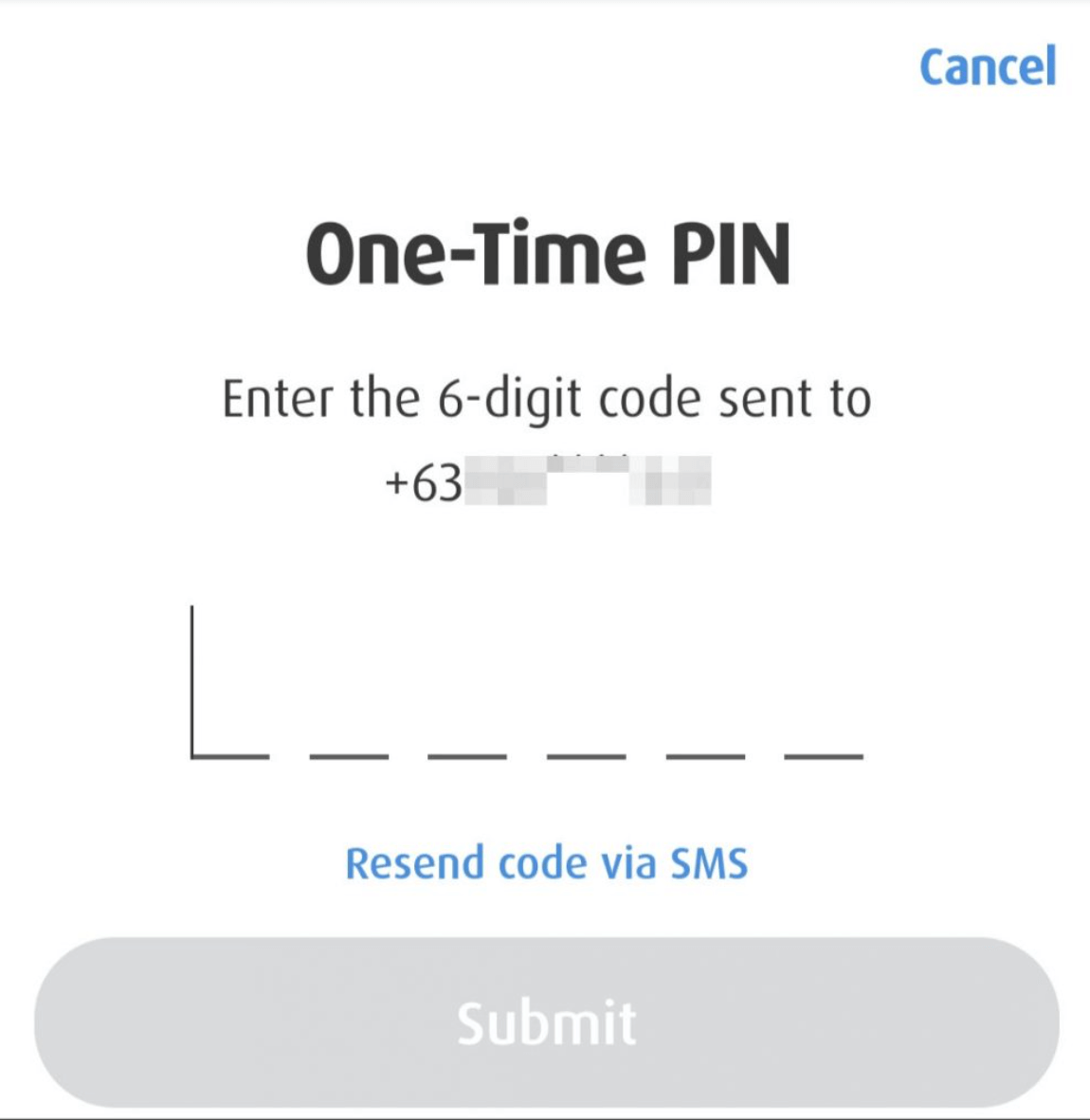

- Receive a One-Time Password (OTP) by SMS. Enter it in the GCash app and tap the “Submit” button.

- Choose “New Account” and enter all required information, including full name, birthdate, address, and email. Tap “Next” to preview the registration form. Tap the “Confirm” button to continue when everything is complete and correct.

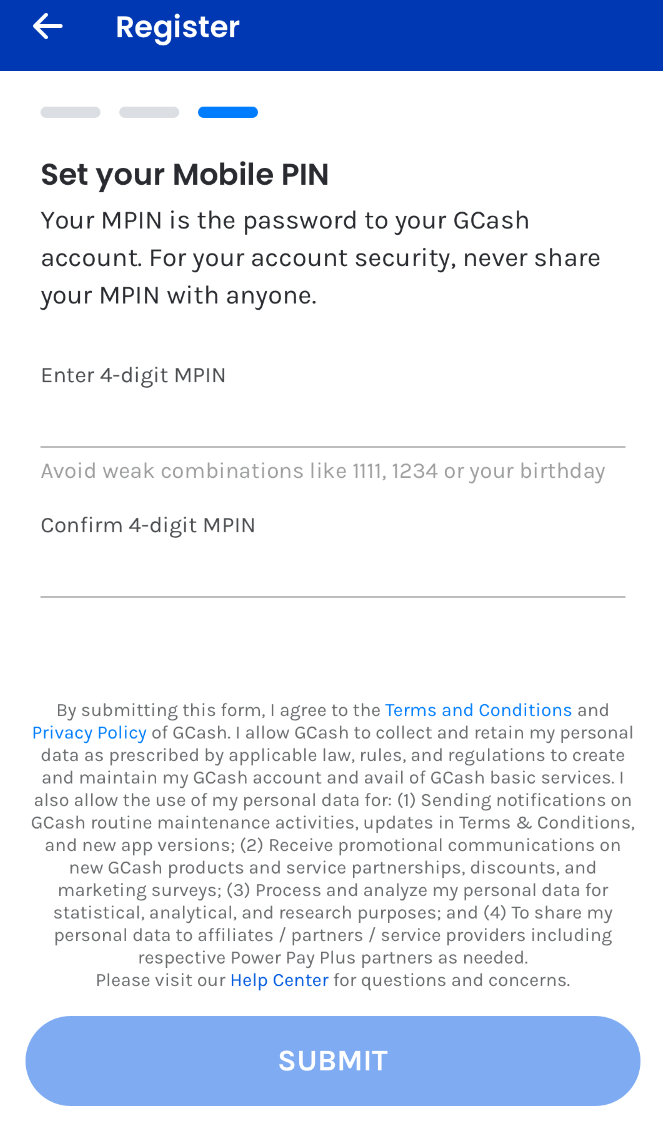

- Set a 4-digit mobile PIN, also known as MPIN which serves as a password to log in to your GCash account. Now you have a GCash account with basic services.

How to Apply for a Gcash Account for Between 7 to 17 Years Old

Users aged 7 to 17 years old can apply for a GCash Jr. account and it should be linked to the GCash account of a parent or legal guardian. The application process is similar to that for adults, and parental consent is needed when verifying the account. Just make sure to use a primary phone number and personal information of the kid. The system will automatically distribute a GCASH Jr. account when it recognizes that the applicant is under 18 years old.

How to Verify GCash Account

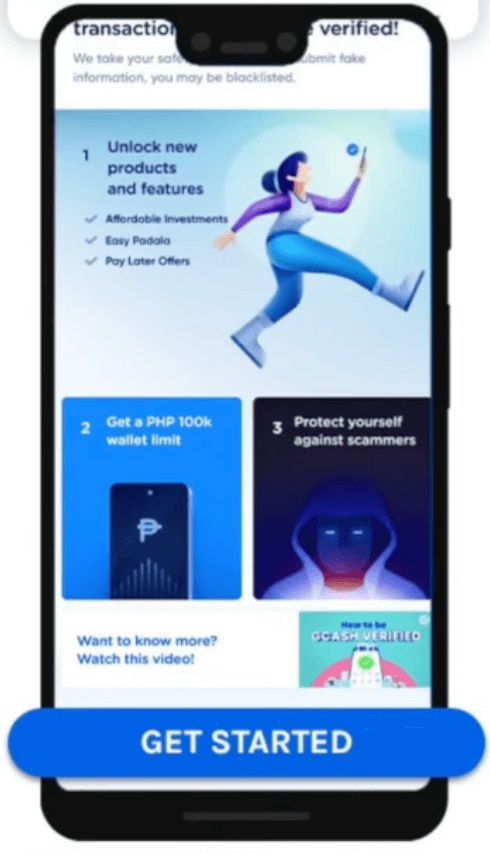

Verifying the GCash account helps to activate other financial services except for online purchasing and secures your account from fraud and misuse.

How to Verify GCash Account Above 18 Years Old

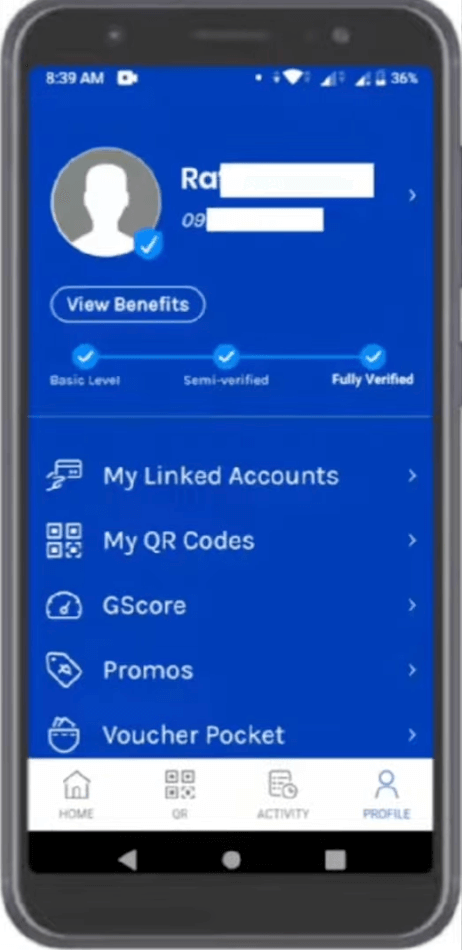

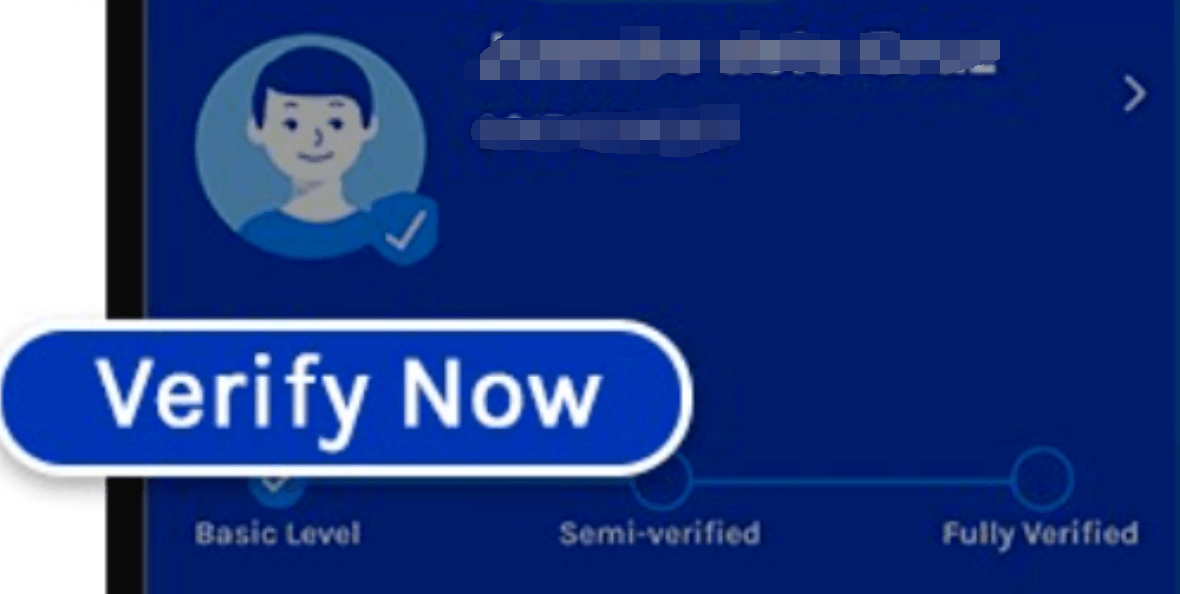

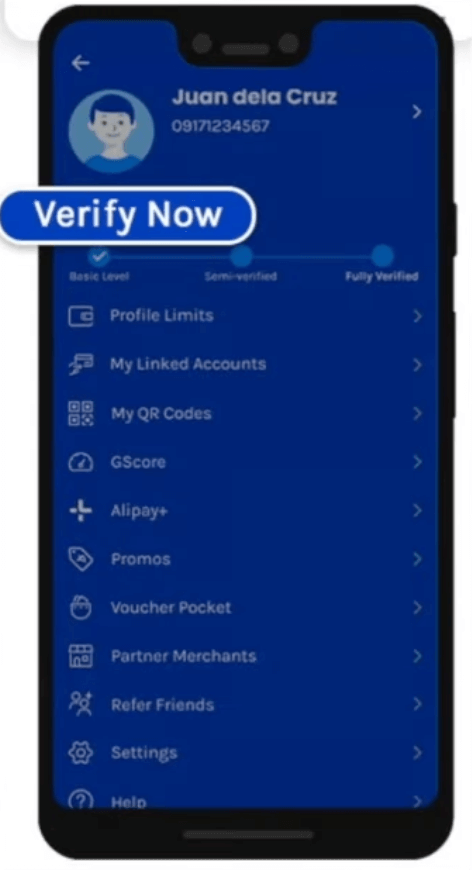

- Open the GCash app and log in. Tap the “Profile” at the bottom menu bar.

- Tap the “Verify Now” below the profile picture.

- Tap “GET STARTED” and read the instructions.

- Enter a 6-digit OTP sent to your registered mobile number.

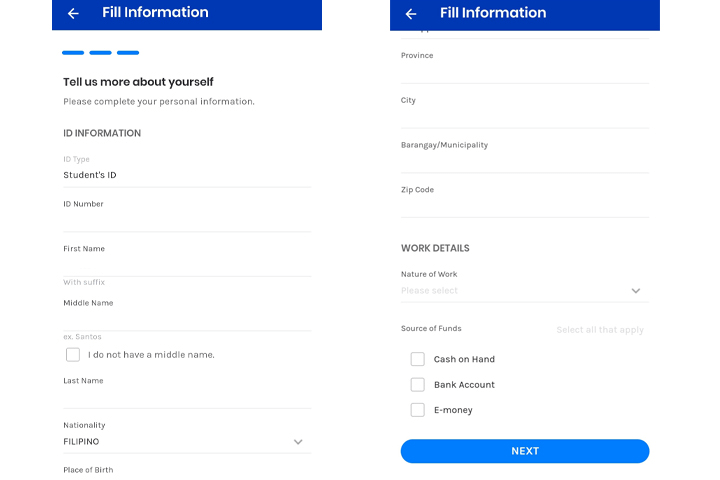

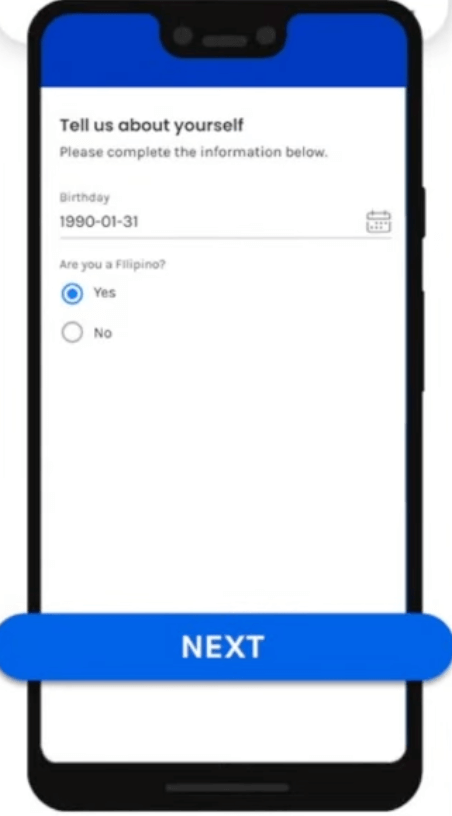

- Enter your birthday and select whether you are a Filipino citizen or not.

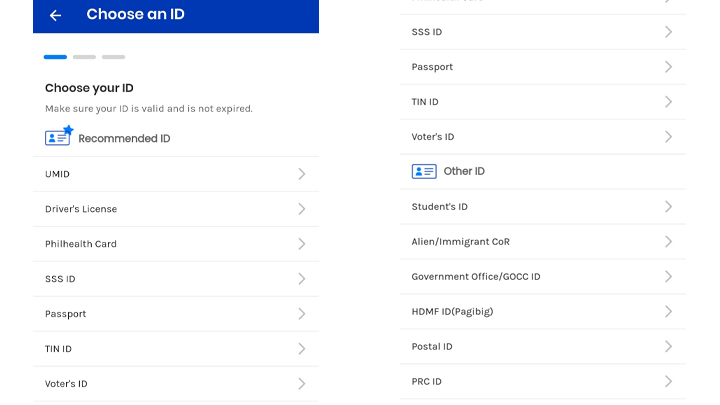

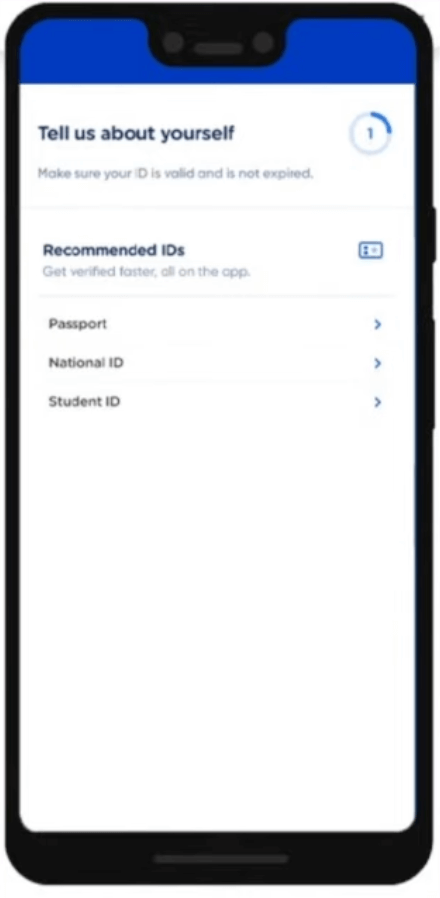

- Choose a valid government ID that you will submit to verify your identity from the list.

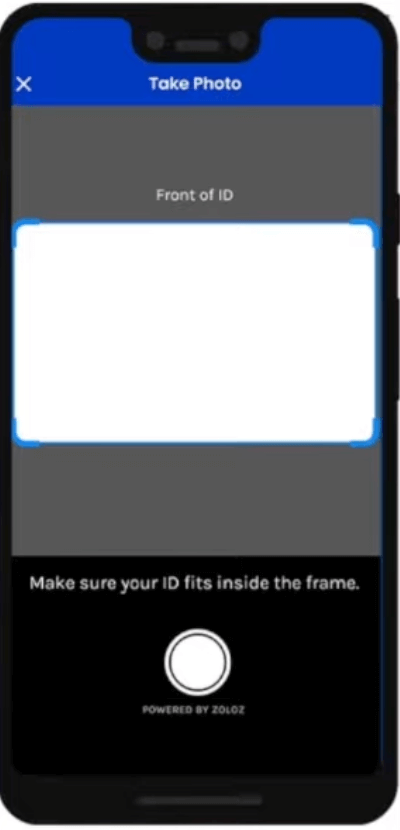

- Scan the front and back sides of your ID and tap the “Submit” button to upload them.

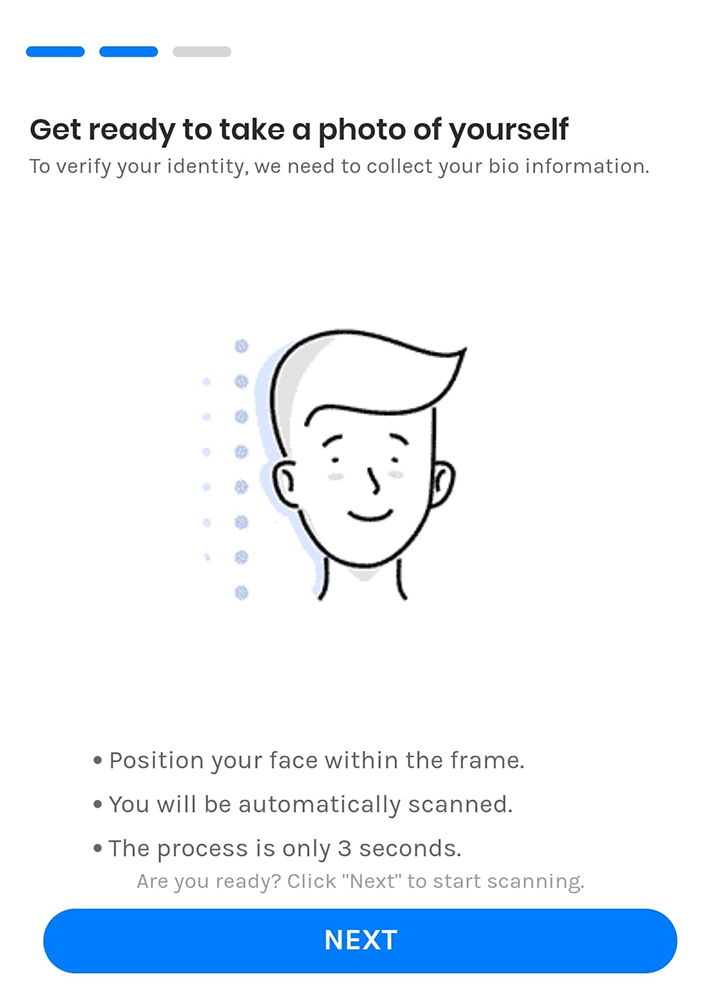

- Read the instructions for face scanning and tap “Next”.

- Scan your face in a well-lit place and take a selfie. Make sure your face fits the frame perfectly.

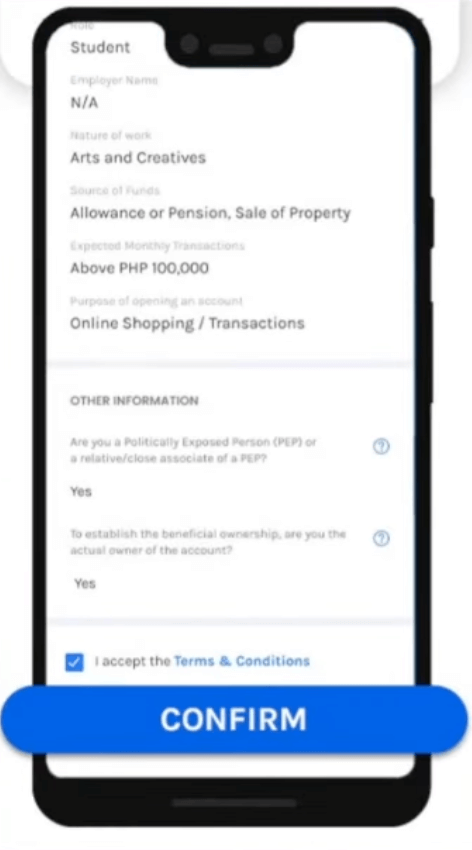

- Complete the “Tell us more about yourself” page with more detailed information.

- Tap “Next” and review the provided details.

- Read the terms and conditions, check the box at the end to agree to them, and tap “Confirm”.

- Wait for GCash to review your request, which takes about 30 minutes to 24 hours.

How to Verify GCash Account Between 7 to 17 Years Old

- Log in to the GCash app and tap “Profile”.

- Tap the “Verify now” button.

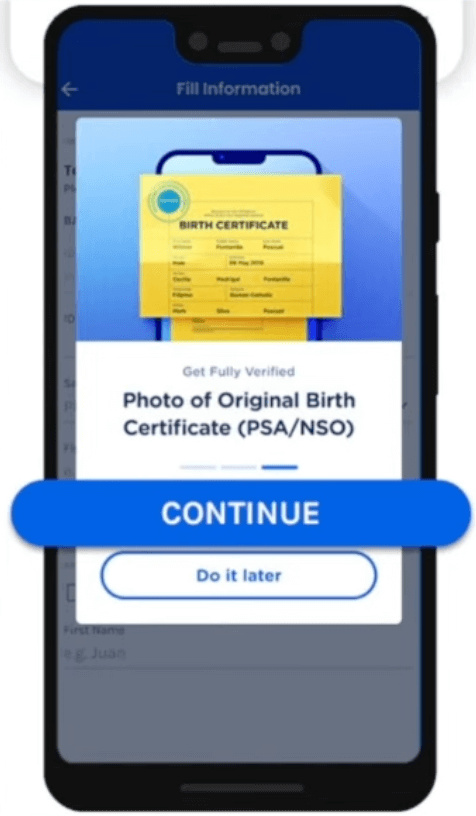

- Tap the “GET STARTED” button and preview the required government-issued ID, selfie instructions as well as other reminders.

- Choose the birthday and answer the question “Are you a Filipino?”

- Choose a desired ID for identity verification.

- Read the tips to upload the document and tap “SELECT ID”.

- Scan the selected ID according to the previous instruction.

- Take a photo of the minor with headwear, facial coverings, and glasses.

- Double-check the information and click on “Okay”.

- Provide all required details and tap “CONFIRM”.

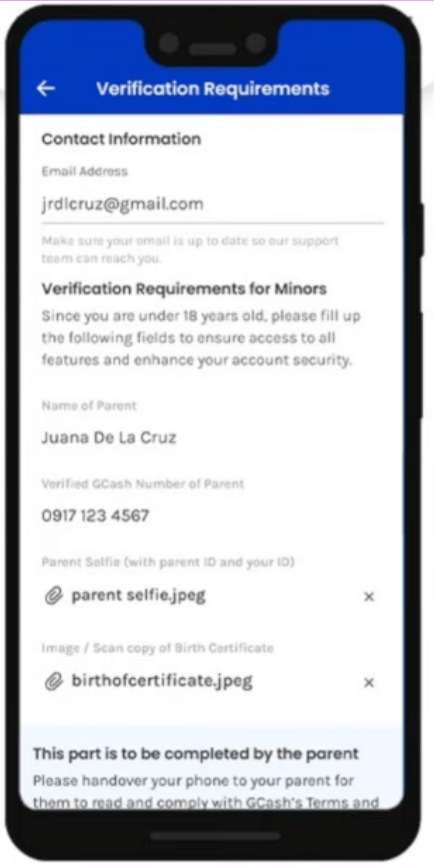

- Provide the fully verified GCash account ID number of the parent and other necessary information.

- Take a selfie of the parent with the minor’s ID.

- Take the minor’s original birth certificate issued by the National Statistics Office (NSO) or Philippine Statistics Authority (PSA)

- Enter an email address and the parent’s name. Submit the information along with the photos that were taken previously.

- Agree to the terms and conditions and submit the request.

👉View more details below:

How to Verify GCash Account as Foreigners

- Open the GCash app and go to the “Profile” section.

- Tap the “Verify Now” and then “GET STARTED” button.

- Receive a 6-digit authentication code by SMS and enter it in the GCash app.

- Enter your date of birth and select your nationality.

- Choose a desired identity document that you want to submit.

- Scan the ID card.

- Take a selfie using the face scanning tips.

- Provide extra required information and confirm it.

- Submit the application and wait for a few hours to verify your account.

Full List of Valid IDs to Verify GCash Accounts

Proof of identity is essential for the sake of security and identification. The identity document must present the cardholder’s basic personal information, including name, address, date of birth, etc. Here is a list of acceptable IDs for different groups of people.

| Applicants | Acceptable IDs |

| Filipino Citizens aged at least 18 years old with PH SIM | Philsys ID (paper or digital type) ePhil IDPhilippine passport Home Development Mutual Fund (HDMF) ID, such as The Pag-IBIG Loyalty Card Plus Driver’s license Philippine postal ID Professional Regulation Commission (PRC) ID Unified Multi-Purpose Identification (UMID) Social Security System (SSS) ID |

| Minors between 7-17 with PH SIM | PSA or NSO birth certificate National IDePhil ID Philippine Passport Student ID Alien Certificate of Registration (Foreign National or Non-Filipino Minors) |

| Foreign National with a PH SIM | Alien Certificate of Registration (required for foreigners above 18) DOLE Alient Employment or School Registration Form along with proof of billing |

| Filipino Living Abroad with a non-PH SIM | National ID (card type or digital type) ePhil ID Philippine passport HDMF ID Driver’s license Philippine Postal ID PRC ID UMID SSS ID |

What Will Happen if GCash Is Not Verified?

Not verifying the GCash account means you can only enjoy lower transaction limits and basic services, including offline cash-in, paying bills, buying loads, AMEX Virtual Pay, and QR paying. If the account was not fully verified and there is no transaction within 12 months, GCash will remind you of a deadline through a few notifications. If the account is not unverified before that date, it will be deactivated permanently and not allowed to be recovered. You have to apply for a new account if you want to use GCash.

What Are the Benefits of Getting a GCash Account?

Getting a GCash account is not only a popular new lifestyle but also provides lots of advantages that are listed below.

- You do not need to carry bank cards or cash anymore when shopping offline, which eliminates the trouble of lost or stolen cash.

- One app fits all. In this case, you can conduct transactions, invest, and apply for loans with a GCash app, which makes capital management more convenient, especially when you have to deal with multiple accounts.

- Through cashless payment, you don’t need to worry about counterfeit money or cheating.

- GCash has invested a lot to secure users’ information and money, thus preventing privacy leakage and identity fraud in online payments or transfers.

FAQ

Can I make another GCash account using the same ID?

Yes. As the GCash account ID is linked with the mobile phone number, you can have more than one account under your name but with a different phone number.

How to verify GCash account using student ID?

Minors aged 7-17 years old with a PH SIM can choose a student ID as a valid ID. If it is not available in the list, you can go to the GCash help center and submit a request. Besides basic information, please select “Account verification > My valid ID is not on the list” for “Concern Category”, “Others” for “ID Submitted for Verification”, and enter “student ID” for “Others (Please specify)”.

Which countries is GCash available in?

The company launched GCash Overseas for Filipinos to use the app in 16 countries and territories, including Australia, Canada, Germany, Hong Kong, Italy, Japan, Kuwait, Qatar, Saudi Arabia, Singapore, South Korea, Spain, Taiwan, the United States, the United Kingdom, and the United Arab Emirate。

Can I register GCash with an international number?

Yes. Filipinos living outside the Philippines can register GCash Overseas with an international SIM card.

Can minors below 7 years old apply for a GCash account?

No. There is only GCash Jr. for minors between 7-17 and GCash for adults.

Summary

GCash makes payment more convenient in the Philippines. Individuals aged at least 7 years old can apply for an account and it is suggested to fully verify it to access a wider range of services. The GCash account ID number is important for transactions and it can be found on the GCash app or through the GCash help center. We hope this passage can help better manage a GCash account.