In the Philippines, the Social Security System (SSS) is an essential organization that offers its members financial security. It is crucial to frequently verify your SSS contribution to make sure you are getting the benefits to which you are entitled. In this article, we’ll go over the several ways to check your SSS contribution. Keep reading to learn more about the SSS contribution.

What Are SSS and SSS Contribution?

The Social Security System, also known as SSS, is a provider of social security or insurance established by Republic Act No. 1161 (Social Security Act of 1954). The government established the SSS to offer financial support and aid to its members during illness, disability, pregnancy, old age, disasters, unemployment, or death.

The SSS contribution is paid by employers and employees per month. As a proportion of your pay, these payments serve as the cornerstone of a strong social safety net that offers you essential assistance when you need it most.

Why Do I Need to Check My SSS Contribution?

There are several benefits to checking your SSS contribution. The following are the main windfalls you can obtain:

- If you have a job, you can prevent a 2% monthly late payment penalty by making sure your employer pays your contributions accurately and on schedule.

- You can discover if you have any overpayments or missed payments for Social Security if you examine your SSS records as an independent contractor or voluntary member.

- One way to find out if you qualify for an SSS home loan or salary loan is to check your online contributions. If you are eligible for additional member benefits like unemployment or disability payments, you can also check your eligibility.

Types of SSS Contributions

You can check the following various SSS contributions types, depending on your SSS membership category:

✅ Monthly contributions. This is the amount you pay each month as an employer on behalf of your staff members. On the day of their first employment, you must enroll your staff members in the system.

✅ Contributions from self-employed or voluntary members: These are payments made by self-employed (SE) or volunteer members (VM). Self-employed people and voluntary members must enroll themselves in the system, unlike employees.

✅ Flexi-fund: If you are a Filipino worker abroad (OFW), you must make these flexi-fund payments. Coverage starts the moment you make your first SSS contribution, and you have to self-enroll in the scheme.

✅ The Worker’s Investment and Savings Program (WISP): It is an optional retirement savings plan that is applicable to those who work for themselves, make voluntary contributions, or are self-employed abroad.

✅ Employees’ contribution payments and loan repayments: You can view a history of all the past contributions and loan repayments made by your employees through your SSS account.

Payment reference number (PRN): When making loan or contribution payments, you must use the PRN, which is a number generated by the SSS.

✅ Employee-submitted sickness and maternity reimbursement claims: You are entitled to maternity and sickness reimbursement benefits if you are an employee and are unable to work because of a pregnancy or illness.

✅ Employees’ retirement certification and salary loan: Your cash loan entitlements as an employee, independent contractor, or volunteer who actively contributes are known as salary loans. Your eligibility for retirement benefits as a retired employee is confirmed by your retirement certification.

✅ Maternity notification, sickness notification, employment report form (Form R1A), contribution collection list (Form R-3), and loan collection list (Form ML-2): Employers may track the details of their employees’ contributions by using Forms R1A and R-3.

How to Check My SSS Contribution

Wondering how to check your SSS contribution? There are 4 easy ways for you to check the SSS contribution. Just follow the instructions below step by step.

How to Check SSS Contributions Online

The easiest way to check your SSS contribution is to visit the official SSS Member Portal website. Follow the steps here:

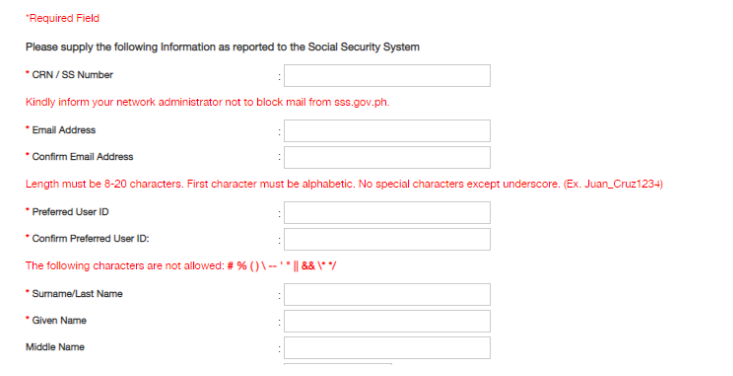

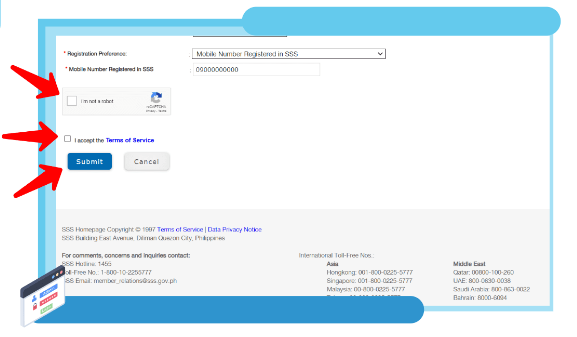

Step 1. Go to the website and register a new account by providing your personal information.

Step 2. Log in with your SSS User ID and password.

Step 3. Navigate to Inquiry > Contribution by hovering your mouse.

Step 4. Select the SSS contribution type and input the number to inquire about exact information.

How to Check SSS Contributions using a Mobile App

Apart from the online website, the SSS official also provides a mobile app for users to check SSS contributions on phones. Just download the app and follow these steps:

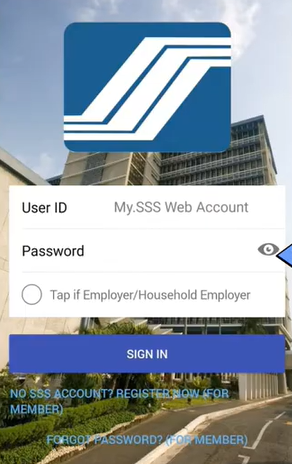

Step 1. Launch the SSS app and log in with your ID and password.

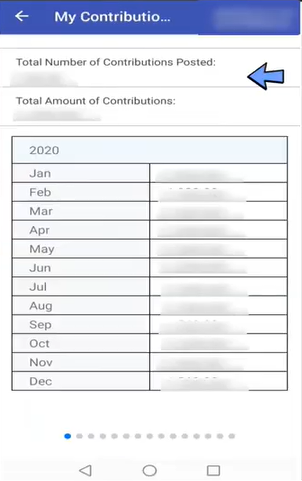

Step 2. Click on the Total Contribution then you can check your total contributions, last posted contribution, and other details.

How to Check SSS Contributions via SMS

Another way to check SSS contributions is to use SMS. You can follow the steps here:

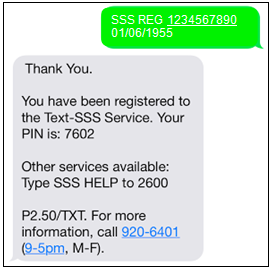

Step 1. Text SSS REG <SS Number> <Date of birth in mm/dd/yyyy format> to 2600.

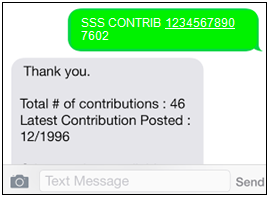

Step 2. Send SSS CONTRIB <SSS NUMBER> <PIN> to 2600 to check your SSS monthly contributions.

How to Check SSS Contributions by Visiting an SSS Branch

The last way to check your SSS contributions is to go to the nearest SSS branch in person. Simply request to have your contribution checked from the SSS database by lining up at the Verification area. A verification slip with your membership information, including the total number of contributions you have made and the month and year of your most recent posting, will be sent to you.

FAQ

📌What is the SSS Contribution Rate for 2024?

In 2024, the SSS contribution rate has increased to 14%. Employers contribute 9.5% of total SSS contributions, and employees contribute 4.5% of their monthly salary credit.

📌What information do I need to inquire about my SSS contributions?

To check your SSS contributions, you need to register an account on the SSS Member Portal site. You need to provide the following information: CRN/SS Number, email address, preferred user ID, name, and birth.

📌How often should I check my SSS contributions?

It is recommended that you check your SSS contributions once a month to see whether the SSS contribution status is normal.

📌Can I check SSS contributions for other people?

A person other than the SSS member can only obtain SSS records with the written consent of the member, by a subpoena duces tecum, or by the authority of the SSS President.

📌How can I get assistance with the SSS contribution inquiry?

You can contact the customer support hotline offered by SSS (1-847-688-6888) for assistance with questions about contributions and other connected issues. It is open throughout regular business hours.

The Bottom Line

That’s all about how to check your SSS contributions. The SSS contribution in the Philippines is a great benefit for any employees. Make sure you already know how to check the status of your SSS contribution and utilize the benefits it provides.