Having a baby usually means a massive expense for a family and mothers might face significant medical risks during pregnancy. The good news is that many countries have launched a variety of social security programs to help mothers-to-be relieve financial stress. Philipiines is no exception. In this article, we are going to introduce SSS benefits for maternity in the Philippines, including SSS maternity requirements, qualifications, how to apply for maternity benefits in SSS online, and how to compute the benefits.

What Are SSS Maternity Benefits?

SSS maternity benefits are daily cash allowance given to female members of the Social Security System who have to stop working due to pregnancy, childbirth, miscarriage, emergency termination of pregnancy, or any other maternal emergencies. The benefits are available to all qualified beneficiaries despite their civil status, employment status, child legitimacy, or pregnancy frequency. Both employers and employees should learn about the maternity benefits under the program. Here are some common examples.

- Paid Leave

The leave covers all mothers whether it’s normal birth or not. The days of leave depend on the outcome of the pregnancy. For example,

- Live childbirth (either natural labour or caesarean section): 105 paid days

- Miscarriage or emergency pregnancy termination: 60 paid days

- Solo parent: extra 15 days based on the conditions above

- Full Pay

During the paid leave, new mothers will get a full base pay. However, extra allowance, merit pay, and commissions are not included. Moreover, employers should also offer health care benefits during pregnancy and postpartum benefits.

- Right to Work

It is illegal for employers to fire pregnant women or those on maternity leave. When the leave is over, the employer should allow you to return to your job or arrange a new position. The regulation aims to protect the working rights of mothers and eliminate discrimination.

- Friendly Environment

Pregnant employees might have special needs. It is the company’s responsibility to build up a welcoming environment for them, such as ensuring proper ventilation in the workplace, providing ergonomic furniture, setting up breastfeeding rooms, and so on. Please note that some facilities are not mandatory. Employers can satisfy their employees’ needs according to their real conditions.

- Maternity Reimbursement

As you have contributed to SSS for months, you can claim maternity reimbursement whether you miscarry, normally give birth, or undertake a cesarean delivery. The amount is determined by the Monthly Salary Credit of the SSS contribution.

SSS Maternity Benefits for Voluntary Member

Voluntary members can also enjoy SSS benefits. SSS maternity benefits for self-employed and non-working spouses are similar to those for mandatory members, but you should directly notify SSS about your pregnancy While employees can finish it through employers. The maternity notification can be done in person or online as soon as you have the first ultrasound report. Moreover, the Maternity Notification Form (Mat1) and Maternity Reimbursement Form (Mat2) should be filled by yourself. When it comes to “how much is SSS maternity benefit voluntary”, it is similar to that for mandatory and we will talk about SSS maternity benefit computation later.

Qualifications for SSS Maternity Benefits

To be qualified for the SSS benefits, a female must:

- Be a member of SSS.

- Have paid contributions for at least 3 months within 12 months before childbirth, miscarriage, or other maternity emergencies.

- Have noticed the SSS of pregnancy and Expected Date of Delivery (EDD) through employers if she is an employee.

- Have noticed the SSS of pregnancy and Expected Date of Delivery directly if she is separated from employment, self-employed, or a voluntary member.

How Much is the Maternity Benefit in SSS for 2024?

Females whose expected delivery date falls on 1st January 2024 and onwards might gain up to P70,000 and up to 120 days of paid leave. The amount of SSS Maternity benefit is determined by Monthly Salary Credit (MSC) and salary differential. To calculate how much you can claim, let’s learn about some basic concepts.

- Monthly Salary Credit (MSC)

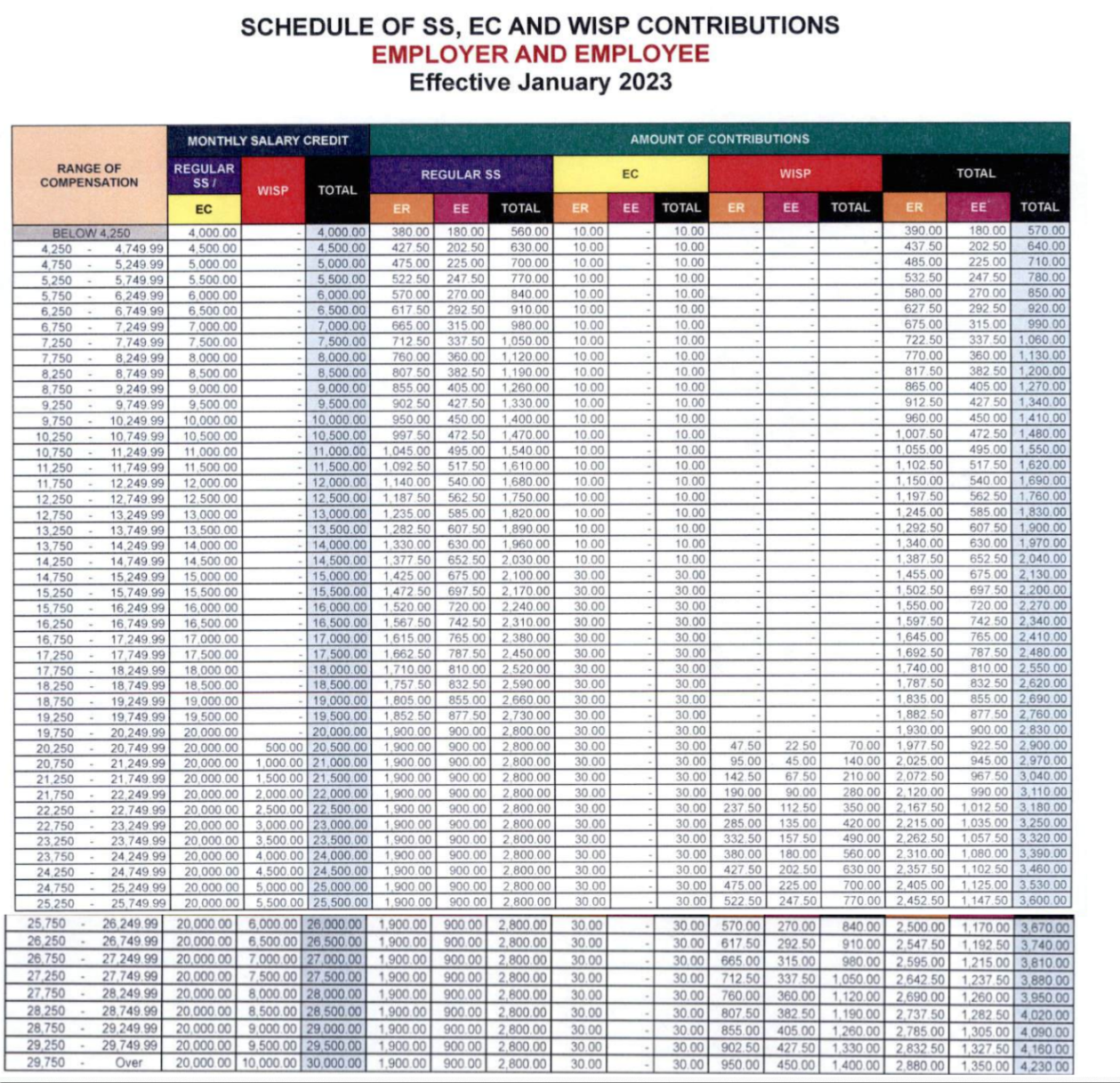

It refers to the compensation base related to monthly contributions. The SS contribution rate is adjusted regularly. As of 2023, the minimum Monthly Salary Credit (MSC) was increased to P4,000 (total amount of contributions: P570) and the maximum MSC to P30,000 (total amount of contributions: P4,230). Here is the 2023 SSS Contribution Table.

- Semester of Contingency

A semester refers to 2 consecutive quarters (6 consecutive months) of the year. There are 4 quarters in a year.

| Quarter | Months Covered |

| Quarter 1 | January, February, March |

| Quarter 2 | April, May, June |

| Quarter 3 | July, August, September |

| Quarter 4 | October, November, December |

As There are 4 semesters of contingency.

| Semesters | Quarters Covered | Specifications |

| Semester 1 | Quarter 1 & 2 | January, February, March, April, May, June |

| Semester 2 | Quarter 2 & 3 | April, May, June, July, August, September |

| Semester 3 | Quarter 3 & 4 | July, August, September, October, November, December |

| Semester 4 | Quarter 4 & 1 | October, November, December, January, February, March |

Your semester of contingency should be the quarter that your EDD falls and the previous quarter. For example, you are giving birth in January which belongs to quarter 1 before which is Quarter 4, so your semester of contingency should be Semester 4.

- Average Daily Salary Credit (ADSC)

It indicates the amount of the member’s daily maternity benefit allowance which is calculated by diving 180 into the total MSC.

How to Compute SSS Maternity Benefit

To help you better understand how much you will receive, we will give you an example in this section. First of all, we need to assume some data.

| Months | MSC | Notes |

| Oct. 2022 | P10,000 | / |

| Nov. 2022 | P11,000 | / |

| Dec. 2022 | P10,000 | / |

| Jan. 2023 | P10,000 | / |

| Feb. 2023 | P11,000 | / |

| Mar. 2023 | P11,000 | / |

| Apr. 2023 | P11,000 | / |

| May. 2023 | P10,000 | / |

| Jun. 2023 | P10,000 | / |

| Jul. 2023 | P10,000 | / |

| Aug. 2023 | P12,000 | / |

| Sept. 2023 | P10,000 | / |

| Oct. 2023 | P10,000 | Semester of contingency |

| Nov. 2023 | P11,000 | |

| Dec. 2023 | P11,000 | |

| Jan. 2024 | P10,000 | Expected delivery date |

Supposing that you gave birth in Jan. 2024, here is a step-by-step SSS maternity benefit computation:

- Determine the semester of contingency. In this example, it falls in Semester 4 which involves Oct. 2023, Nov. 2023, Dec. 2023, Jan. 2024, Feb. 2024, and Mar. 2024.

- Figure out the previous 12 months from the month before the semester of contingency. In this example, it ranges from Oct. 2022 to Sept. 2023

- Pick out the 6 highest MSCs within the 12 months according to your monthly contributions (10,000, 11,000, 11,000, 11,000, 11,000,12,000).

- Add the 6 monthly salary credits to get the total MSC (for example 10,000 + 11,000 + 11,000 + 11,000 + 11,000 +12,000 = 66, 000).

- Figure out the ADSC by dividing the total MSC into 180 days (P66,000/180=P366.67).

- Calculate the total amount of maternity benefits by multiplying ADSC by days of paid leave which is subject to the pregnancy outcome.

| Situation | Amount of maternity benefits | Example |

| Miscarriage or emergency termination of pregnancy | Ave. MSC / 180 x 60 days | P366.67 x 60 = 22,000.2 |

| live childbirth (normal or caesarean section delivery) | Ave. MSC / 180 x 105 days | P366.67 x 105 = 38,500.35 |

| Solo parent | Ave. MSC / 180 x 120 days | P366.67 x 120 = 44,000.4 |

How to Compute Maternity Leave

Full-pay leave is one of the maternity leave benefits in the Philippines. There are 105 days of leave for normal childbirth and 60 days for miscarriage or emergency pregnancy termination. If you are a single mother, you will be granted an additional 15 days.

The maternity leave should be enjoyed continuously, which means weekends and holidays are included. It consists of prenatal leave (not earlier than 45 days before the expected date of confinement) and postnatal leave (total leave minus prenatal leave).

SSS Maternity Benefits Requirements

Before starting the maternity benefit reimbursement application (MBRA), the following documents are required.

- Maternity Notification Form with SSS stamp

- Maternity Reimbursement Form after notifying SSS

- SSS ID or two valid photo IDs (at least one with the date of birth of the SSS member)

According to the pregnancy outcomes, there are extra SSS maternity requirements.

Live Childbirth (Normal or CS)

- The child’s certificate of live birth (CLB) or certificate of death issued by LCR (Local Civil Registrar) when applying within 6 months after the date of delivery, or

- The child’s birth certificate or death certificate issued by PSA (Philippine Statistics Authority) when applying beyond 6 months after the date of delivery, or

- Report of Child’s Birth/Death issued by the Philippine Embassy, Consulate, or PSA when the child is born abroad. Include an English translation if the original copy is non-English.

Stillbirth or Fetal Death

- Certificate of Fetal Death (COFD) issued by LCR when applying within 6 months after the date of delivery, or

- Death certificate issued by PSA (Philippine Statistics Authority) when applying beyond 6 months after the date of delivery, or

- COFD is issued by the Philippines’ foreign affairs office when it happens abroad.

Miscarriage or Emergency Termination of Pregnancy

- Proof of pregnancy, such as pregnancy test results, or other diagnostic reports containing Ultrasound, blood pregnancy test (Beta HCG); or early pregnancy test results.

- Proof of termination of pregnancy

- Medical certificate, records of consultations, or clinical abstract/discharge summary

When Can I Apply for SSS Maternity Benefits?

You are supposed to submit a maternity notification as long as you have the ultrasound report and file a maternity benefit reimbursement application according to instructions from the authority. It is suggested to apply for it at least 60 days from the date of conception or even after your child is born, but don’t do that later than 60 days after childbirth.

How to Apply for Maternity Benefits in SSS Online

In terms of how to avail of maternity benefits in SSS, it includes the notification process (online) and the claims process (in person). In this part, we will introduce how to notify SSS online, which should be done at least 60 days from the date of conception. If you are employed, please inform your employer of your pregnancy who will apply online on your behalf.

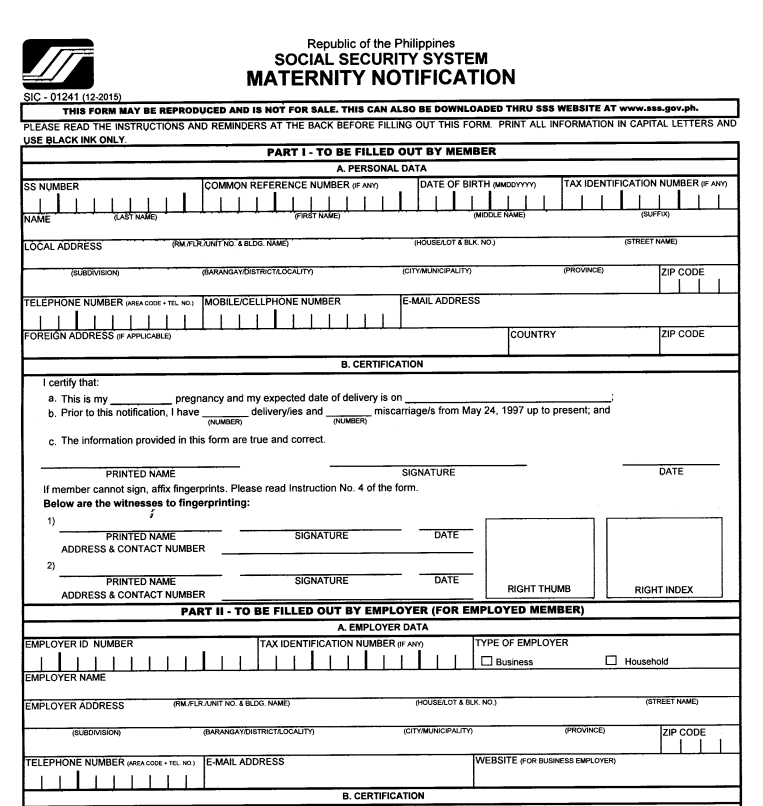

- Fill out the SSS Maternity Notification Form, which could be done by the employee or the employer.

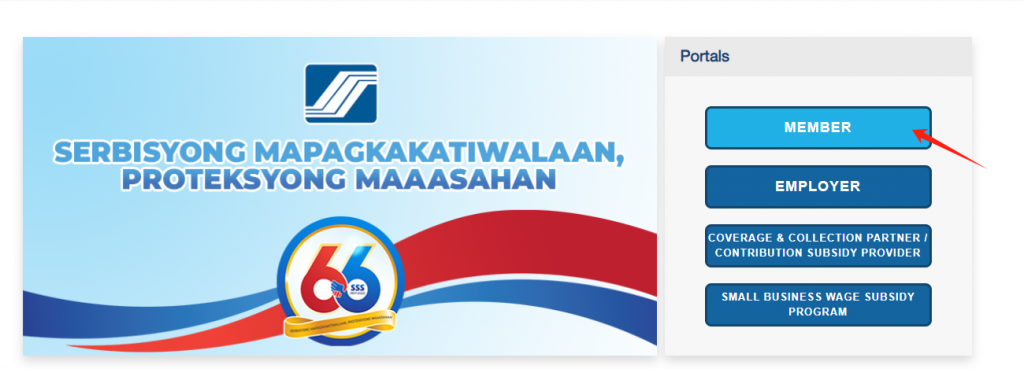

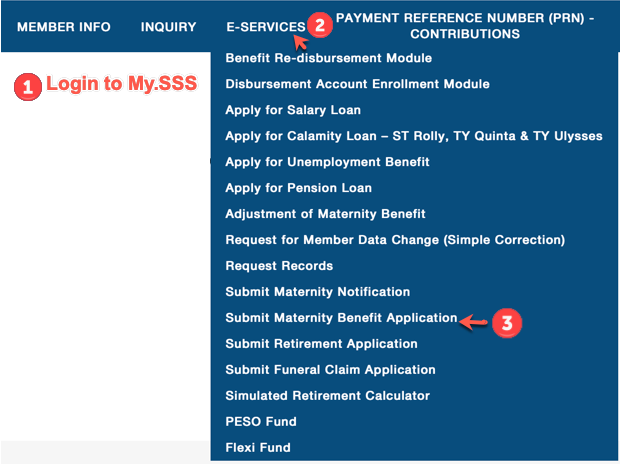

- Visit the official website of SSS. If you are applying for yourself, click on the “MEMBER” button and log in. If you are applying for your employee, click on the “EMPLOYER” button and log in.

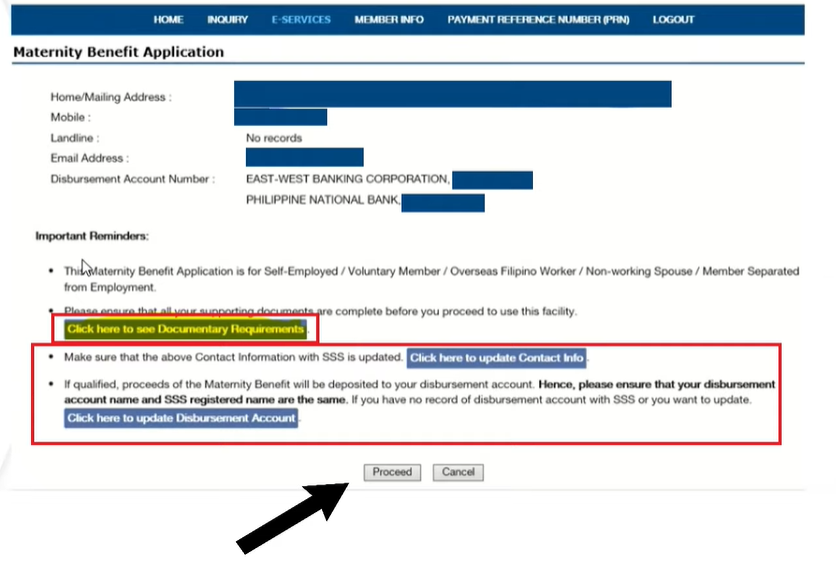

- Click on the “Submit Maternity Benefit Application” in the ”e-services” tab.

- Read the instructions and proceed.

- Provide required information, such as employee member, SS Number, Expected Date of Delivery, and Allocation of Maternity Leave Credits. Make sure to enter the details of the beneficiary.

- Click “SUBMIT LIST” to upload supporting documents, including the Maternity Notification Form, ID card(s), and ultrasound report.

- Keep the transaction proof by noting down the transaction number, printing the acknowledgment page, or checking the email.

👀 View the video tutorial here:

Maternity Benefit Reimbursement Application

The maternity benefit claims can be submitted at any SSS branch while the processing and reimbursement will be handled by the registered branch. The beneficiaries should bring the following documents to the nearest branch.

- Maternity Notification Form (Mat1) submitted to and returned by SSS

- A completed Maternity Reimbursement Form (Mat2) which is available in a physical branch or SSS official website

- SSS ID or two valid IDs

Separated members also need extra documents:

- Certification from the last employer indicating the date of separation, notice of company’s closure/strike, or certification of pending labor case between employee and employer

- Certification of no advance payment (on condition that the expected date of delivery is during or before separation)

FAQ

- How long do I have to claim my SSS maternity benefit after approval?

60 days for normal delivery or miscarriage and 78 days for cesarean delivery.

- Can I apply for maternity benefits after giving birth?

Yes, but no later than over 60 days after your baby’s birth.

- Can I extend my maternity leave?

Yes. Employees in the Philippines can extend their leave to another 30 days.

- Can a solo parent apply for maternity benefits?

Yes. Marital status is not one of the SSS maternity benefits requirements.

- What are the SSS miscarriage benefit requirements?

Besides the basic requirements like application form, proof of pregnancy, and valid ID, miscarriage benefit requirements request extra proof of termination of pregnancy and medical certificate.

- How to Avail of 70k SSS Maternity Benefits?

PHP 70,000 is the maximum amount of maternity benefits. You have to pay maximum contributions to SSS to avail of it.

Summary

SSS maternity benefits reflect public care for pregnant women and working mothers who can enjoy paid leave, rights to work, a favorable environment, and financial support. When it comes to how to avail maternity benefits in SSS, you must submit a maternity notification of pregnancy online by yourself or through your employer and file a maternity benefit reimbursement application. How much you can receive depends on Monthly Salary Credit (MSC), semester of contingency, and average daily salary credit. We hope that the SSS maternity benefit computation will help you calculate it.