Both PAN card and Aadhaar card are crucial forms of identification in India. The Indian government has requested citizens to link the Aadhaar card with PAN card to make it more convenient to deal with income tax returns, bank transactions or related activities. Since June 30, 2023, failing to link the two cards would lead to a penalty. This passage is going to explore how to link a PAN card with Aadhaar card and address some common concerns.

What is PAN Card?

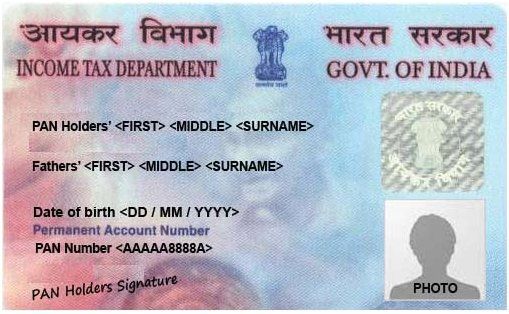

PAN card refers to Permanent Account Number Card. It is an electronic system that contains a 10-digit PAN number that records a taxpayer’s tax information, either for an individual or a company. It is issued by Indian Income Tax Department. It is a must-have to create a bank account, sell and purchase assets. As PAN card carries detailed information about each account holder in a special way, every tax entity must hold a separate card.

image resource: https://en.wikipedia.org/wiki/Permanent_account_number

What is Aadhaar Card?

Aadhaar card is one type of identification card for Indian citizens issued by UIDAI. It consists of a 12-digit number, a unique code for every individual. By carrying biometric and personal information, it is used as identity proof in case of information theft and fraud subsidy claim. With Aadhaar card, it would be much easier to get a passport, create a bank account and create a fund investment account.

Why is it Important to Link PAN Card with Aadhaar Card?

PAN card Aadhar card link is mandatory in India. This regulation aims to prevent tax evasion because each taxpayer is featured with a customized identifier. It would lead to a series of inconveniences if you don’t. And here are the benefits of linking them.

File Income Tax Return (ITR)

When handing in the ITR, you are required to provide the Aadhaar Card number. If you haven’t linked the two cards, the Income Tax Department would reject your application. Failing to file the ITR hinders applicants from getting a tax refund.

Access Government Services

It is usually required to submit both cards while trying to make use of government services, such as subsidy application, passport application, bank account creation, etc. If the two cards are not linked, you would fail to move on to complete the application.

Replace PAN Card

Supposing that your PAN card is lost, stolen or damaged, you have to replace a new one. However, if you don’t link the two cards, you would fail to get a new one because the government requests the Aadhaar Card number attached to a new PAN card application.

How To Link PAN Card with Aadhaar Card?

There are two ways to connect PAN with Aadhaar card: online or by SMS. It usually takes 1-7 days to finish the linkage. And here are the step-by-step guides.

Pan Card VS Aadhar Card Link Online

● Step 1: Go to the E-filing website for PAN-Aadhaar Linkage page of Income Tax Department Portal.

● Step 2: Input your PAN and Aadhaar numbers in the form.

● Step 3: Input your name and make sure it is consistent with that on the Aadhaar card.

● Step 4: Verify the captcha code and check the box. Visually impaired users can also request an OTP instead of captcha code, which would be sent to the registered phone number. Please note that the OTP would become invalid after 15 minutes upon sending out, so don’t miss it.

● Step 5: Click “Link Aadhaar” button.

● Step 6: A pop-up page would appear, stating whether the linkage is done. If there is anything wrong, correct the mistakes and start again according to the error message.

PAN Card VS Aadhar Card Link via SMS

Step 1: Edit the message in a specified form. For Example, if your Aadhaar number is “123456789012” and PAN is “ABCDEFGHIJ”, the message should be “UIDPAN 123456789012 ABCDEFGHIJ”.

Step 2: Send the message to 567678 or 56161 from the registered phone number.

Step 3: A message would be sent to you to verify the linkage.

How to Check Aadhaar PAN Linking Status?

If you want to track the status of the Aadhaar PAN linkage, please do as follows:

● Go to the official e-filing website of the Income Tax Department.

● Locate the option “Link Aadhaar -Aadhaar PAN linking status”.

● Offer PAN number and Aadhaar number respectively.

● Click the “View Link Aadhaar Status” button. Then you will see the linkage status. If they have linked, you would receive a message confirming successful connection. If not, you should move forward to correct or refile the application again according to the instructions.

PAN Card Aadhar Card Link Exemption

Although it is mandatory to link these two cards, 4 types of users are exempted from this requirement.

● NRIs

● Non-Indian citizens

● Citizens over 80 upon the deadline (June 30, 2023)

● Residents in Assam, Meghalaya or Jammu & Kashmir

What if You Fail to Link Aadhaar Card to PAN Card?

Name error is one of the most common situations that leads to failure in connection. It might take a few weeks to correct information on both cards. You can try the linkage again after receiving a new card. Here are ways to correct the name on either PAN card or Aadhar card.

Correct the Name on PAN Card

● Step 1: Go to the official e-filing website of NSDL and choose the “Changes or Correction in PAN Data” option under the “Application Type” section.

● Step 2: Choose the “Individual” under the Category and enter required information.

● Step 3: Verify captcha code and click on the “Submit” button. You will receive the updated PAN card with correct information.

Correct the Name on Aadhaar Card

● Step 1: Go to Aadhaar Enrolment Center with all required documents, including the original Aadhaar card and proof of identity. Search it on UIDAI official website and find a nearby one.

● Step 2: Get an enrollment form and complete it.

● Step 3: Hand in the form and the documents to the officer. He/she would review your application and make amendments.

● Step 4: Use the unique request number (URN) which is provided after submitting the form and documents to check the updating status on UIDAI website.

Summary

Now that you have learned about what is PAN card and Aadhaar card, the importance of linkage and how to link PAN card with Aadhaar card, just get started if you have not finished it yet. On condition that they aren’t linked together, you would face a penalty of Rs. 1000. Please make sure the information on both cards is the same, or your application would be rejected. If there is any inconsistency, correct them before linking the two cards. The whole process must be done online. No offline service is available. You can choose to connect them online or through SMS.