In the Netherlands, every citizen needs a BSN number to access government and social services. You will face some difficulties if you don’t have it when you ‘re trying to get some benefits or services. In this article, we will show you a complete guide on where can I find my bsn number.

What is BSN number

The BSN (Citizen Service Number), a unique eight- or nine-digit number, is a personal number assigned to everyone registered in the Personal Records Database (BRP). It can be used as your official social security number, national identification number, and tax number in the Netherlands for your entire life.

When to use BSN number

In the Netherlands, you will need it for most aspects of your administrative and financial life, healthcare and housing , etc. Here are some public services that require a BSN number:

- You must obtain a DigiD to verify your identity.

- You need to pay your Dutch taxes

- You need access to public health care

- You apply for a driver ‘s license.

- You receive a Dutch pension or social security payments

- You vote in Dutch elections

- You open a Dutch bank account

- You get a mortgage or loan

- You apply for ajob or start a business in the Netherlands

- You are studying at a Dutch school or university

- You move address or buy a home in the Netherlands

You are required to obtain a BSN number to access all the necessary government services, which is vital for your smooth life in Netherlands.

Who needs a Burgerservicenummer

Burgerservicenummer is a must-have citizen service number for everyone who lives, studies and works in the Netherlands. Here you can check if you are on the list of BSN numbers:

for Dutch citizens

You will receive your BSN at birth on a Dutch passport or national ID card.

for non-Dutch citizens

- Long-term stay (longer than four months): You must register with the BRP to obtain your BSN within five days of arriving in the Netherlands.

- Short-term stays (less than four months): You should register with the BRP as a non-resident (RNI) to obtain a Dutch BSN to access financial services or health insurance.

- International students: Overseas students enrolled in a college or university in the Netherlands need a Dutch Citizen Service Number. If students study in the Netherlands but do not live in the country, they must apply for a temporary Dutch BSN.

- From abroad: If you want to claim a Dutch social security payment from abroad, or you want to make a claim for a partner who is abroad, you can enroll in the BRP from abroad as a non-resident and receive a Dutch BSN.

- Companies registered in the Netherlands (A RSIN) or unregistered companies (using individual owners’ BSNs for tax purposes).

Where to find my BSN number

There are several ways to find your BSN numbers. Here you can check the following ways, such as passport, ID card, driver’s license and health insurance card , etc.

on Dutch passport

You can find your BSN number on your passport:

If your passport is after 2014, the BSN is at the top of page 1, on the back of the personal details page (the page with your photo). It shows the text ‘personal number’, which is another word for BSN.

If your passport is issued after August 30, 2021, you will also find your BSN in a QR code on the back of the personal details page.

If the passport is issued before 2014, you can find the number on the front of the personal details page (the page with your photo), next to your date of birth.

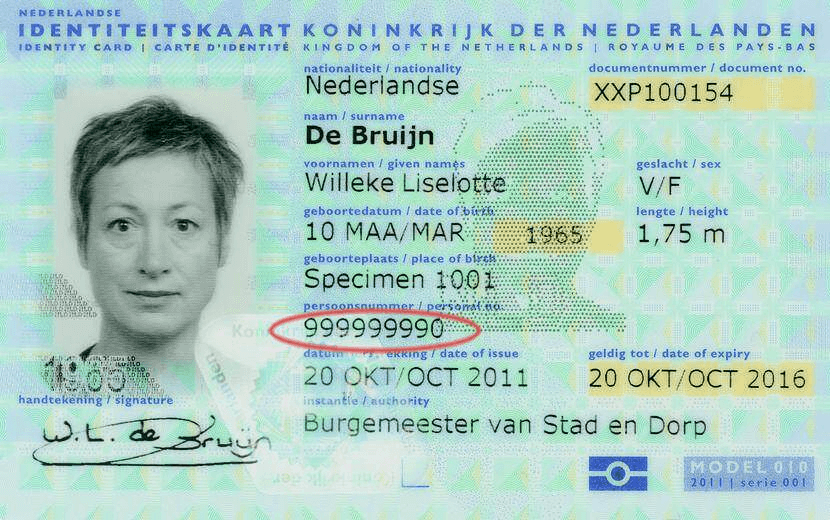

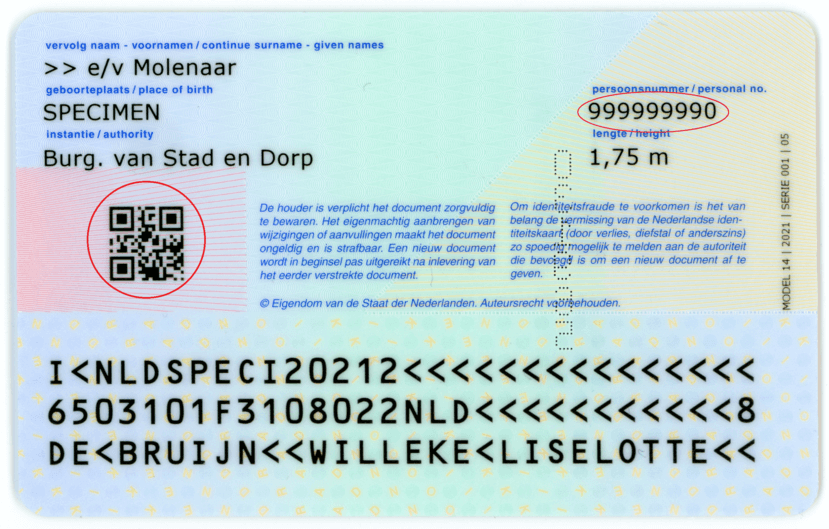

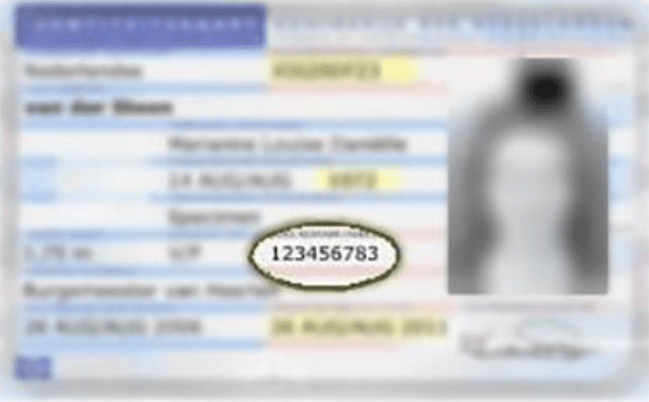

on Dutch ID card

If your Dutch ID card was issued before 2014, the citizen service number (BSN) is located on the front of your Dutch ID card. If your Dutch ID is issued after 2014, the citizen service number (BSN) is located on the back of your Dutch ID card. If it is August 2, 2021 or later, your citizen service number is also displayed in a QR code on the back of your ID card.

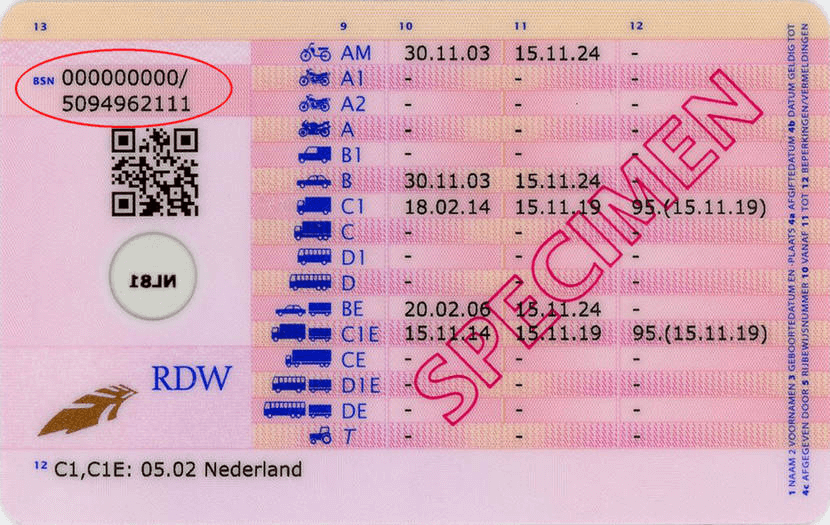

on Dutch driving license

The BSN is displayed on the back of your new Dutch driving licence. The number before / is the BSN. The number after the / is the driving licence number.

on health insurance card

You can also check the BSN number on a Dutch health insurance card under ‘BSN’ or ‘personal identification number’.

Salary specification

You will find the BSN stating on the salary specification / income specification.

MijnOverheid

You can check your BSN online on MijnOverheid by using your DigiD or a recognised eID from another European country.

The BSN number will be shown on most of the government issued ID to prove the holder’s identity.

How to apply for a BSN number in the Netherlands

It is important to register with the BRP to obtain your BSN number Dutch within five days of your arrival in the Netherlands. However, there are different ways to obtain a BSN number in the Netherlands depending on your basic needs.

- If you live in the Netherlands for more than four months, you can apply for a Dutch BSN by registering with the BRP at the Gemeente (municipality) of your place of residence.

- If you live in the Netherlands for less than four months, you can apply for a Dutch BSN as a non-resident.

- If you wish to apply for a Dutch BSN from abroad to obtain your Dutch pension, you should contact the Dutch Social Insurance Bank (Sociale Verzekeringsbank – SVB).

- If you wish to apply for a Dutch BSN for a partner abroad, you must complete a Request for Citizen Service Number for Supplementary Partner (Foreign) form with the Dutch tax office (Belastingdienst).

Before you register at the municipality (or ‘gemeente’ in Dutch), you must prepare all the necessary documents to complete the application. Here you can check the list of requirements to obtain the BSN in the Netherlands.

- An address certificate to register as your home address to register with the municipality, such as a rental contract.

- If you are a non-EU member, you must also bring a Dutch residence permit and employment contract (if applicable).

- If you are a resident of the EU, the European Economic Area (EEA), and Switzerland, you must provide a photo ID, such as a valid passport.

- Those from outside the EU/EEA/Switzerland will also need to provide a valid Dutch residence permit.

Once registered, you will receive a BRP extract and obtain your BSN for life. When you move to a new address, you must inform the municipality to keep your address updated in your BRP records.

What if there is no citizen service number

If there is no citizen service number, you must send a letter with the following information to the local authorities.

Belastingdienst Buitenland

Afdeling Klantregistratie (bsn)

Postbus 29

6400 AA Heerlen

The Netherlands

The letter must contain the reason why you need the citizen service number Netherlands (e.g. ‘filing an estate tax return’), details of your address abroad and the telephone number or email address where you can be reached.

You also need to prepare a copy of valid proof of identity and a copy of the residence certificate from your country of residence in Dutch, German or English.

FAQ

How long does it take to get a Dutch BSN number?

Once you have submitted your application, it will take approximately 8 weeks to receive the citizen service number. You should wait patiently for the issue of the BSN number Netherlands. If the documents submitted are not valid, it will take longer to obtain a Dutch BSN number.

Can I get a job in the Netherlands without a BSN number?

You can’t get a job in the Netherlands if you don’t have a BSN number. If you want to work for a Dutch employer in the Netherlands, your employer needs your BSN in order to file your payroll tax return. If you can’t get a BSN number, you can’t get a job in the Netherlands.

Can I live in the Netherlands without BSN?

No, everyone living in the Netherlands, regardless of the length of stay, needs to register with their municipality. Otherwise, you will face many problems accessing government services.

Can I get BSN number without registration?

Yes, you can get a BSN number without registration. If you are staying in the Netherlands for shorter than four months, you can still get a BSN to register yourself as non resident at one of the 19 municipalities with an RNI desk.

Conclusion

If you wish to live or work in the Netherlands, you must obtain a BSN personal identification number. When you open a bank account, pay taxes on your income, and start working, you will need this BSN to prove your identity. Make sure you have the BSN number within 5 days of arrival.