Most people in the Philippines are involved in the Social Security System, a government-run compulsory contributory program providing social insurance to domestic employees, overseas Filipino workers, etc. SSS ID is a key to accessing social security benefits. In this article, we are going to talk about how to get SSS ID, SSS requirements, social security benefits, and other concerning issues.

What Is SSS ID or SSS Number?

SSS number, also known as Social Security Number, is a 10-digit number shown on the SSS ID card. It is assigned to individuals requesting to join the Philippines’ Social Security System (SSS). You will be asked to provide the number when accessing SSS-related benefits or privileges from public or private institutions.

Why Do I Need SSS Number?

It is well-known that the SSS number is required in many cases. However, not all of us can tell why it is important. Here are the answers.

Employment

According to the Philippines’s Social Security Law, employers cannot hire those without SSS ID because they have to pay a share of contributions to the Social Security System for employees. Otherwise, they will be severely punished, such as a fine of PHP 5,000 to PHP 20,000 or imprisonment. The unpaid contributions will also be recovered along with extra penalties. Therefore, you must provide an SSS number to get employed.

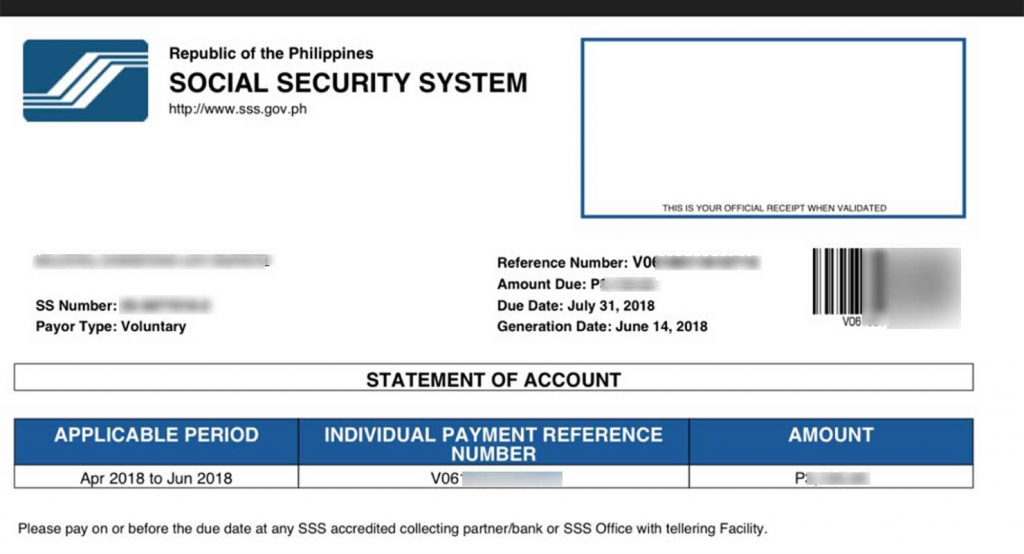

SSS Contribution Payment

The Philippines’ Social Security Act requires both employers and employees to pay for the SSS contributions after deducting a certain amount from their monthly salaries. Hence, it’s necessary to check your SSS contributions from time to time. Moreover, employers should submit a report to the Social Security Office demonstrating employees’ contributions every month. In such cases, the SSS number is needed.

Access to SSS Benefits

Your SSS number determines how much benefit you can obtain from SSS which is listed below.

- Salary loan

Social Security System members can get short-term loans from the SSS to address temporary cash needs.

- Sickness Benefits

It is available to those who are unable to work due to an injury or illness. You can receive an allowance for sick leave. Click here to learn more about SSS sickness benefits.

- Unemployment Insurance

According to the newest Social Security Act, employees who were dismissed or involuntarily left the job are qualified to receive two months of cash allowance so as to go through the time when seeking a new job. Click here to learn more about SSS unemployment benefits.

- Maternity Allowance

It is granted to females who have to take a leave for childbirth or miscarriage.

- Disability Pension

Employees with permanent disabilities can avail of a lump sum or monthly paid cash benefits.

- Retirement Pension

Retired employees aged 60 years old and above can receive the pension at one time or every month.

- Death Benefits

It is insurance or pension money paid to a beneficiary of a deceased SSS member.

- Funeral Support

Anyone who paid for the funeral cost of a deceased SSS member can claim a cash benefit.

Who Can Apply for SSS ID?

All Filipinos who are aged 60 or younger and haven’t obtained the SSS number can apply for SSS ID. People satisfying the SSS ID requirements are divided into two categories: compulsory and voluntary coverage.

Individuals Required to Register for SSS

It involves Filipino citizens either being hired or self-employed, working domestically or abroad, such as:

- Employees

It includes part-time or full-time workers in the Philippines under regular or probationary status, such as:

- Government employees

- Public or private sector employees

- Household service staff

- Seafarers

- People who work for foreign governments or international institutions with administrative agreements with the SSS.

- Self-employed Persons or Freelancers

They establish a business or work for themselves. Individuals who earn no less than PHP 1,000 per month can apply for SSS ID, such as:

- Professionals

- Business owners

- Farmers

- Fishermen

- Informal workers like street pedlars, jeepney drivers, tricycle drivers, and so on.

- Temporary employees working for government agencies without the Government Service Insurance System (GSIS) benefits.

- Film and television industry workers like actors, directors, scriptwriters, etc.

- Journalism practitioners like journalists, news correspondents, etc.

- Professional athletes, coaches, licensed trainers, and other workers in related fields

- Overseas Filipino Workers (OFWs)

All Filipinos working abroad should apply for SSS ID to guarantee their rights and benefits. The following citizens need to obtain SSS membership.

- Filipinos hired by foreign employers in the Philippines to work outside the country

- Filipinos receiving wages outside the Philippines

- Filipinos who are permanent residents in other countries

Individuals Voluntary to Register for SSS

If your legal spouse is an SSS member and you are managing the household full-time can also avail of the Social Security program. Please note that you should pay a certain amount of contributions. Moreover, other employed individuals might also be eligible for the program provided that they haven’t registered with Social Security System.

SSS ID Requirements

To make sure the SSS application goes smoothly, it is suggested to prepare the required documents in advance.

- Proof of Identity

It is acceptable to submit one of the primary documents or two of the secondary documents (listed below). Both an original and a certified copy are required

| Primary Documents | Birth certificateBaptismal certificate A valid passport Full LTO driver’s License Professional Regulation Commission (PRC) Card Seaman’s Book |

| Secondary Documents | Alien Certificate of Registration ATM card, include a certification from the issuing bank if the name is not shown Bankbook Credit Card Certificate from Office of Cultural Communities, Office of Muslim Affairs, etc. Certificate of Licensure, Qualification Document, or Seafarer’s ID issued by the Maritime Industry Authority Naturalization certificate issued by the Bureau of Immigration Company ID Company Representative Authorization Card issued by Social Security System (SSS) Fisherman’s Card issued by the Bureau of Fisheries and Aquatic Resources Government Service Insurance System (GSIS) ID Health or Medical Card ID card issued by Local Government Units ID card issued by the Professional Regulation Commission (PRC) Life Insurance Policy Marriage Certificate NBI Clearance Overseas Workers Welfare Administration card Pag-IBIG Membership card Firearms licence PhilHealth ID card Police Clearance Postal ID School ID Seafarer’s Registration Certificate Senior Citizen ID Card TIN (Tax Identification Number) Card Temporary LTO driver’s license and student permit School transcript Voter’s ID |

Depending on the applicant’s civil status, extra documents might be required, such as:

- Marriage certificate or copy of your spouse’s SS Form E-4

- Marriage certificate and death certificates of the deceased spouse or court order on the adjudication of death

- Decree of legal separation

- Certificate of Finality of Annulment

- Decree of divorce

- Children’s birth certificate or baptismal certificate (required when registering children as beneficiaries)

How to Get SSS ID

SSS ID applications can be done online or in person. In this section, we will introduce how to get SSS ID through in-person visits according to your status and identity.

Employers

SSS registration might differ subject to your company type.

- For single proprietorships, applicants just need to complete the Employer SSS Registration Form (R-1) as well as and SSS Employment Report (R-1A) and submit them at the SSS office.

- For partnerships, applicants should also include both a photocopy and an original copy of the Articles of Partnership except for the two forms above.

- For corporations, applicants should also present both a photocopy and an original copy of the Articles of Incorporation besides the two forms which should be filled by the company’s president or a corporate officer.

Employees

- Gather supporting documents.

- Complete the SSS Form E-1.

- Submit applications at the nearest SSS branch.

- Pay the initial contribution according to your monthly income.

- Wait for approval and receive your SSS number.

Self-employed Persons

The procedures are similar to those for employees, but self-employed persons should complete the SSS Form RS-1. Supposing that you have employees, you should also apply as an employer.

OFWs

The SSS requirements and applications are the same as those for employees. If the applicant already has an SSS number, you can keep using it by reactivating the membership. When choosing the payor type for contribution payments, remember to choose “OFW”.

Kasambahays

If you have a kasambahay who performs domestic household tasks for you, you are supposed to register him/her with SSS through the steps below.

- Complete Kasambahay Unified Registration Form, which can be done by yourself or your kasambahay. Fill out the form for each person if you have more than one kasambahay.

- Complete the Household Employer Unified Registration Form and the Household Employment Unified Report Form.

- Submit the forms along with proof of identity of the Kasambahays at the SSS office, which can be made by yourself, the kasambahay, or an authorized representative.

Voluntary Members

It includes all unemployed persons and non-working spouses. The former should fill out SSS Form RS-5 and provide the existing SSS number. When paying the initial contribution, the previous SSS membership will shift to a voluntary payer status. The latter should fill out SSS Form NW-1 signed by both non-working and working spouses. A marriage certificate must be included in the applications.

SSS Online Application

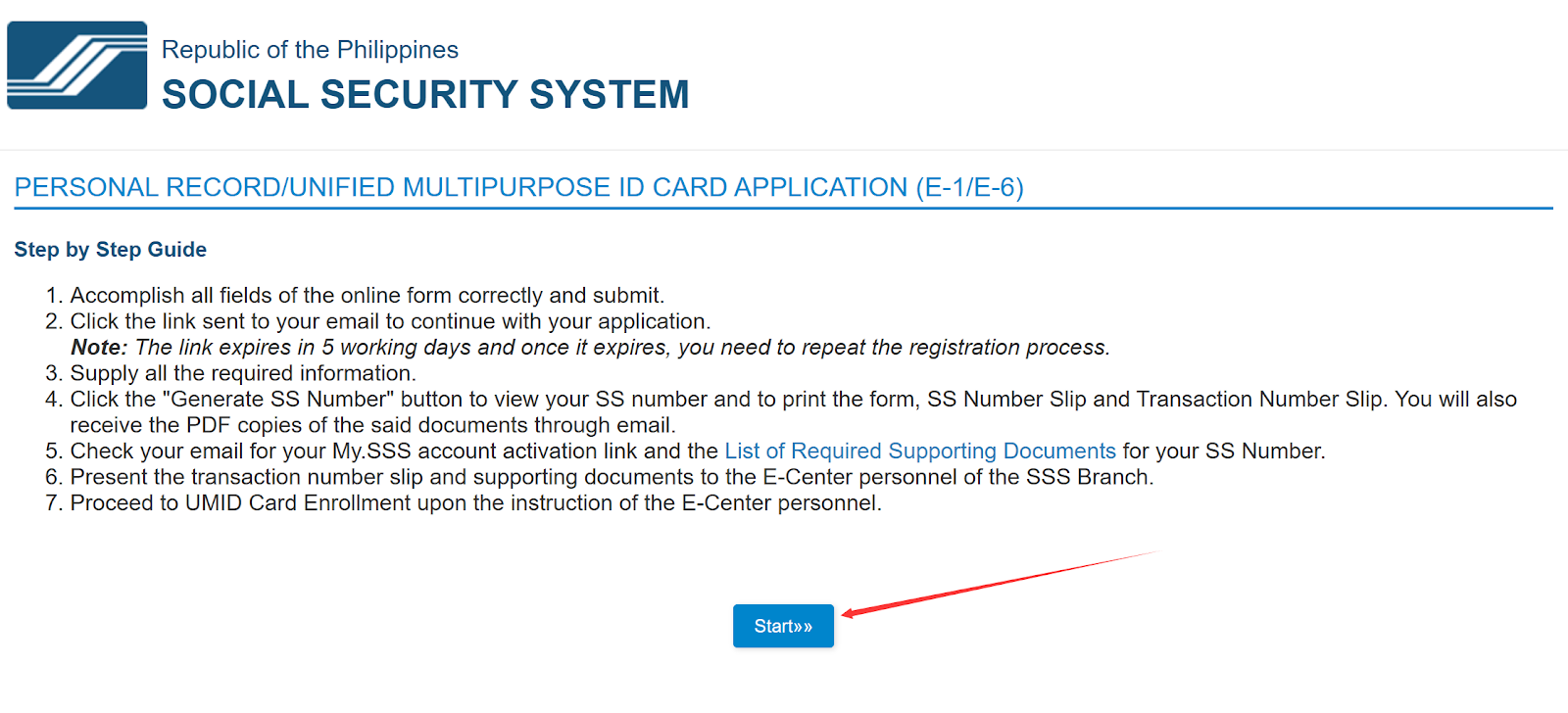

The Philippines government launched an SSS online application system to reduce the waiting time and simplify the procedures. Here is a detailed instruction.

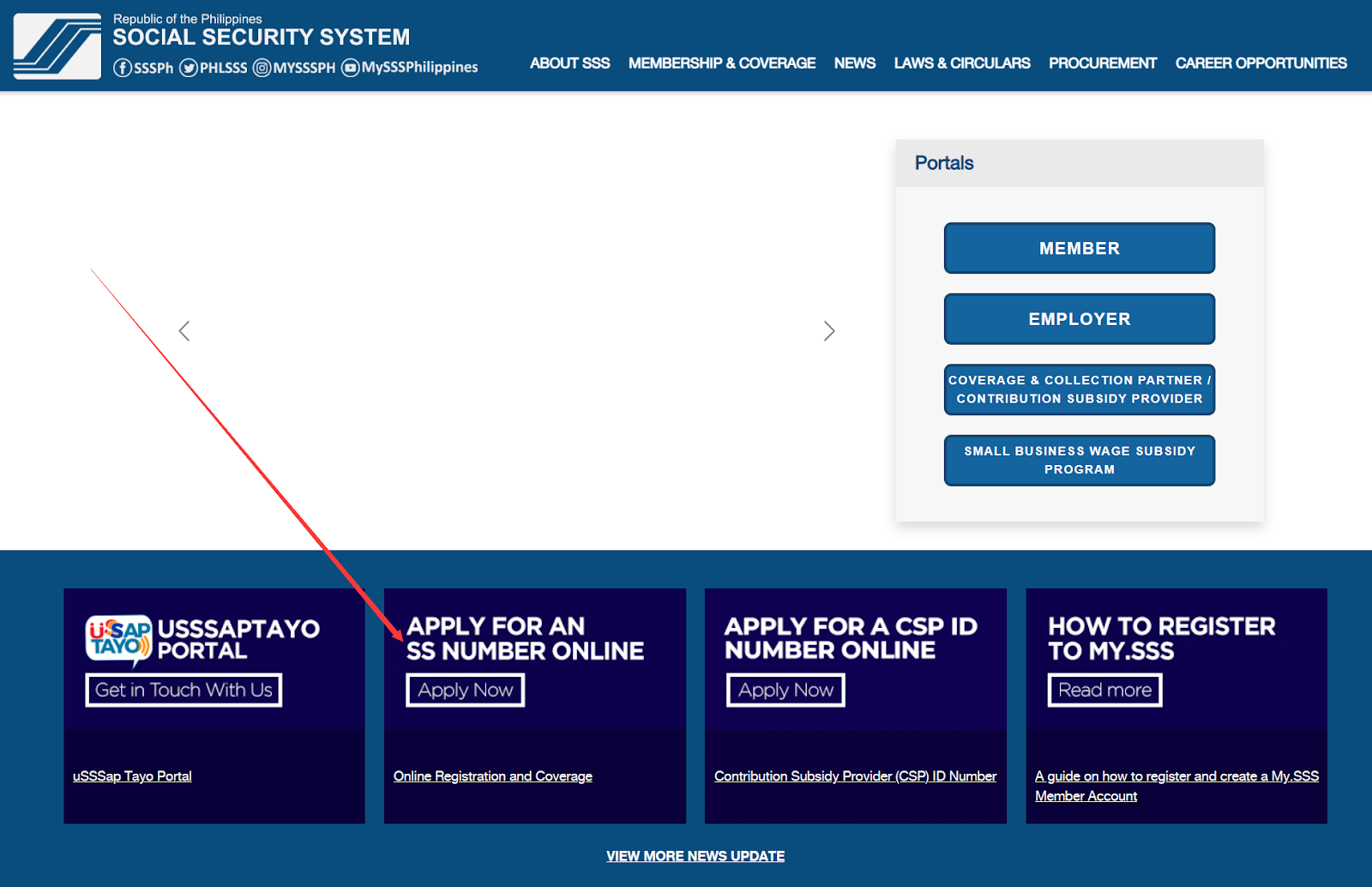

- Visit the official website of the Social Security System.

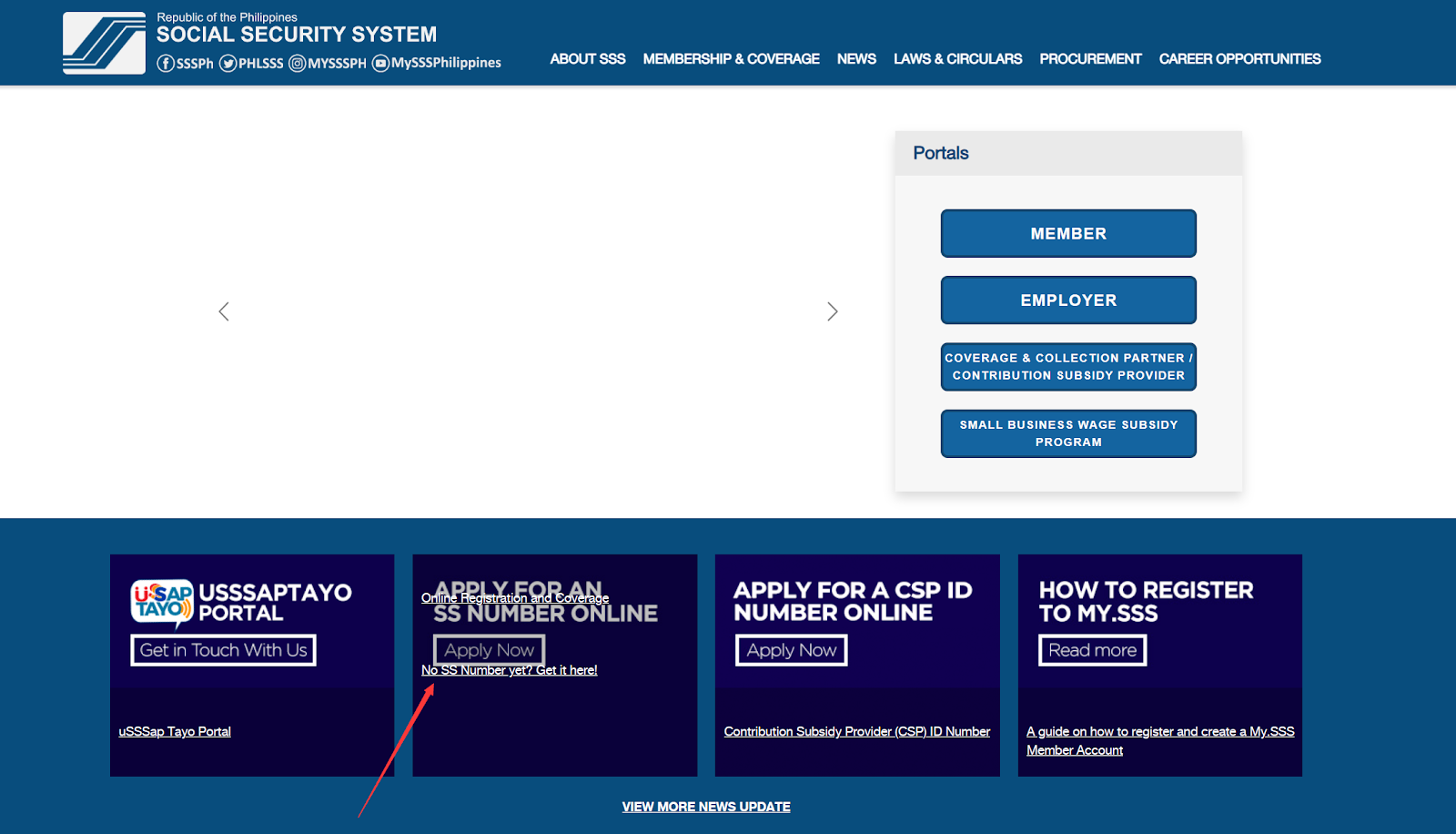

- Move the cursor to the “Apply For An SS Number Online“ section and click on the pop-up hyperlink “No SS Number yet? Get it here!”.

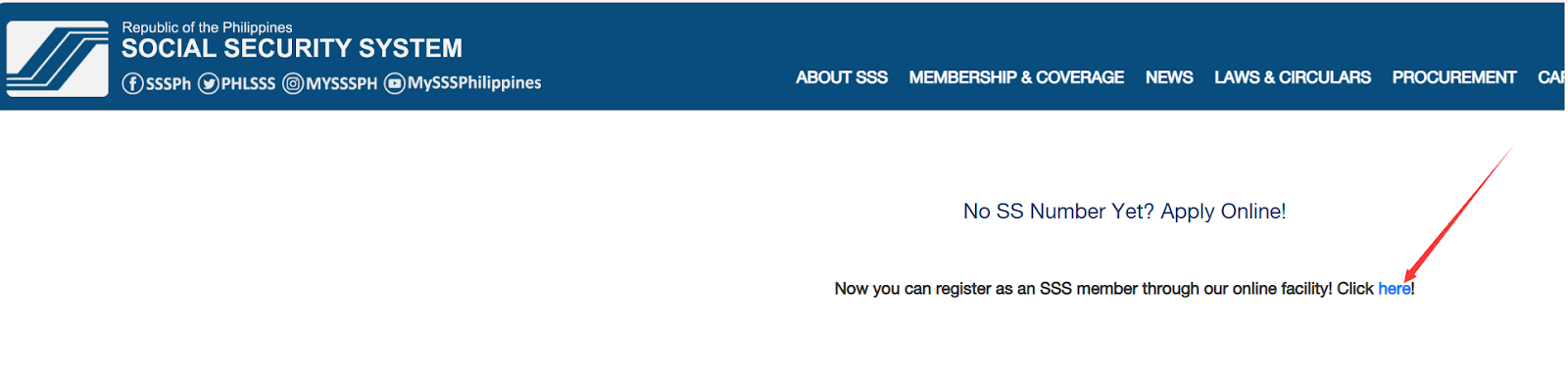

- Click on the “here” on the page saying that “No SS Number yet? Apply Online!”.

- Read the instructions on the screen and click on the “Start” button to continue.

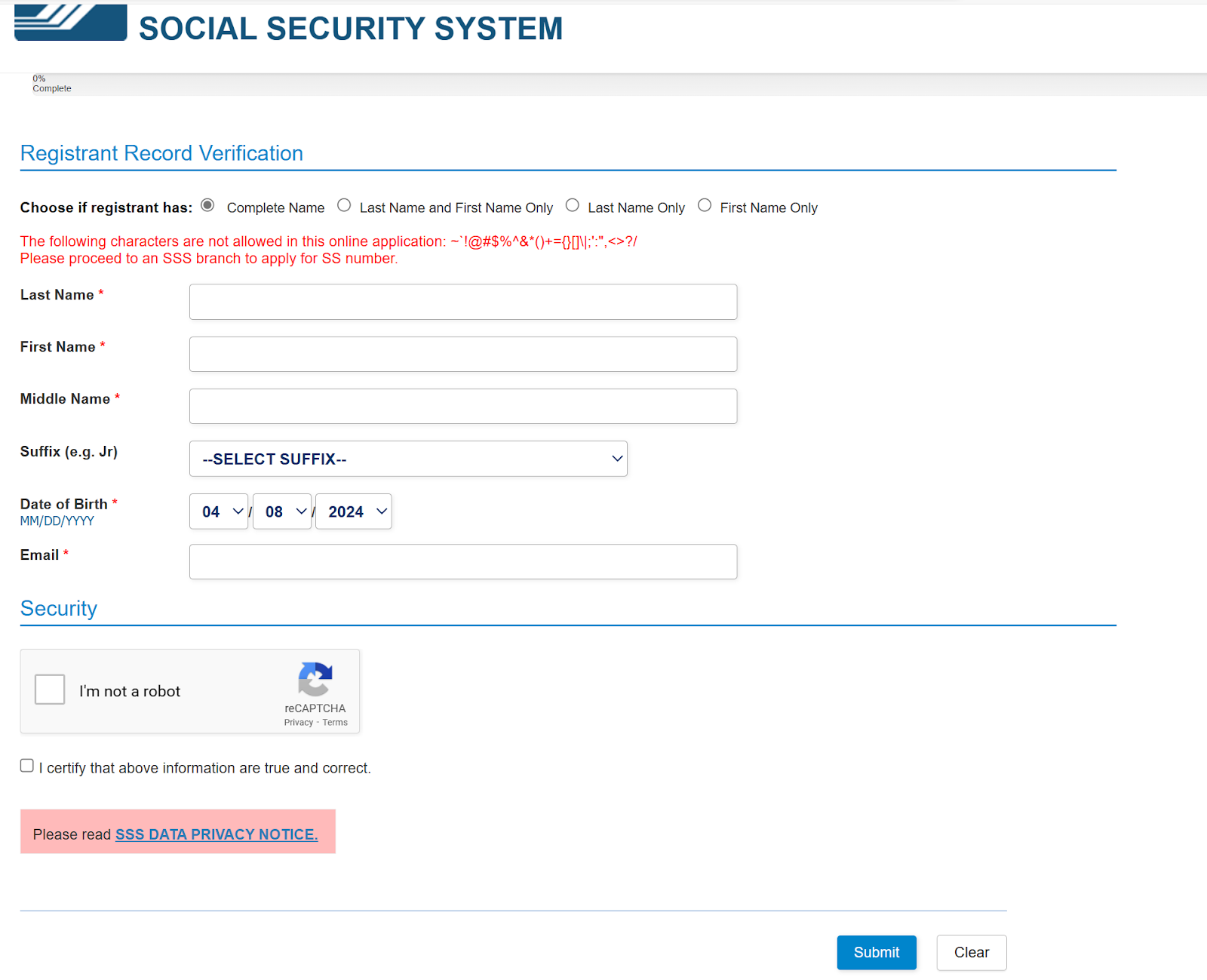

- Provide required information (fields with an asterisk), such as name, date of birth, and email address. Complete the security check and check to agree on the declaration of true and correct information. Click on the “Submit” button to proceed.

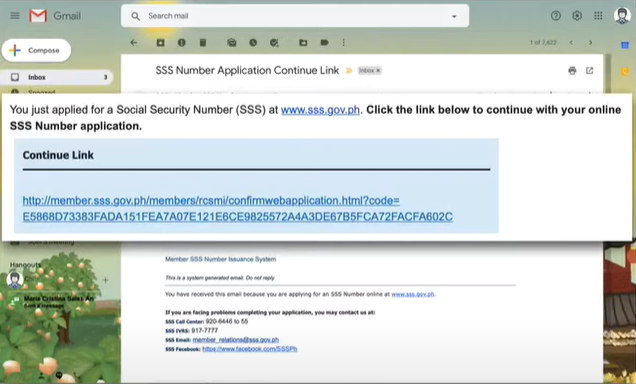

- Receive a notification in your email and click on the provided link. Make sure to activate it as soon as possible, otherwise, the link will expire in 5 days.

- Complete the online application form which requires basic information, contact information, and the address of the beneficiary

- Click the “Next” button and continue registering. Enter a preferred user ID which will be used to log in to My.SSS account.

- Review the previously filled form. If there is nothing wrong, click on the “Generate SS Number” button.

- Now you have obtained the SS number. Print the application form, SS Number slip, and transaction number slip.

- Receive a confirmation email that contains My. SSS account activation link, PDF forms of records of submitted applications, and documents for SSS requirements.

- Visit the nearest SSS Branch with required documents and application records. You can also contact the branch if an SSS online appointment is needed.

- Finish the application according to guidance in the SSS branch.

👀 View the video tutorial here:

SSS Number Processing Time & Fee

How long it takes to receive your SSS number depends on the way you apply. For SSS online registration, you will obtain the number on the same day, which takes only a few minutes. For in-person applications, it will take 10 days.

It is free of charge to get an SSS number, but some applicants might have to pay the initial contribution payment which is subject to the monthly salary.

Temporary vs Permanent SSS Numbers

The temporary and permanent SSS numbers are the same 10-digit code, featuring different status and usage. The SSS marks your SSS number as temporary when a birth certificate remains to be submitted, for example, the number obtained through SSS online registration. A permanent SSS number allows the owner to enjoy all SSS benefits and apply for a UMID card while a temporary one can only be used for SSS contribution payments and employee reports filed by the employer.

To change the temporary SSS number to a permanent one, please do as follows.

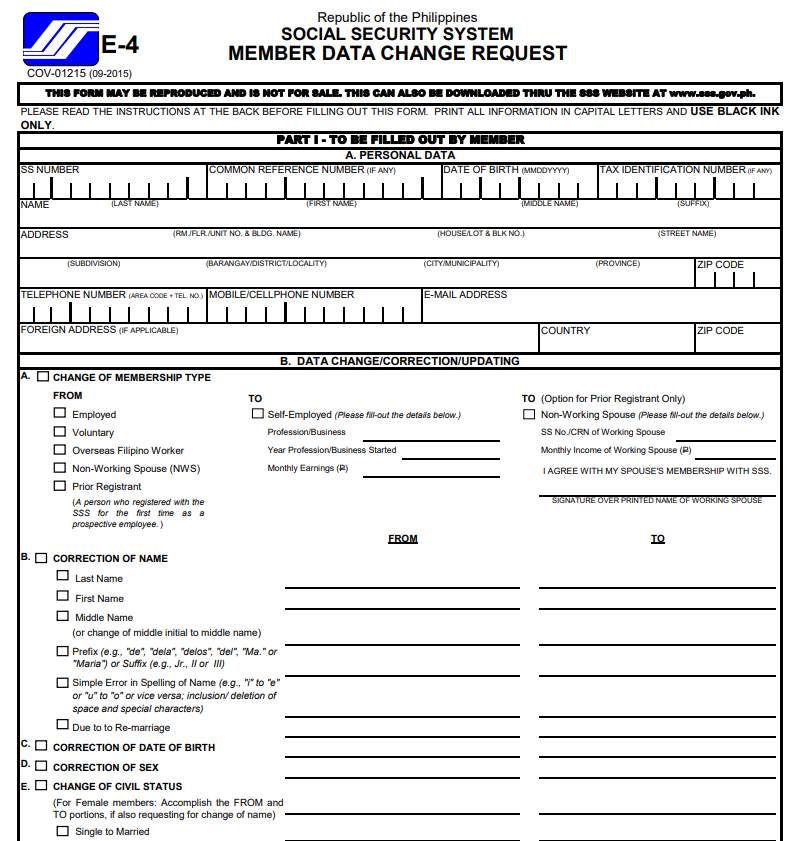

- Fill out SSS E-4 Form

It is also known as the Member Data Change Request Form which is available on the SSS branch or at the SSS Website. Check the box next to “UPDATING OF MEMBER RECORD STATUS from “Temporary” to “Permanent”.

- Gather Required Documents

The authority needs to verify your identity, so a birth certificate or other certified valid ID is necessary.

- Visit the Nearest SSS Branch

Bring the accomplished form and identity documents to an SSS office and tell the officer why you are visiting. It is suggested to visit earlier in case of waiting in a long queue.

Age Limitation for SSS Numbers

The SSS numbers are only issued when the applicant is below 61 unless he/she is a surviving spouse or guardian of an SSS member. That is to say, you can obtain the ID even if you are a student.

Is SSS ID a Valid ID?

Yes. The SSS ID or SSS UMID (Unified Multi-Purpose ID) is a national secondary identity document in the Philippines. It not only helps track the social security contributions and benefits of an SSS member but also serves as an acceptable ID in some public or private transactions. For example, it could be used to support passport or national ID applications along with other secondary or primary IDs.

Is SSS Number Mandatory?

As SSS contribution payments are required for employers in the Philippines, it is mandatory for Filipino workers, either being hired within or outside the Philippines, to obtain an SSS number. In terms of self-employed or freelancers, they are suggested to apply for it so as to enjoy social security benefits while unemployed persons or non-working spouses of SSS members are voluntary to join the SSS program.

Summary

Social Security Number is important for the purpose of employment, SSS contribution payments, and SSS benefits access. It is available to most Filipinos aged 60 or below. Individuals can register online and submit supporting documents in person. To accelerate the application, it is necessary to learn about SSS requirements and how to get SSS ID. Whether you are mandatorily or voluntarily involved in the Social Security System program, make sure to provide accurate information.