Have you ever been required to show a cedula? If yes, you might wonder what it is and what it is used for. It is proof of tax payment and is widely required in many public transactions. In this passage, we are going to find out the answer to cedula requirements, how to apply for a cedula, how much is cedula, etc.

What Is Cedula in the Philippines?

A cedula, also known as a Community Tax Certificate (CTC), is issued to individuals or corporations after paying residence or community tax in the Philippines. It is also an acceptable form of identification in many public and government transactions, such as applying for bank loans, business permits, passports, jobs, filing personal income tax returns, etc. The document is usually valid for 12 months upon issuing.v

Who Needs to Apply for Cedula?

Cedula eligibilities might vary from municipality to municipality. Here are the general requirements.

- The applicant is at least 18 years old and living in the Philippines; or

- The applicant has had a paid job for at least 30 consecutive days for a year; or

- The applicant runs a company or engages in business; or

- The applicant possesses a property or a collective asset worth at least PHP 1,000; or

- The applicant is obliged to file income tax returns.

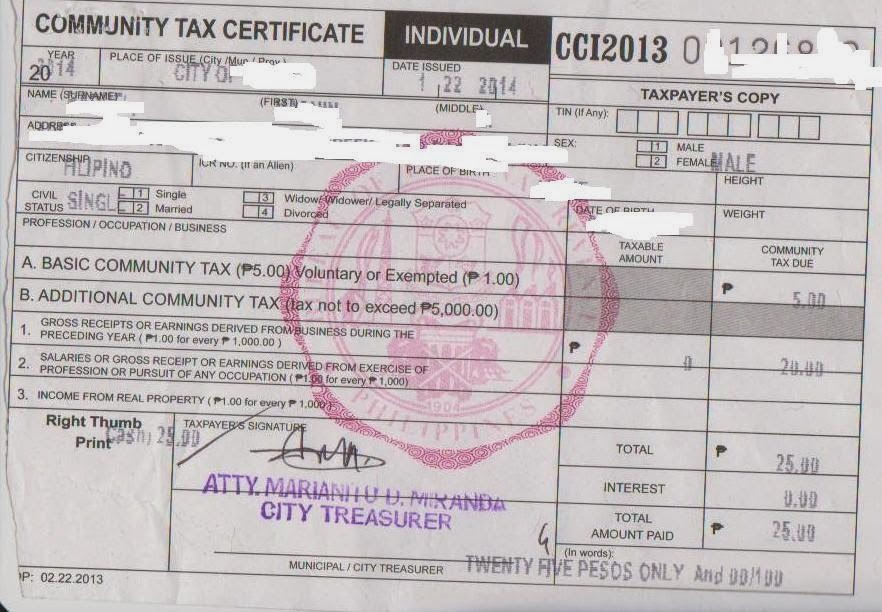

What Information Does Cedula Show?

The cedula contains detailed information on taxation and the taxpayers. For example, on a CTC for individuals, you will find:

- year of taxation

- place of issue

- date of issue

- name

- address

- gender

- citizenship

- ICR number

- place of birth

- date of birth

- civil status: single, married, widows/widower/legally separated, or divorced

- profession/occupation/business

- tax amounts: including basic and additional community tax

- thumbprints

- signature

- TIN (Tax Identification Number)

- Height

- weight

- community tax due

- issuing authority

Requirements for Cedula

Every municipality or city has its own cedula requirements and they might vary depending on the status of the taxpayers. Here are some general ones for individuals, businesses, and representatives.

Requirements for Individuals

- Valid government-issued ID, such as PhilSys ID, LTO driver’s license, UMID, passport, etc.

- A completed community tax declaration form (available at the local city hall, municipal hall, barangay hall, or its official website)

- Copy of payslips

- Proof of income, such as bank statements

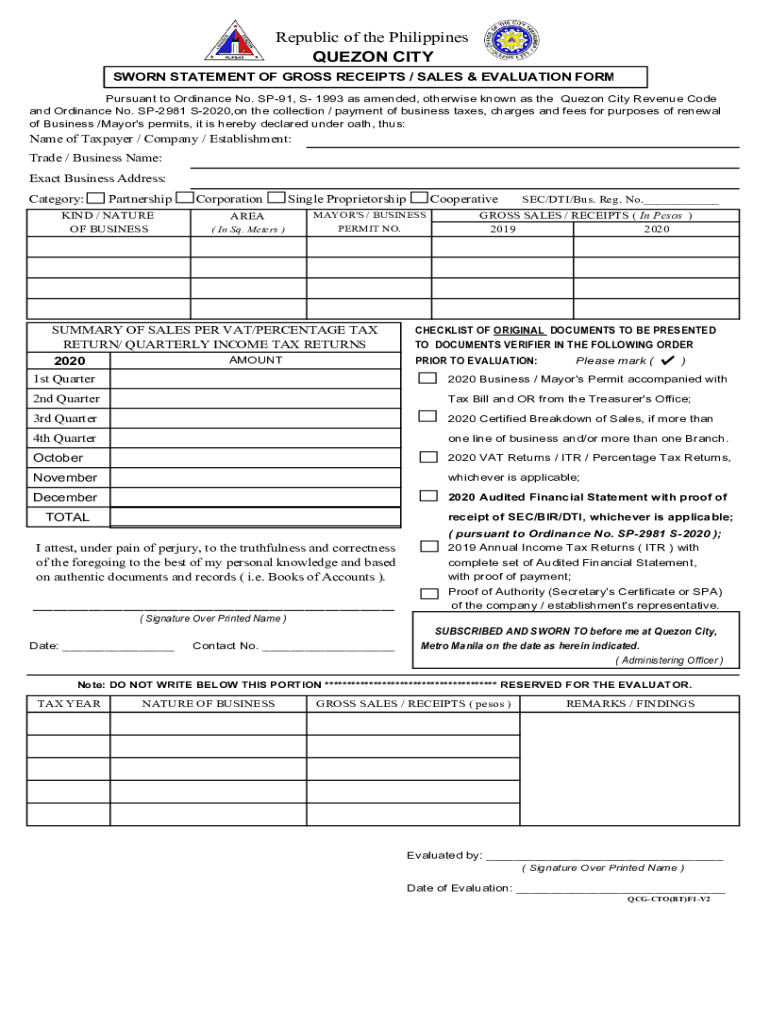

Requirements for Businesses

- Valid government-issued ID

- An accomplished Community tax declaration form (available at the City Treasurer’s Office)

- Certificate of business registration

Requirements for Representatives

- Valid ID of the representative

- Authorization letter from whom the representative is representing

- Photocopy of valid ID of who the representative is representing

How to Get Cedula in 2024

Cedula applications might be a little different depending on the specific city or municipality. Most of them offer both in-person and online services. Here is a step-by-step guide.

How to Get Cedula Offline

- Visit your barangay/municipal/city hall with the required documents during office hours. For example, the Manila city hall opens between 8:00 am and 5:00 pm from Monday to Friday. It is suggested to check before going to the local hall.

- Request a community tax declaration form and fill it out completely and correctly at the counter. If you have downloaded it and accomplished it in advance, just skip this step.

- Submit the form along with a valid identification and other required documents.

- Fulfill payment, sign the copies of the CTC, and submit fingerprints according to the officer’s instructions.

- Receive your cedula after a few days which might be mailed to you or must be collected from where you apply.

How to Get Cedula Online

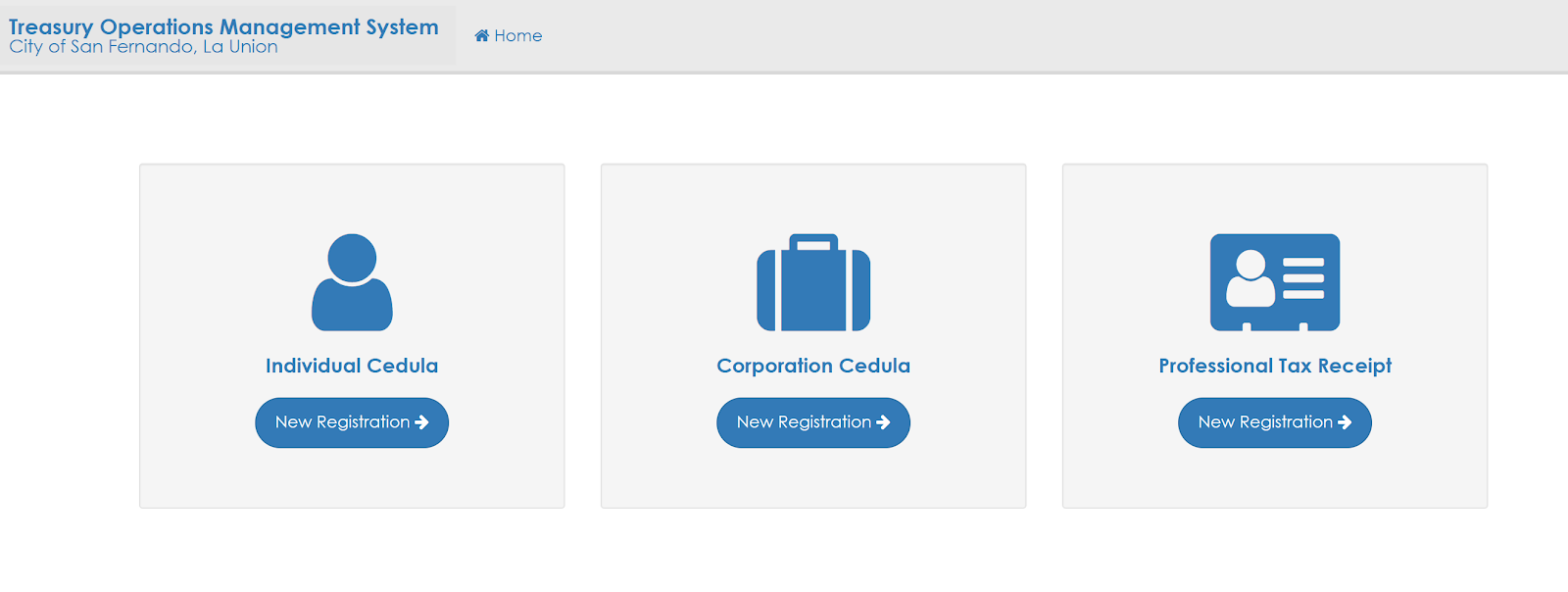

The cedula online application is more convenient and time-saving. However, it is only available in Manila, Cebu, and San Fernando. Citizens in these cities can complete the Community Tax Declaration Form online.

San Fernando and Cebu governments require applicants to submit applications and pay cedula fees in person at the city hall while the Manila government launches an app -Go! Manila app- allowing applicants to finish the whole process on mobile phones without physically present at the city hall.

In this section, we are going to take San Fernando as an example to introduce how to get cedula online.

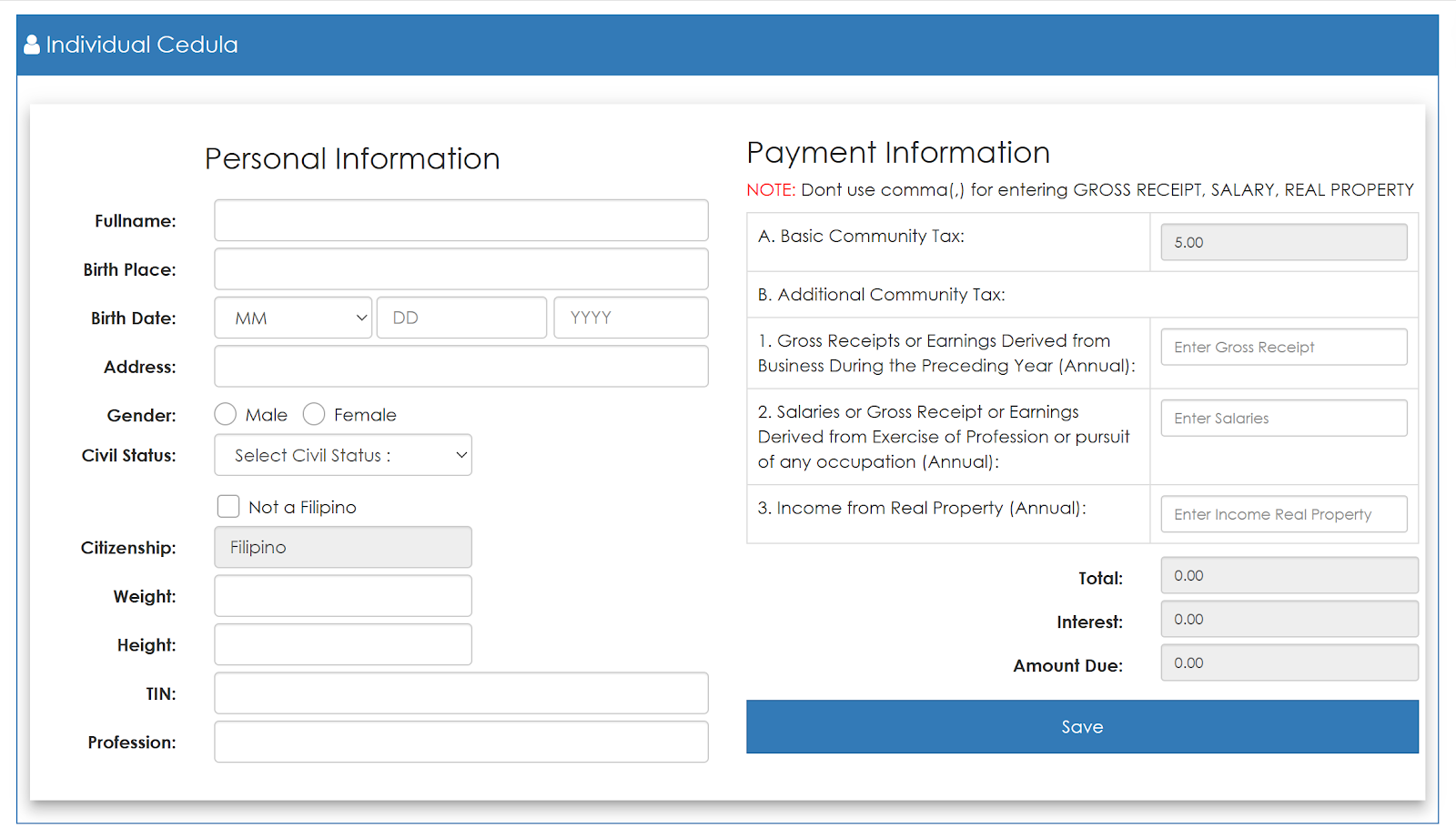

- Visit the San Fernando Cedula application portal and choose the document type you want. For example, individual cedula.

- Fill out the electronic application form which gathers personal information and payment information. Click on the “Save” button.

- Print out the accomplish form and prepare other required documents.

- Visit the city hall at F.I. Ortega Highway, Barangay I, City of San Fernando, 2500 La Union.

- Present your ID and submit applications.

- Pay the cedula fees. Sign and leave your finger marks on the CTC copies.

- Collect the original copy of CTC.

How Much Is Cedula?

The cedula fees vary according to where you apply from, how much you earn, and whether you are applying as an individual or an entity. Here is an approximate price list.

| Applicant Type | Basic Community Tax | Additional Community Tax |

| Individuals | minimum of PHP 5 |  PHP 1 for every PHP 1000 of gross receipts or earnings of business for the previous year; PHP 1 for every PHP 1000 of gross receipts or earnings of business for the previous year; PHP 1 for every PHP 1000 of salaries of gross receipt or earnings of occupation-related exercise; PHP 1 for every PHP 1000 of salaries of gross receipt or earnings of occupation-related exercise; PHP 1 for every PHP 1000 of income from real estate or total assessed value. PHP 1 for every PHP 1000 of income from real estate or total assessed value. Note: The additional Community Tax should be up to PHP 5000. Note: The additional Community Tax should be up to PHP 5000. |

| Corporations | minimum of PHP 5 |  PHP 2 for every PHP 5,000 of gross receipts earnings for the previous year; PHP 2 for every PHP 5,000 of gross receipts earnings for the previous year; PHP 2 for every PHP 5,000 of income from real estate or total assessed value. PHP 2 for every PHP 5,000 of income from real estate or total assessed value. Note: The additional Community Tax should be up to PHP 10,000. Note: The additional Community Tax should be up to PHP 10,000. |

Cedula Validity & Expiration

The cedula is usually valid for 12 months (1 year) from the issuing date. Please note that it is not related to a calendar year. For example, if the certificate is issued on December 1st, 2023, it will remain valid until November 30th, 2024 instead of December 31st, 2023.

Holding an expired cedula might prevent you from accessing certain services, such as applying for a passport, doing business, creating a bank account, etc. Worse still, it might result in fines, administrative penalties, or other legal repercussions due to the local governments.

Therefore, it is necessary to renew the certificate before the cedula expiration, which should be conducted at the same office where it is applied. The renewal process is similar to first-time applicants. You will bring a valid ID and other necessary supporting documents to the barangay/municipal/city hall, fill out the renewal form, and pay the renewal fees.

Applications of Cedula

The cedula can serve as not only proof of paying tax but also proof of identity in the following conditions.

- Applying for a job

- Applying for government licenses, receipts, and certificates

- Applying for other identity documents, such as passports, marriage licenses, etc.

- Applying for bank loans

- Filing personal income tax returns

- Verifying residential address

- Verifying Ownership of real estate

- Purchasing property

- Registering or renewing a business

- Receiving government payments or salaries

FAQ

No. The certificate can only be obtained within the municipality or city you live in.

No. There are a variety of acceptable IDs. If you do not have any of them, please obtain one before applying for a cedula.

Yes. the representative can help you fill out the form and IDs of both parties are needed. However, the person being represented must submit applications and biometrics in the municipal, barangay, or city hall in person.

No. You have to apply for the cedula within the place of residence.

Yes, as long as they live in the country and satisfy the requirements for cedula.

Yes, if they are Philippine residents and aged 18 years old. The cedula requirements are generally the same as other applicants. A school ID or the most recent school study load is acceptable.

You should visit the local barangay hall with a valid ID and file an application in person.

Summary

Now you have learned about cedula thoroughly. As this community tax certificate is widely applicable in the Philippines, it is necessary to obtain it if you have paid residence or community tax. The requirements for cedula might vary according to the local government. When it comes to how to apply for cedula, applicants usually need to fill out an application form, and submit it along with supporting documents and biometrics at the local city/municipal/barangay hall or, in rare cases, online.