When people earn a lot of money in any country, you need to contribute a portion of your earnings to the development of the country. It’s very proud for taxpayers to do this because you get benefits from the society where you work. Citizens are responsible for paying taxes in every country. There’s no exception in the Philippines.

In the Philippines, you can request a TIN (Tax Identification Number) ID that proves you are a taxpayer from your nearest BIR (Bureau of Internal Revenue) office. If you don’t know how to apply for a TIN ID, in this article, we will show you the complete guide, application requirements, fees and other steps to get your TIN ID.

What Is TIN ID?

A TIN ID (Taxpayer Identification Number Identification Card), also called a TIN card or TIN ID card, is a card issued by the BIR in the Philippines that contains the holder’s unique identification number, complete name, address, birth date, picture, and signature. It is not only a must-have card for registered taxpayers, but also a valid ID when you need to show your identity when transacting with government agencies, such as police clearance, SSS transactions, postal ID and so on. Surprisingly, the TIN ID doesn’t have an expiration date, so you don’t need to renew a new one like a passport or other ID card. Therefore, no matter which TIN cards you have, the yellow-orange one previously issued or the new green one, both are long-term TIN ID cards.

TIN ID Requirements 2024

Before you start applying for a TIN ID, you must prepare the following documents in advance.

- Tax identification number

- Completed BIR registration form by employment classification

- A valid ID, such as a birth certificate, passport, LTO driver’s license, or community tax certificate

- 1×1 TIN ID picture (if applicable)

- Marriage contract (if applicable)

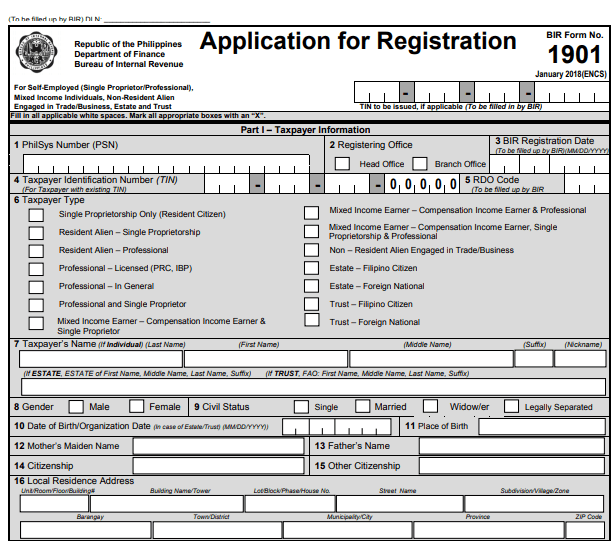

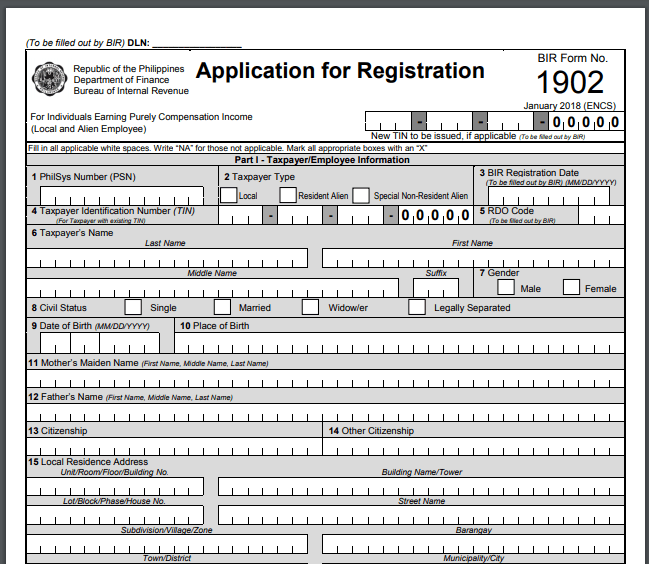

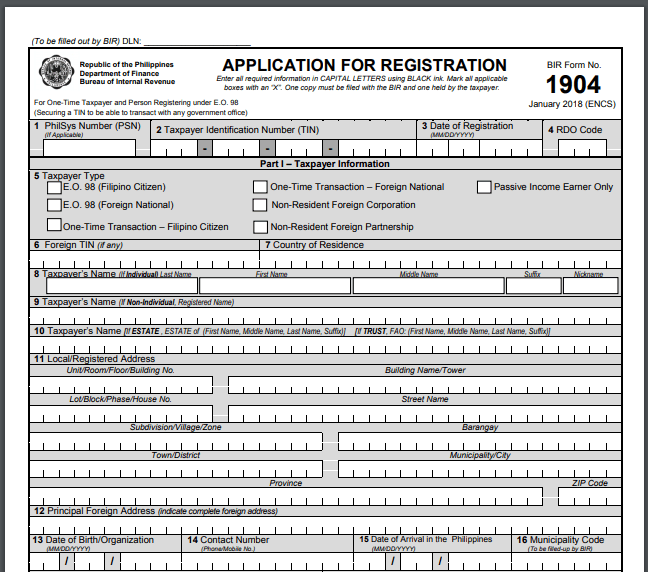

Here are some different application forms:

- BIR Form 1901 – For self-employed persons, mixed-income individuals, non-resident aliens engaged in trade/business, estates, and trusts.

- BIR Form1902 – For persons earning income solely from compensation.

- BIR Form1904 – For one-time taxpayers and persons registered under Executive Order 98

How to Get TIN ID 2024

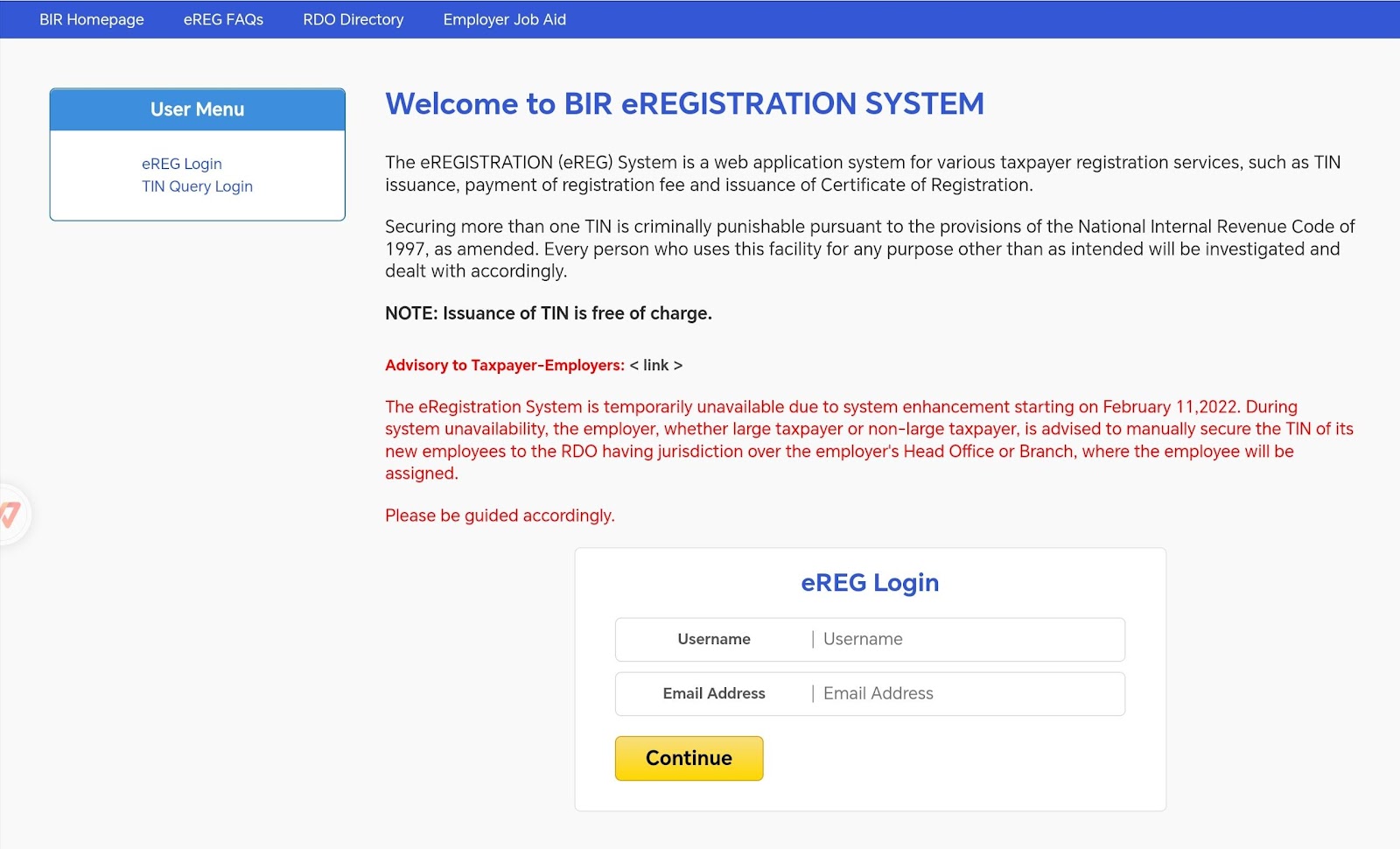

If you do not have a TIN, you need to apply in person at the Bureau of Internal Revenue branch offices in 2024. Starting in 2022, the online eREG platform for online TIN ID applications has been suspended. Filipinos need to personally visit the BOI branch to submit the necessary documents and get a TIN ID card.

Below are the detailed steps to apply for a TIN ID:

- Visit Your Local BIR Office: Start by heading to the nearest Bureau of Internal Revenue (BIR) branch in your area. Click here to find the nearest BIR branch.

- Prepare the Required Documents: Bring a completed BIR Form 1902 or 1904, along with a valid government-issued ID, such as a driver’s license or passport. If necessary, also bring your PSA marriage certificate and PSA birth certificate.

- Submit Your Application: Hand over your documents to the designated personnel at the BIR office for processing.

How to Obtain A TIN ID if You Already Have a Tax Identification Number

According to the rules, taxpayers can’t get their TIN ID in any Revenue District Office (RDO) which has jurisdiction over the taxes in the taxpayer’s home or your employer’s office. It means that you can only obtain your TIN card at the designated RDO. If you already have a TIN, you can follow the steps below to get a TIN card easily.

- Obtain and complete BIR Application Document 1902 (for income-earning and non-resident citizens) from the RDO – Client Support Section Area tom or download it from BIR ‘s website.

- Go to the designated RDO and submit the required documents mentioned above.

- Wait for officials to verify that you are registered with the RDO and appear in person in the RDO. If yes, process the card application. Otherwise, taxpayers will be introduced to the registered RDO.

- You can obtain your TIN Card and paste the latest 1×1 TIN ID photo in front of the Registration Officer.

Usually, if you submit your application before the 1:00 p.m. deadline, the RDO will process your application and let you pick it up the same day. However, if you submit the application later than the deadline, you are requested to obtain it on another working day. Remember, you must apply and obtain the TIN Card yourself. No authorized representatives are allowed to obtain the TIN card from the RDO.

How to Get TIN Number for Unemployed Online

If you are a student or unemployed individual over the age of 18, you can still obtain a TIN ID under Executive Order No. 98. Here’s how to get a TIN ID:

- Finish BIR Form 1904

- Prepare the required documents: Birth certificate, driver’s license, passport, or any other document issued by an authorized government.

- Bring and submit the files to the RDO of the city you’re living in.

- Once your application is completed, you can wait for the issuance date of your TIN ID.

- When you get your TIN card, attach your 1×1 ID picture to it.

How to Get Digital TIN ID Online

The electronic identification can be obtained on the BIR portal. Here is a step-by-step instruction on the BIR TIN ID online registration.

Create an ORUS Account

Provided that you haven’t got a TIN or record with BIR, you should create an ORUS account. If you have an existing TIN or record with the BIR, the registered email must be active and permanently used. Otherwise, you should update an email address by completing BIR Sheet Form S1905 on Taxpayer Registration Related Application (TRAA) page. Please note that only one email can enroll in ORUS for each taxpayer. To register with ORUS, please do as follows.

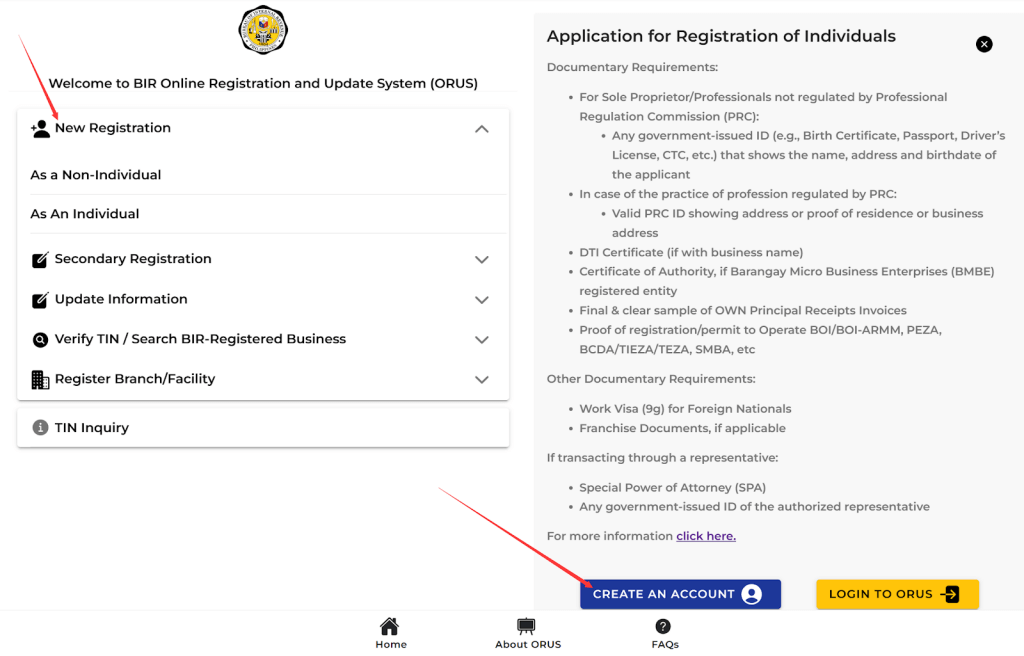

- Visit the BIR’s Online Registration and Update System (ORUS)

- Choose “As an Individual” under “New Registration”. Read the instructions on the right and click on the “CREATE AN ACCOUNT” button.

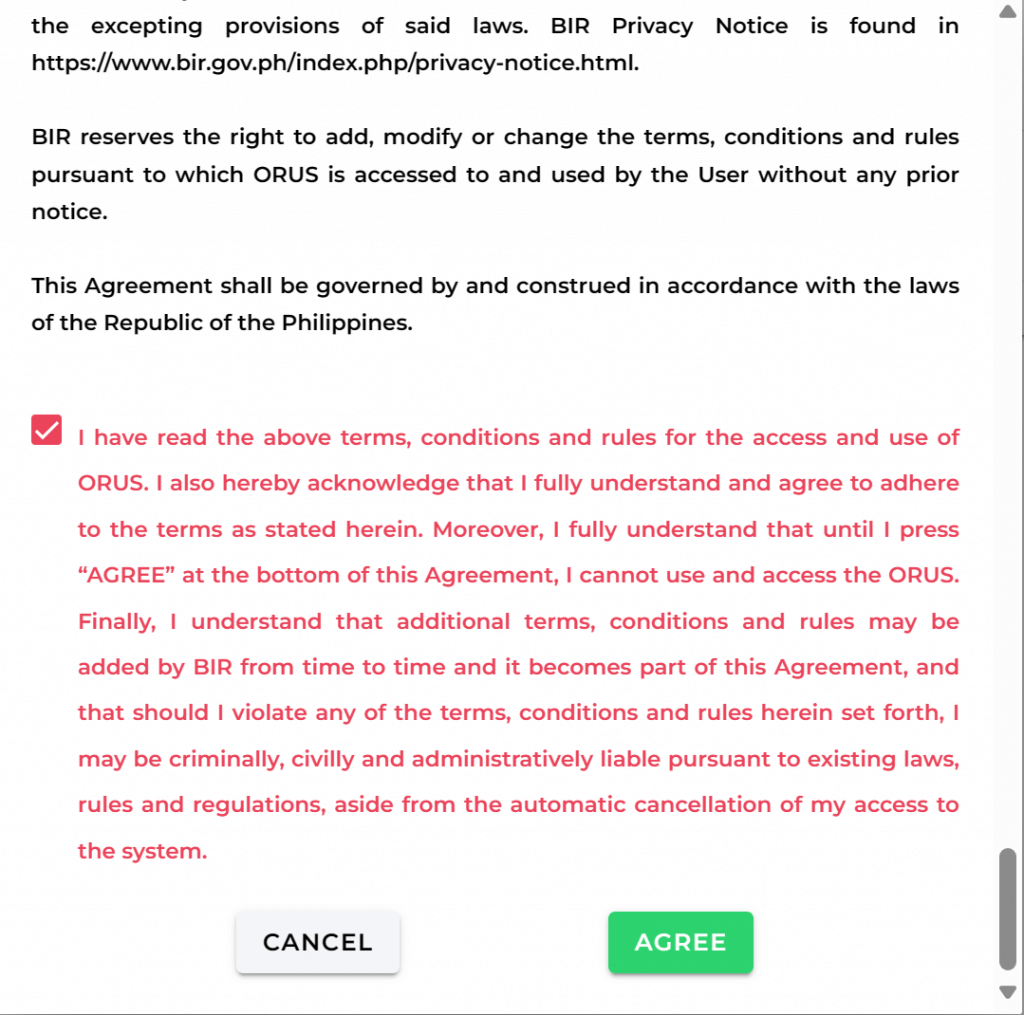

- Read the Terms of Service and User Agreement in the pop-up window and check the box next to the statement in red. Click on the “AGREE” button to continue.

- Select “Taxpayer” for “Register As” and “With Existing TIN” or “Without Existing TIN”.

- Fill out the required fields with an asterisk and click on “REGISTER”.

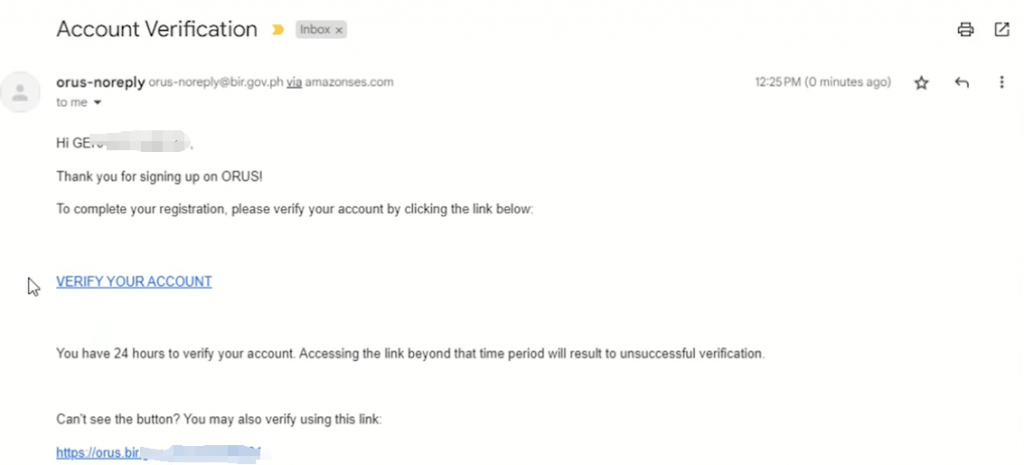

- A confirmation email will be sent to the registered email address. Click on the “VERIFY YOUR ACCOUNT” link in the email and return to the ORUS page to log in. Please note that the account enrollment must be verified within 24 hours after receiving the email.

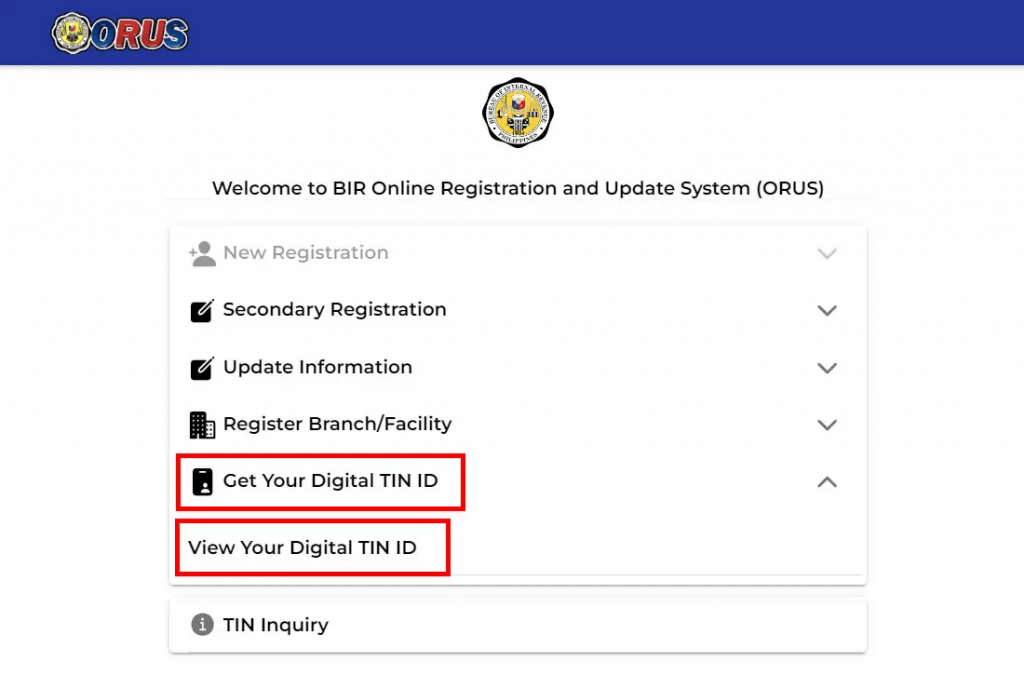

Apply for Digital TIN ID

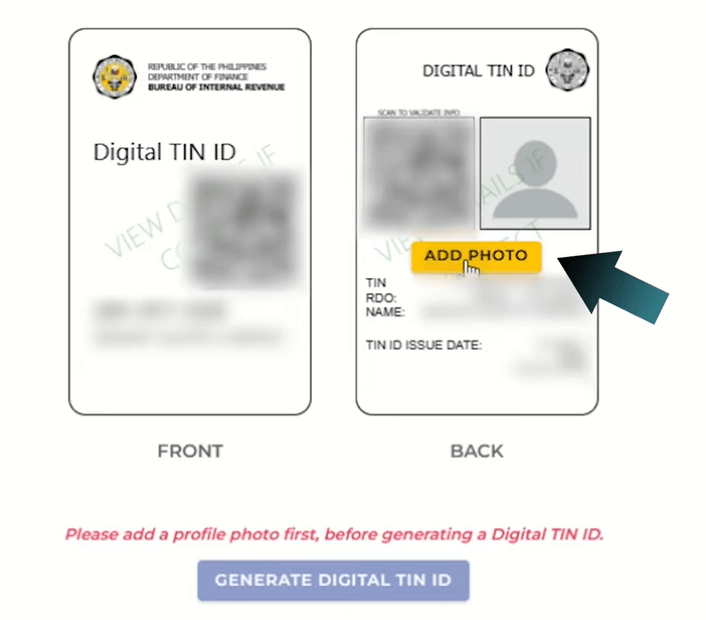

After logging in to the BIR portal, you should choose “Apply for Digital TIN ID”. Fill out the application form and upload clear scanned copies or photos of the required documents, including a biometric photo, a valid government-issued ID, birth certificate, proof of address, and other necessary proof. Submit the applications and wait for it to be verified. If you already have a TIN, you can choose “View Your Digital TIN ID” to see a draft of the digital version.

Download Digital TIN ID

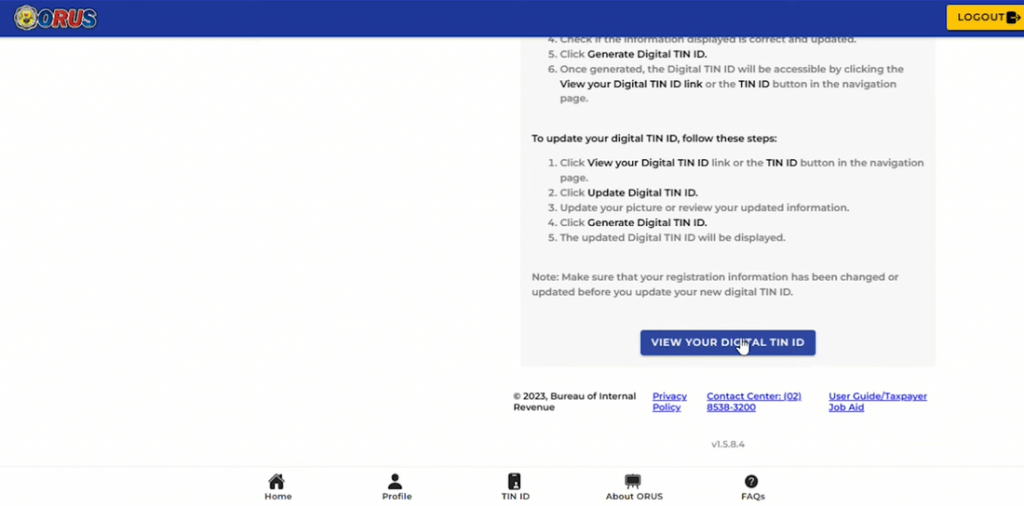

After the authority approves your application, you will receive a TIN confirmation or notification which tells you the good news and how to access the digital TIN. According to the Visit the instruction, please log in to the ORUS portal again and click on “View Your Digital TIN ID”.

Read the instructions on the right of the screen and scroll down to click on “View Your Digital TIN ID” button at the bottom. Preview the digital card and check the personal information. Download and print it out. It is necessary to note that the procedures might vary occasionally. If there is any problem, please don’t hesitate to ask BIR for help.

👀 If you are still confused about the process, you may take a look at the below video from YouTube:

Physical vs Digital TIN ID: What’s the Difference?

A digitized TIN ID is a digital version of the physical TIN card and both of them are issued by the Bureau of Internal Revenue (BIR). According to the BIR, both paper and electronic cards are valid, so individuals can apply for either type. Those who already have a physical card are not required to obtain a digital one. Here is a comparison between these two forms of ID.

| Comparison | Physical TIN ID | Digital TIN ID |

| Appearance | A paper card with name, TIN, RDO, photograph, date of issue, date of birth, and signature. | A digital card with name, TIN, RDO, photograph, date of issue, and a QR code. |

| Application Process | Apply in person at a BIR branch. | Apply online on the BIR website and be issued digitally. |

| Usage | Serves as a permanent identity document for private and public transactions. | Serves as a permanent identity document for private and public transactions. |

How Much Is TIN ID?

TIN ID issuance is free of charge. But you need to pay ₱100 for the damaged or replaced TIN card. If you apply for a business TIN as a professional or mixed-income earner, you need to pay ₱500 for the registration and ₱30 for the documentary stamp tax or DST.

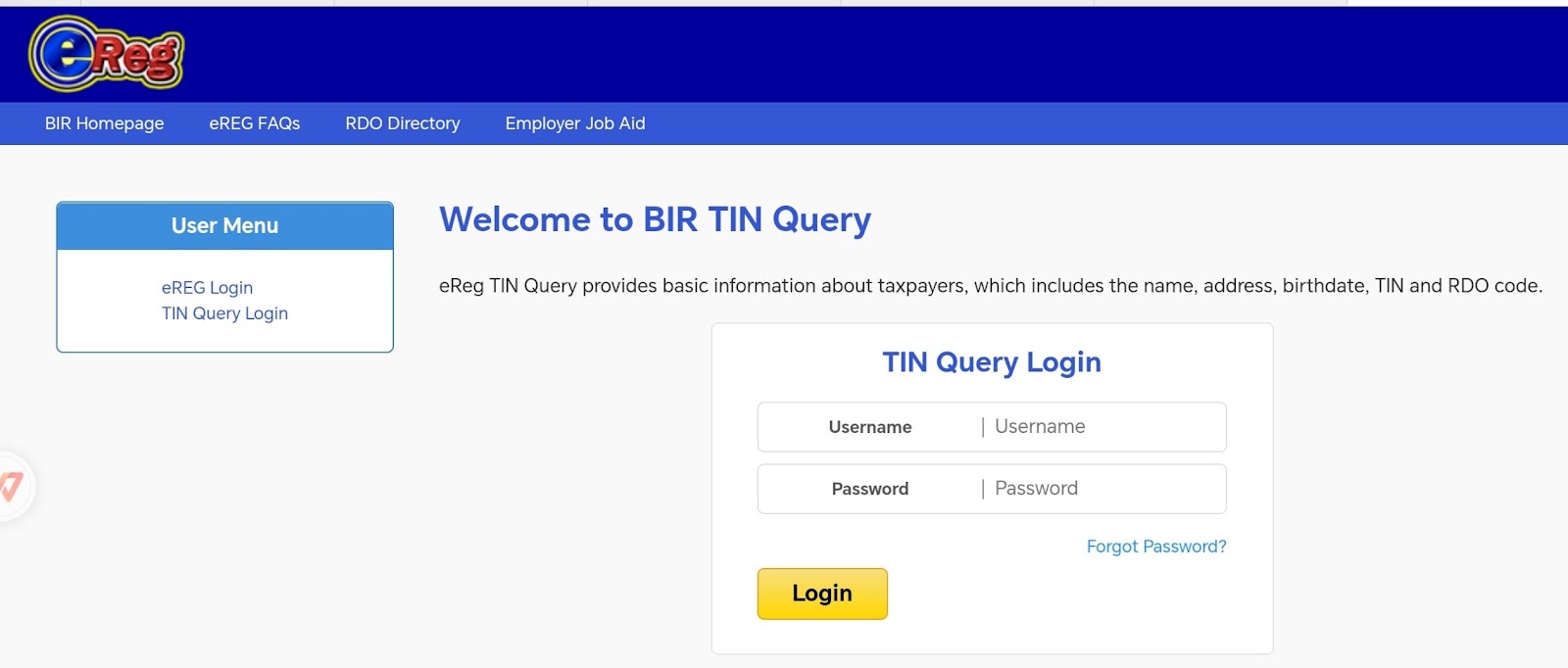

How Do I Know if I Have a Previous TIN?

Every Filipino has a TIN in their life. If you keep two, you’re breaking the law. So you can find out if you have one or not. Let eTIN, the BIR database, help you search for results. If not, you can apply for a new one on the eTIN.

What Should I Do if I Lose My TIN ID?

If you accidentally lose your TIN ID, you can pay ₱100 for a replacement. Follow the steps below to get a new one.

- Complete BIR Form 1905 (Registration Information Update Form)

- Obtain Form BIR 0605 (Receipt to pay the replacement fee).

- Prepare the notarized affidavit of loss old TIN card and other required documents.

- Take them to your designated RDO, and get a new TIN ID.

FAQ

📌Is a digital TIN card a valid ID?

Yes. It serves the same purposes as a physical card.

📌How much does it cost to get a digital TIN ID?

It is free charge to apply.

📌How long does it take to get a Digital TIN ID?

It depends on the verification period after submitting applications. It is suggested to check the application status regularly.

📌Can I use the Digitial TIN ID for official transactions?

Yes. The officer will scan the QR code on it to verify your identity.

📌Is a Digital TIN ID valid for a lifetime?

Yes. It will never expire.

Conclusion

TIN ID is a must-have for taxpayers. In this article, we have shown you how to get your TIN ID card personally and online. Due to its convenience, durability, security, and reliability, it is suggested to obtain one from the BIR’s Online Registration and Update System (ORUS). Don’t get this from some advertising channels. It is free for every taxpayer to apply.